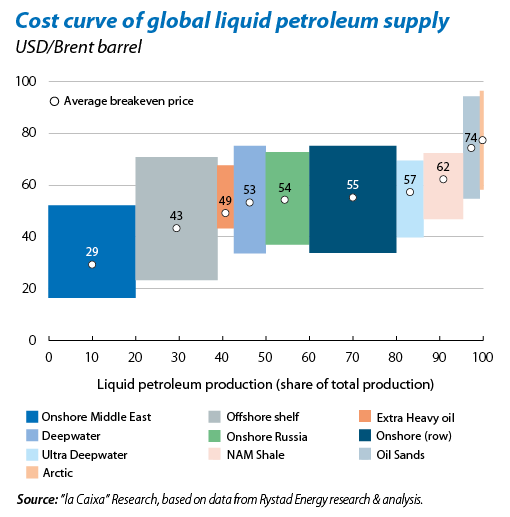

Over the last few years, Saudi Arabia has taken advantage of its privileged position to act as a swing producer and keep global oil supply in line with demand at any given time, thereby helping to stabilise prices. However, within the current context of increasing supply, OPEC's major producer has decided not to reduce its production, a stance which has clearly pushed down prices, something the country can easily withstand given its low extraction costs (see the first graph).

But this is a card that not all oil-producing countries can play. At current prices, part of the supply is no longer profitable, which should help to gradually push up the crude price as those producers most affected by lower profits will cut back on their investment, leading to a reduction in supply over the medium term. It should be noted that the cost of producing oil depends both on the region and on the method of extraction: the cheapest petroleum to extract is, precisely, onshore oil in the Middle East, followed at some distance by offshore shelf and Russian onshore extraction. Among the most expensive is North American shale oil. According to estimates by Rystad Energy, the average price at which shale exploitation becomes profitable is around 62 dollars per barrel, 2.5 higher than the figure for Saudi Arabia. Unusually low prices for a prolonged period of time would therefore seriously punish shale oil production in the US.1

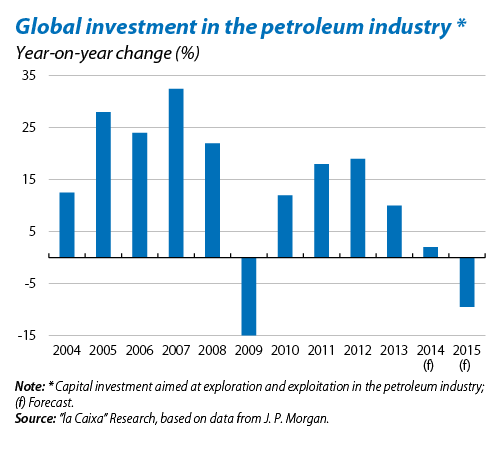

So is Saudi Arabia managing to curtail production by its competitors? This does seem to be the case. In the US, the number of oil platforms in operation has dropped to its lowest level since 2011 while the number of new shale extraction permits has also fallen, from close to 3,000 a month granted in September 2014 to 1,500 in December 2014. More generally, large oil companies have announced investment cuts to the tune of 20% (see the second graph), such announcements being in line with the cancellation of numerous exploration projects in the Arctic area, where crude oil has yet to be exploited due to high extraction costs.

In short, oil prices are likely to recover gradually given the lower amount of capital being invested by energy firms. Nonetheless, we cannot rule out further shocks to the price, especially as crude oil inventories have increased considerably over the past few months.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure from RBA rate decision

AUD/USD spiked lower by more than 20 pips following the RBA rate announcement to test the key psychological support at 0.6600. Losing this key level could see the currency pair trek lower towards the 100-hour EMA support near 0.6580.

EUR/USD edges lower to near 1.0750 due to the upward correction in the US Dollar

EUR/USD snaps its four-day winning streak, trading around 1.0760 during the Asian hours on Tuesday. However, the Euro found support from higher-than-expected Eurozone Purchasing Managers Index data released on Monday.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.