Dow Jones and FTSE 100 forecast: More gains ahead?

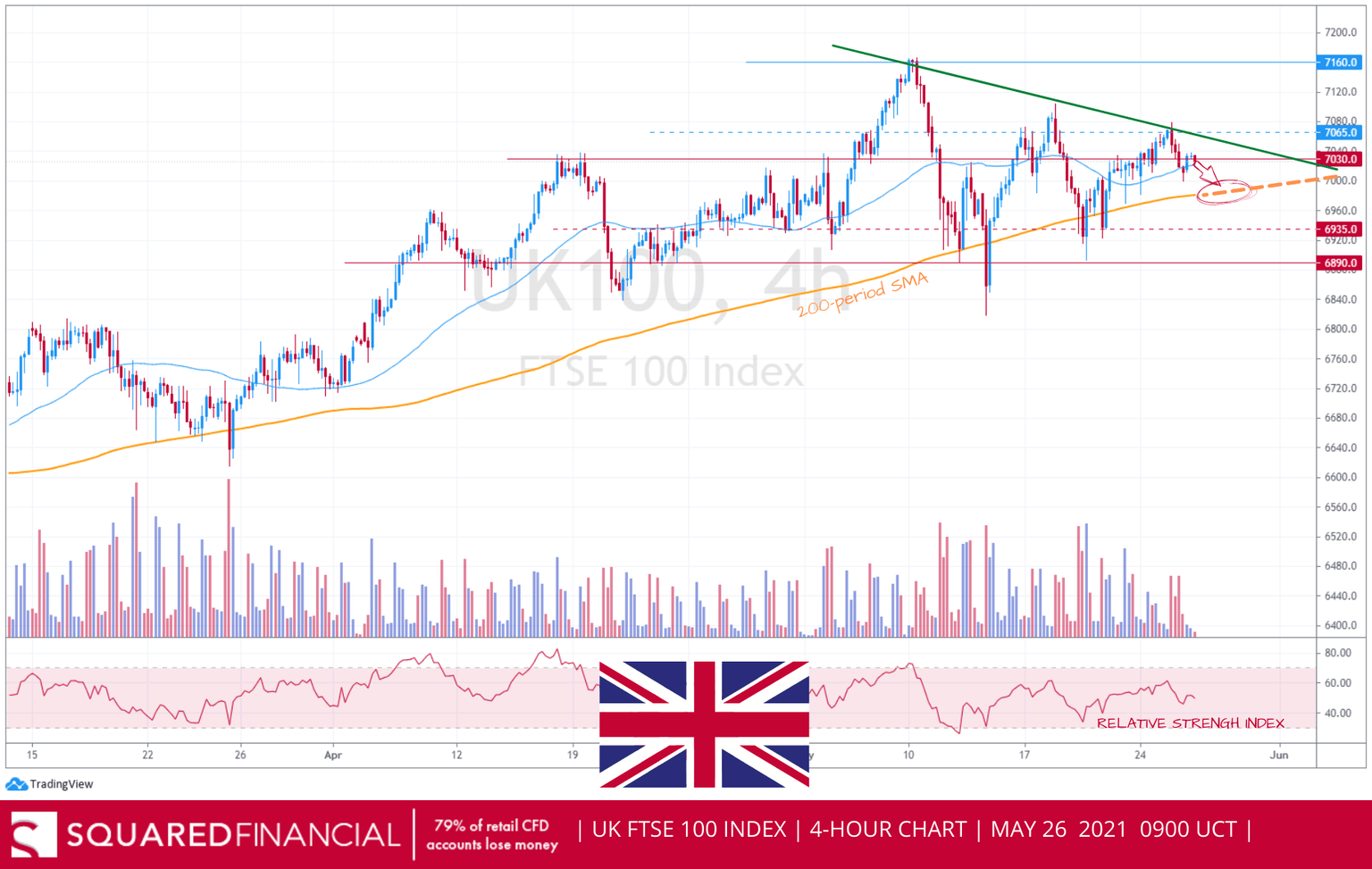

FTSE 100

The FTSE100 index seems to be stalling with bulls finding it hard to push prices back to record levels, as investors become increasingly worried over the Indian variant of the coronavirus in the UK. It is also worth noting that from a technical perspective, the lower lows taken from the bearish trendline are about to connect with the 200-period SMA, and therefore a move below the 200-period SMA at this point may signal a shift in the main trend from bullish to bearish.

Support: 7000/6935.

Resistance: 7030/7065.

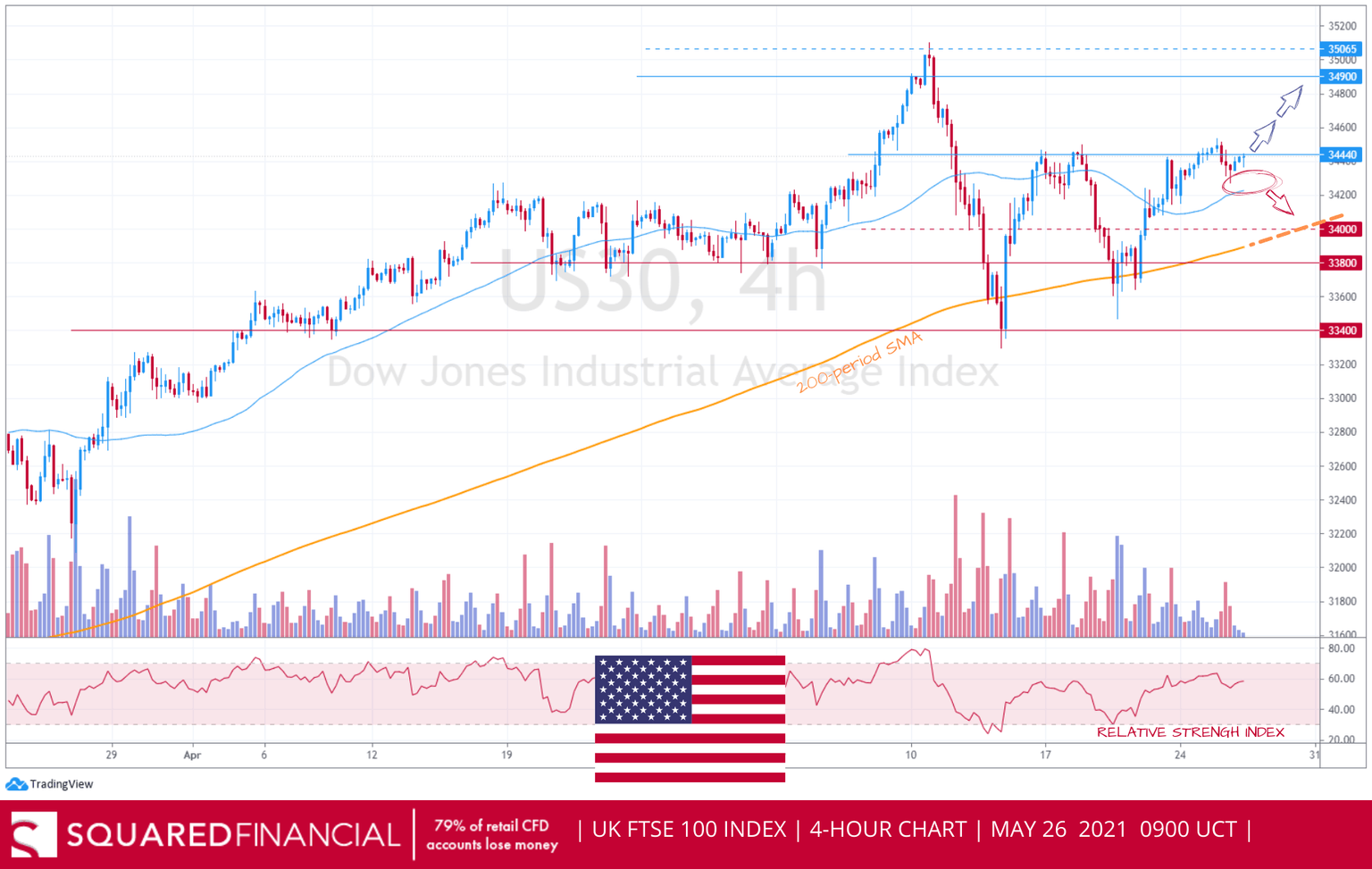

Dow Jones

Equities reversed lower midday Tuesday with the Dow Jones Industrial Average erasing earlier gains after consumer confidence fell more than expected, despite good news on the vaccine front stating that 50% of Americans over 18 are now fully vaccinated. Technically speaking, the 50-period SMA is so far still acting as support, but a sustained move below it may trigger additional selling with the 200-period SMA around 34000 as nearest target.

Support: 34000/33800.

Resistance: 34400/34900.

Author

Rony Nehme

SquaredFinancial

Rony has over twenty years of experience in financial planning and professional proprietary trading in the equity and currency markets.