ECB Preview: Lagarde's lavishness to set the tone for EUR/USD, three scenarios and what to watch

- The European Central Bank may expand its emergency bond-buying scheme.

- Updated growth forecasts are also set to move the euro.

- President Lagarde will likely pressure governments to do more.

Only two hours on the autobahn separate the European Central Bank's headquarters in Frankfurt and the German Constitutional Court in Karlsruhe – but they remain worlds apart. The judges ruled that part of the ECB's bond-buying scheme is illegal, yet the bank is determined to act and help the eurozone economies.

The question for markets is at what size, and when. The Pandemic Emergency Purchasing Program (PEPP) is due to run out of its €750 billion in the autumn, and members of the ECB's Governing Council have opened the door to expanding it already in June.

Contrary to the pre-coronavirus era, more money printing means a more robust currency – at least for now. The bank's buying puts a lid on governments' borrowing costs, allowing them to deploy more funds and provide relief to their economies. In turn, a quicker rebound means a stronger currency. At some point, this flood of newly created euros may weigh on the common currency, but that moment is far.

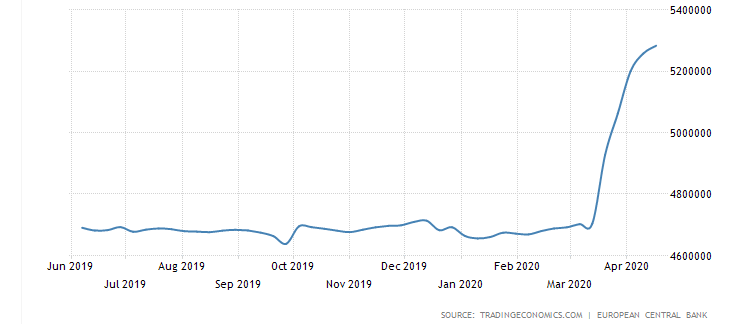

The ECB's balance sheet has been snowballing, and EUR/USD is far above the lows:

Source: Trading Economics

As mentioned earlier, timing and size matter.

Three scenarios for the ECB's QE and EUR/USD

1) Extra €250 billion: The most likely scenario is that the bank tops up the PEPP to a total of €1 trillion – a round number that was on the cards from the outset. That would send a message to markets that the ECB continues supporting the economy while not hurrying too much, as economies are already opening up.

In this case, which has a high probability, EUR/USD would advance but probably remain within known ranges.

2) Going big, +€500 billion or more: Some market participants think that Christine Lagarde, President of the European Central Bank, has learned the lesson from an initial gaffe in early March – suggesting it is not the bank's role to narrow spreads. To send a clear message to bond markets and also the constitutional court, she would push for raising the emergency fund by 66% to €1.25 trillion.

This scenario has a medium probability. While that would boost the recovery, Lagarde and fellow doves would have to convince hawks at the Governing Council. In that scenario, EUR/USD would rally on the unequivocal message from Frankfurt.

3) No action now: The ECB may express content from the current pace of lifting the lockdowns as COVID-19 statistics continue falling. That may trigger caution, waiting until the next meeting in July before acting.

In this scenario, which seems unlikely as the economies continue suffering, EUR/USD will probably tumble down. It would also convey to Karlsruhe that the ECB is backing down.

Forecasts full of fear

ECB staff produces growth and inflation forecasts every other meeting – and new gloomy ones are expected now. After shrinking by 3.8% in the first quarter, the eurozone is likely contracting at a much faster pace in the second quarter.

In early May, the European Commission foresaw a squeeze of 7.4% in 2020 before rebounding in 2020. Predicting economic performance was always hard and is even harder to do amid high uncertainty.

With so much doom and gloom, any outlook that remains within a single-digit contraction – less than a 10% drop in 2020 Gross Domestic Product – would calm euro bulls. Lagarde will likely need to lay out an even bleaker outlook to shock markets. Investors will probably ignore growth forecasts fro 2021.

Negative rates and nudging governments

The debate about the negative interest rates that have rocked the dollar and the pound has skipped over the euro – as the bloc already has a sub-zero deposit rate for years. At -0.50%, the ECB is unlikely to act anytime soon. Any surprising openness to go further down would weigh on the euro.

There is a significantly higher certainty that Lagarde and her colleagues will continue urging governments to do more. That has been a staple of ECB press conferences for several years.

Her call on elected officials to action comes after the European Commission presented an ambitious plan consisting of €500 billion in grants from commonly borrowed money. While all large countries support the package, several states – dubbed the "Frugal Four" – have their reservations, and full approval is not guaranteed. The ECB will probably nudge governments to approve the deal.

Conclusion

Traders' focus in the ECB decision is on expanding the bond-buying scheme – with a larger top-up better for the euro. The common currency would suffer if the bank refrains from the action on the PEPP or opens the door to lower rates.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.