DOW JONES

Dow Jones future contract for December delivery retested new record high posted earlier today on acceleration after Wall St opening.

Reduced tensions over North Korea and rally of financials and industrial stocks lifted Wall St on opening, with focus turning towards this week’s two-day FOMC meeting which starts on Tuesday.

Markets are expecting signs of beginning of reduction of massive US balance sheet, but also focus on comments from Fed chief Janet Yellen regarding inflation, which was the biggest obstacle for the Fed to further raise interest rate.

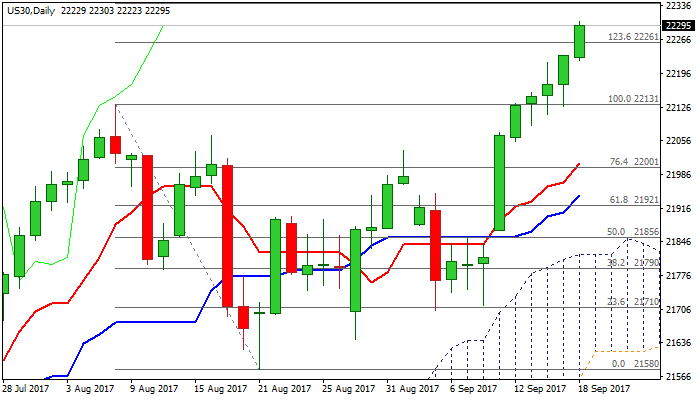

The Dow index posted new all-time high at 22303 on Monday, in extension of steep ascend in past five days which resulted in eventual break above previous record high at 22131.

Strong bullish sentiment could drive the price further in the uncharted territory, with initial target laying at 22341(Fibo 138.2% projection) with stretch towards Fibo 161.8% projection at 22472, being in play.

The rally could be interrupted by corrective actions signaled by overbought conditions on daily chart, but so far lacking firmer correction signals.

Dips are expected to be limited, with former high at 22131, offering solid support, followed by rising Tenkan-sen at 22000, which is expected to contain extend dips.

Res: 22341; 22472; 22552; 22682

Sup: 22223; 22131; 22066; 22035

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.