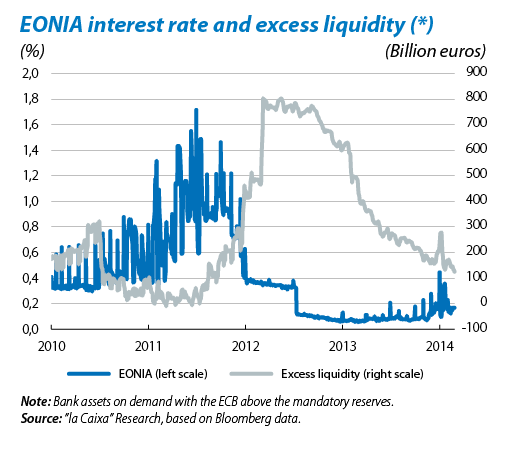

In the middle of last November, the very short-term interbank interest rates embarked on a volatile upward path, jeopardising the goal stated by the ECB to keep these stable, as close to zero as possible. The cause lies in the combination of two factors. First of all, the reduction in banks' excess liquidity at the ECB after paying back early the long-term loans they had received at the end of 2011. Ultimately, this development reflects the gradual resolution of the euro area's sovereign and bank debt crisis and is therefore reasonable. But it was intensified by the «year-end effect»: the desire by banks not to seem dependent on ECB funding, especially considering that their 2013 year-end balances will be the starting point for the bank solvency tests carried out by European authorities over the coming months.

Tensions failing to ease in January lead to more calls for the ECB to act. There is a long list of available measures to put a stop to this problem: lowering the interest rate for loans (now at 0.25%), relaxing the guarantees required for these, pushing the deposit facility rate into negative terrain (currently at 0%), reducing the amount of mandatory reserves, stopping the sterilisation of SMP bonds, etc. All these are technically, legally and politically feasible. And they would be highly effective, even more so when used in combination. It is likely that the ECB decided not to use them in February as it believed the tensions would tend to abate. Indeed, a notable improvement has been observed in the second half of the month. Such a delay could be helping to wear out the year-end effect and allow time for learning: interbank market agents, being used to an excessive amount of liquidity for several months now, may have been surprised by the sudden reduction in this liquidity and have taken time to adapt to a more normalised (but still relaxed) environment.

Whatever the case, the optimistic view is that the measures announced could relatively easily resolve episodes such as the one experienced. Using another instrument already employed in the past, such as long-term loans (LTRO), it would also be possible to keep monetary market interest rates close to zero in the case of more intense pressure.

However, there is a less encouraging view: these weapons seem too modest to avoid a possible increase in the risk of deflation once the so-called «zero lower bound» has been reached. At least compared with the arsenal we have seen deployed by the Fed and the Bank of Japan in the areas of quantitative easing and forward guidance. However, prior to any conceptual or practical considerations concerning their effectiveness, the big problem is that the ECB would encounter serious legal and political obstacles if it attempted to replicate the actions of these two central banks. This is indicated by the precedents. On the one hand, a situation of extreme urgency was required for the OMT programme to be approved, and not without objections from the Bundesbank and with an amber light given grudgingly by the German Constitutional Court. On the other, the proposal for the ECB to become involved, together with the EIB, in financing SMEs has been sidelined. Ultimately, and if the risk of deflation became more evident, the most likely outcome would be for the European authorities to take another step forward, supporting a sphere of action that would allow the ECB to implement decisive measures. At present, this does not seem likely given that the risk of deflation is not yet strong enough to get the political gears in motion. However, and partly precisely because of this, we cannot completely rule out the ECB resorting, in the near future, to some of the aforementioned light weaponry as a preventative measure that would signal to agents its intention to combat excessively low inflation.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.