EUR/USD

4 hour

The EUR/USD broke another support trend line (dotted green) yesterday and the bearish decline is picking up speed. One more important line remains unbroken (solid green), which could mark the difference between a retracement (for more upside) or reversal (for more downside).

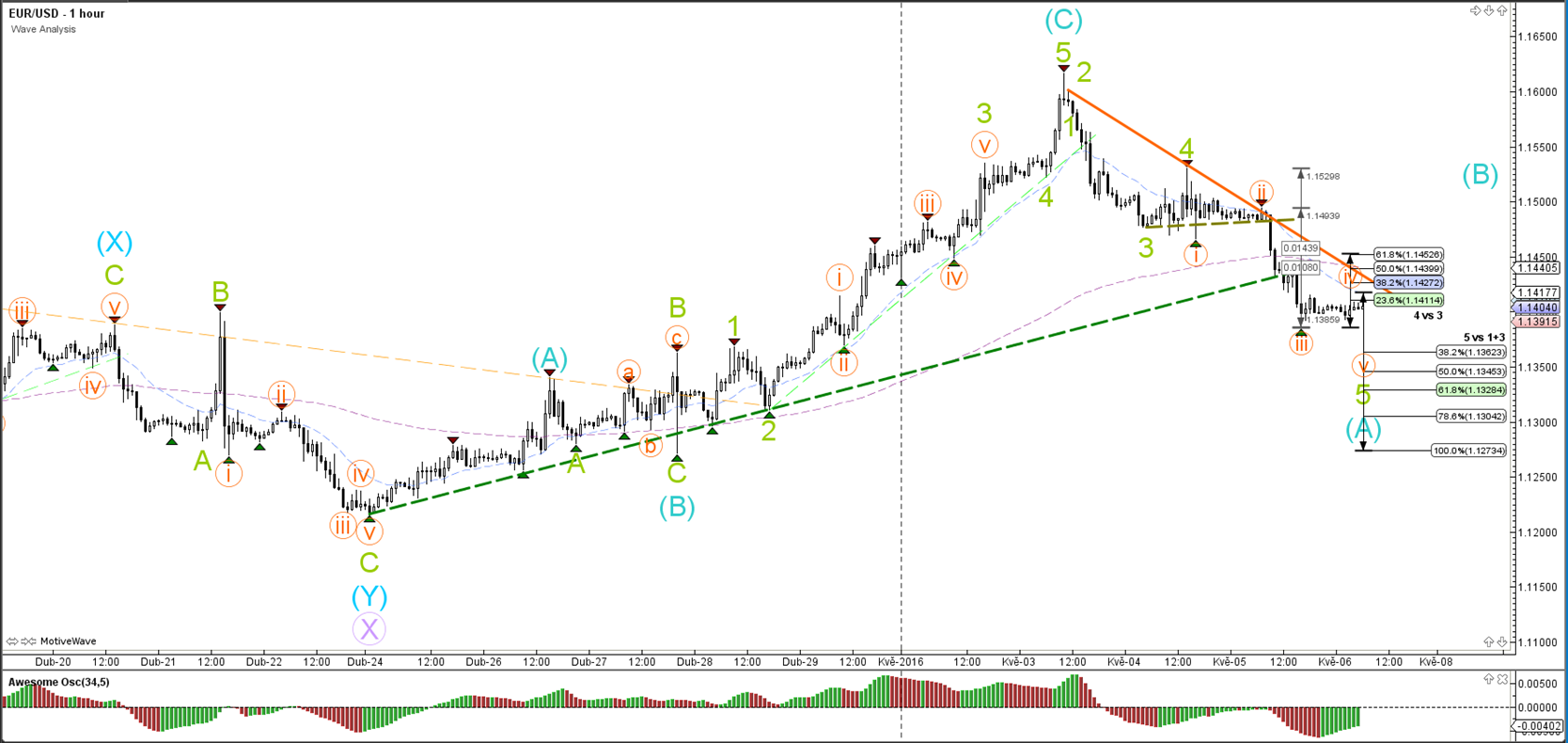

1 hour

The EUR/USD extended the bearish 5th wave (green) yesterday after breaking the support (dotted greens). The extension seems to be unfolding in 5 waves (orange). The ABC (blue) could turn into 123 if price can prove that a reversal is taking place.

GBP/USD

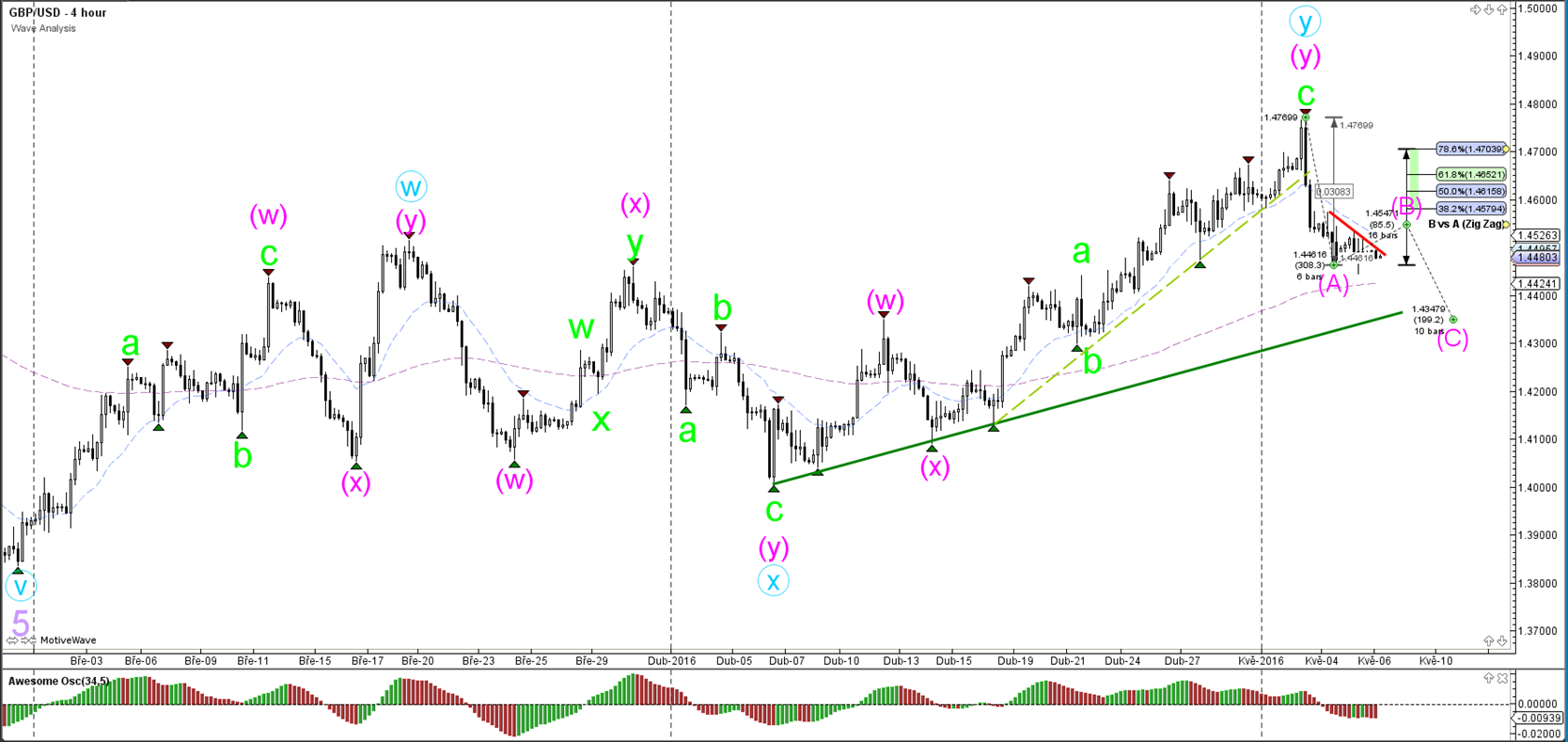

4 hour

The GBP/USD’s decline has expanded with more bearishness. A break of that support trend line would confirm the downtrend on the GBP/USD whereas a bounce at support could indicate an expansion of the uptrend.

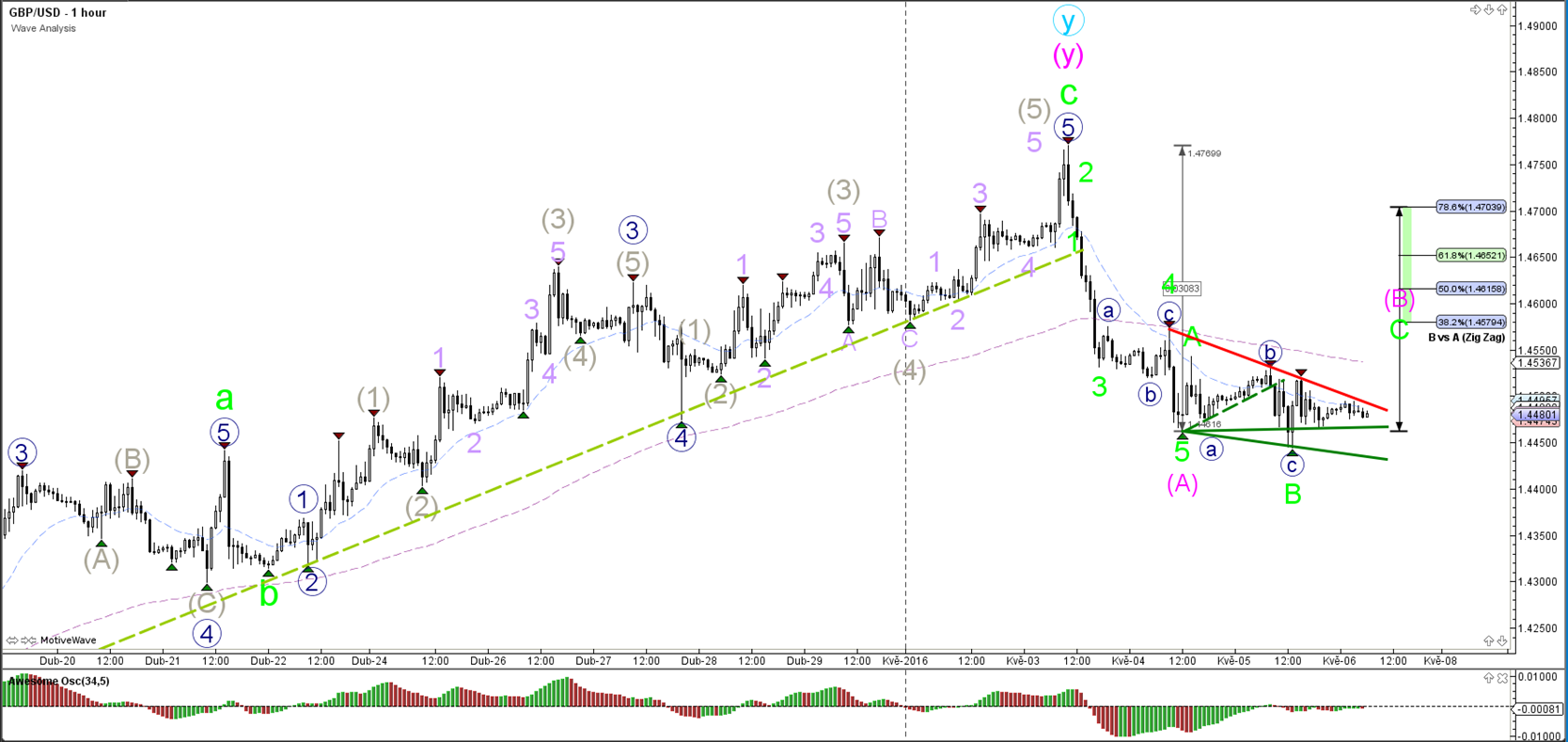

1 hour

The GBP/USD showed a choppy trading day yesterday, which has been marked as an ABC (blue) within wave B (green). A bullish break above the resistance trend line (red) could see price develop towards the Fibonacci levels of wave B (pink). A bearish break below the support trend lines (green) could price expand wave A (pink) lower.

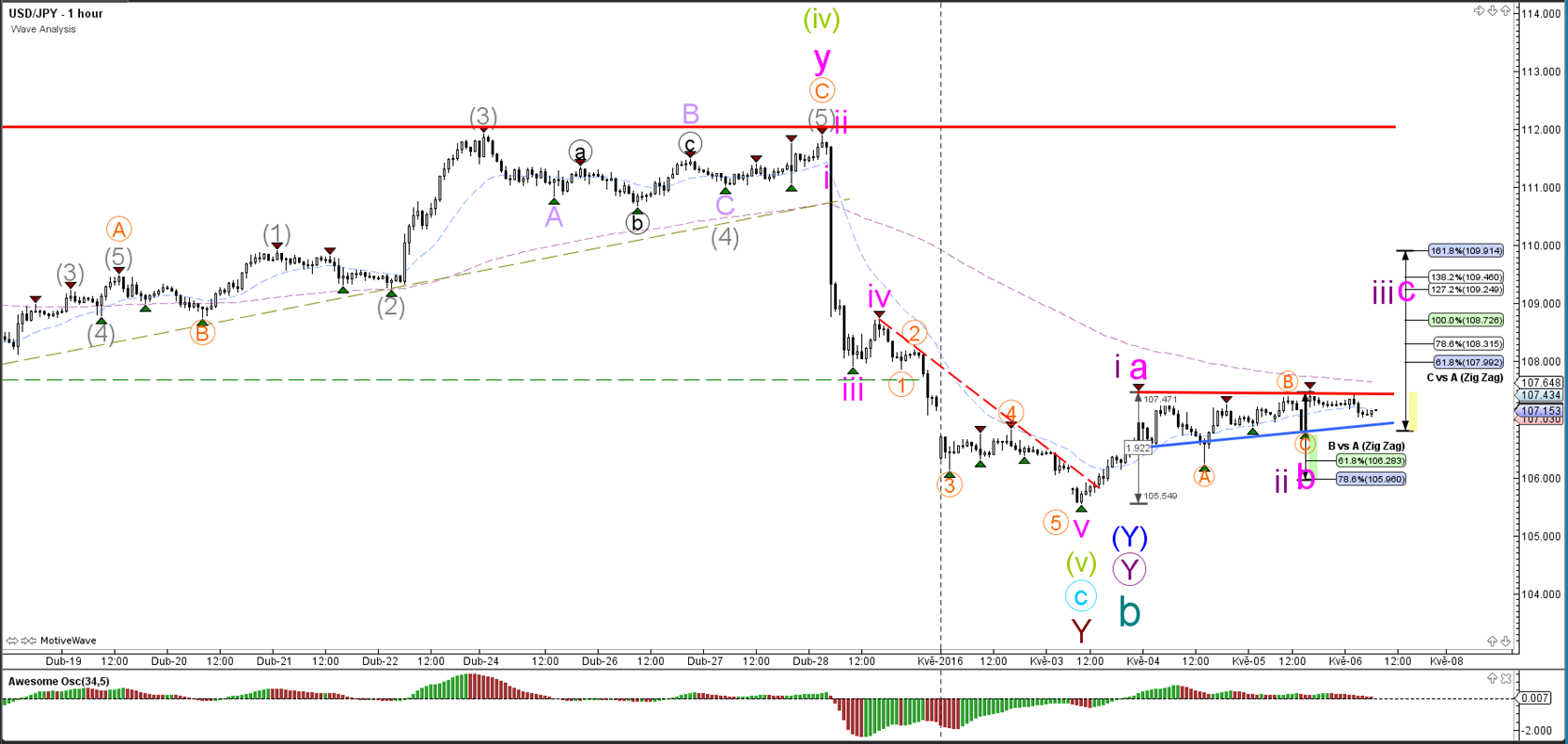

USD/JPY

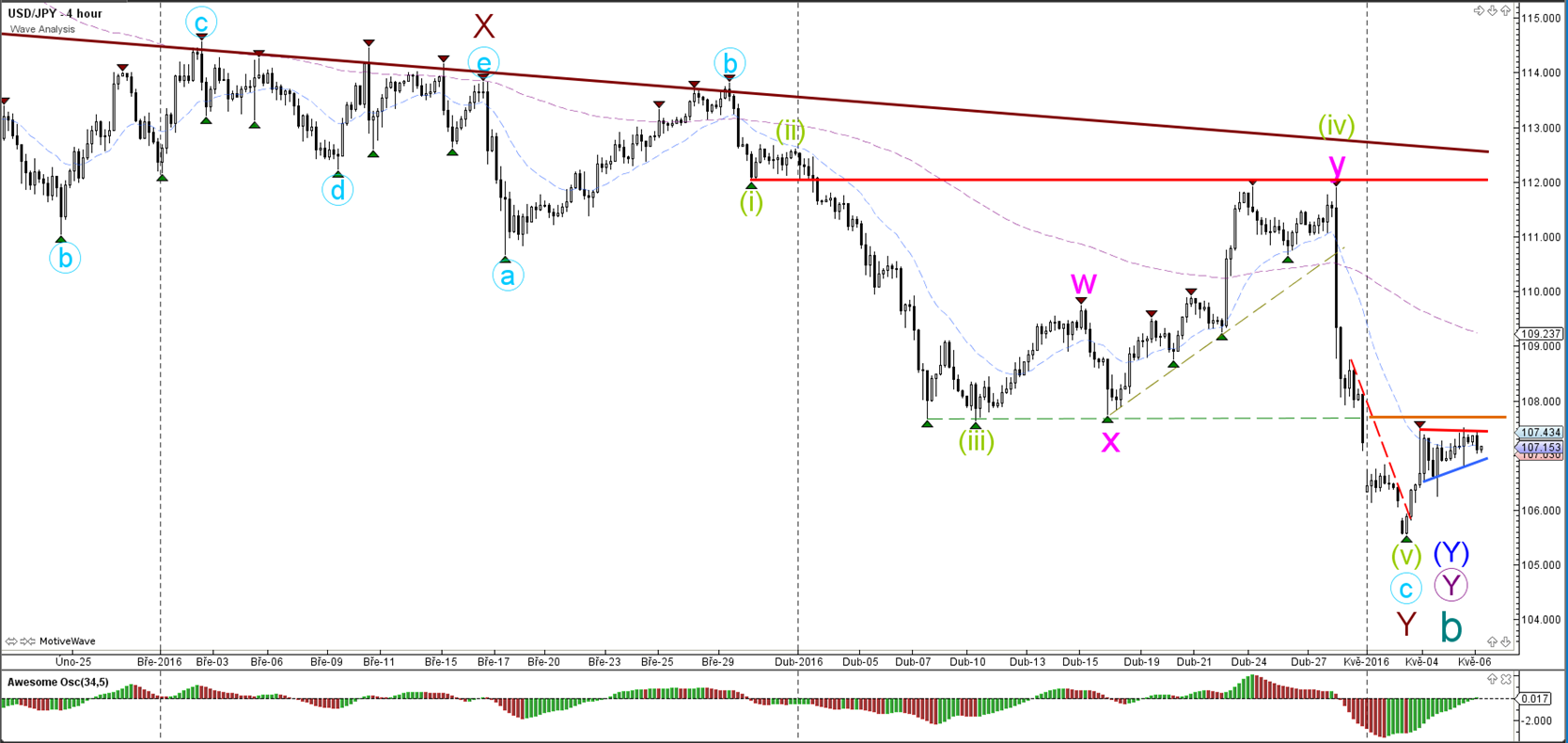

4 hour

The USD/JPY is building a triangle chart pattern below the broken bottom (orange). A bullish break of the triangle could indicate a trend change whereas a bearish break of the triangle could see a downtrend continuation unfold.

1 hour

The USD/JPY has gone sideways yesterday as indicated by the support (blue) and resistance (red) trend lines. A break above the resistance trend line (red) could see the continuation of wave C. A break below support (blue) could see price fall towards the Fibonacci levels of B vs A. The other likely wave count is the start of an impulsive wave count via 123 (purple).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.