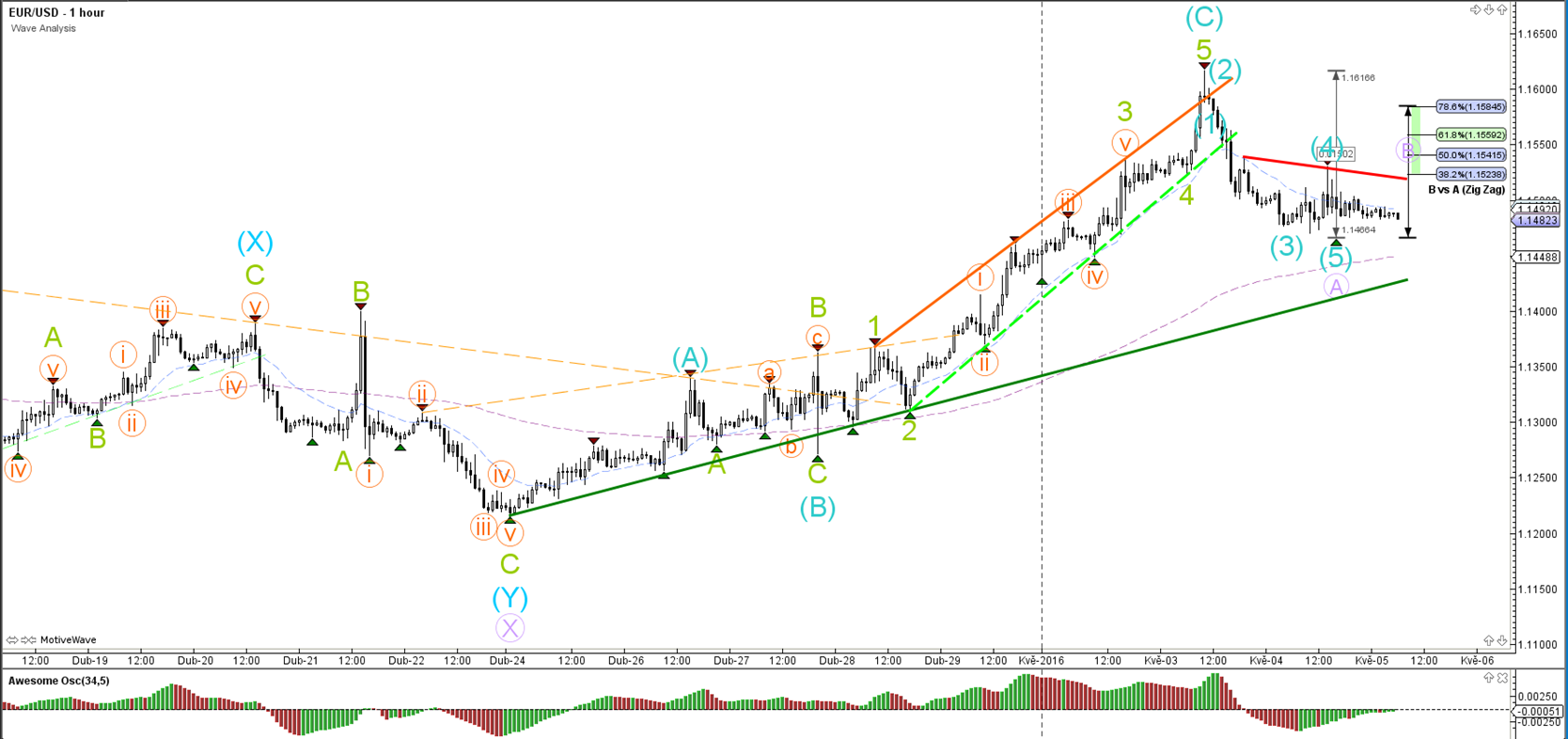

EUR/USD

4 hour

The EUR/USD completed the bullish wave C (blue) but the support trend lines (green) need to break before the waves Y of wave 4 (blue) can be considered completed. Until the trend lines break, the current bearish price action could still be a bearish retracement for an uptrend continuation.

1 hour

The EUR/USD seems to have completed a bearish wave 5 (blue) of wave A (purple). For the moment a bearish ABC zigzag (purple) seems the most logical path of least resistance for price. The wave count could turn into a 123 if price breaks below support.

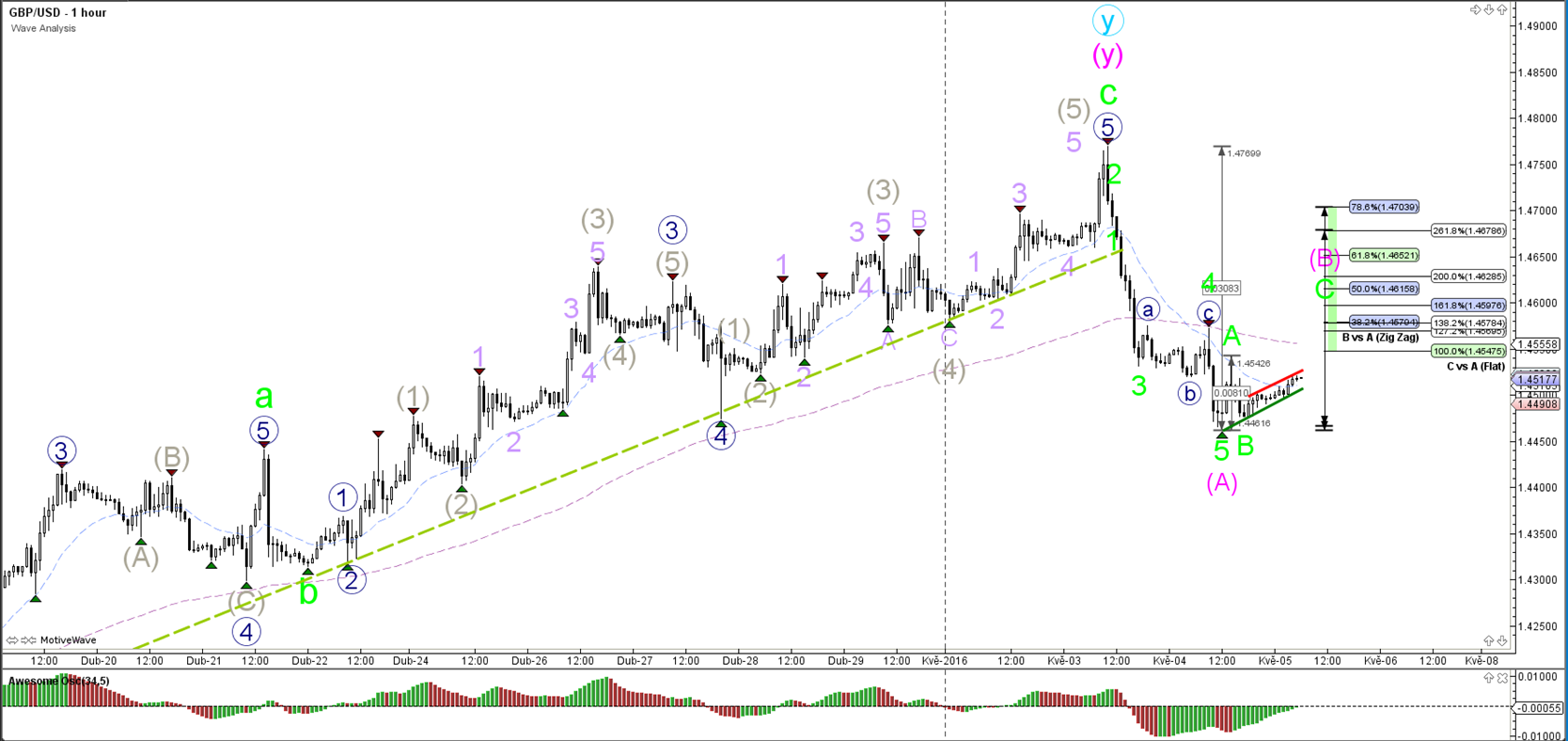

GBP/USD

4 hour

The GBP/USD broke the inner support trend line (dotted green) but has an outer and shallower support trend line remaining (solid green). A break of that support trend line would confirm the downtrend on the GBP/USD whereas a bounce at support could indicate an expansion of the uptrend.

1 hour

The GBP/USD completed a 5th wave (green) within wave A (pink). For the moment a wave B (pink) correction seems the most likely scenario unless price break below the channel.

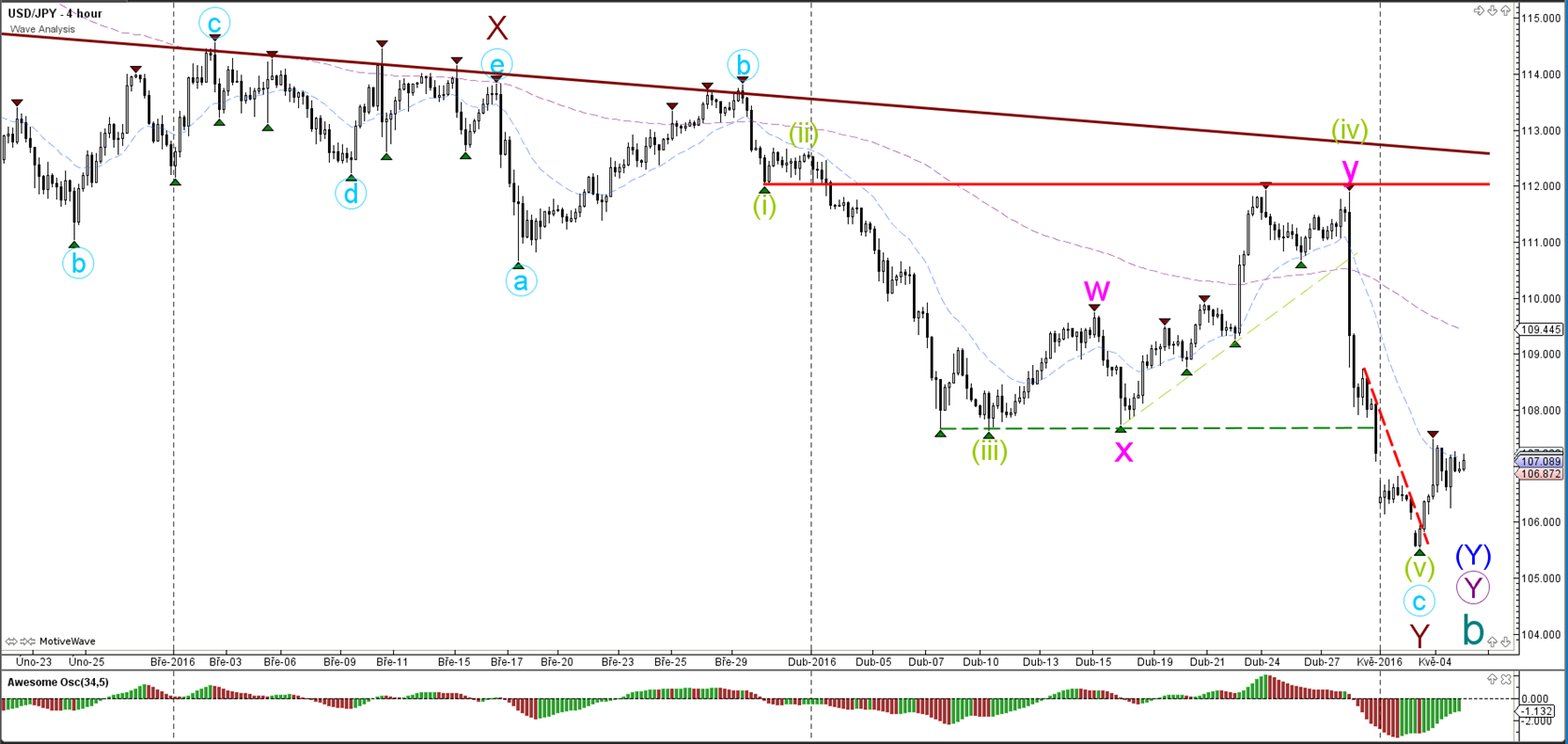

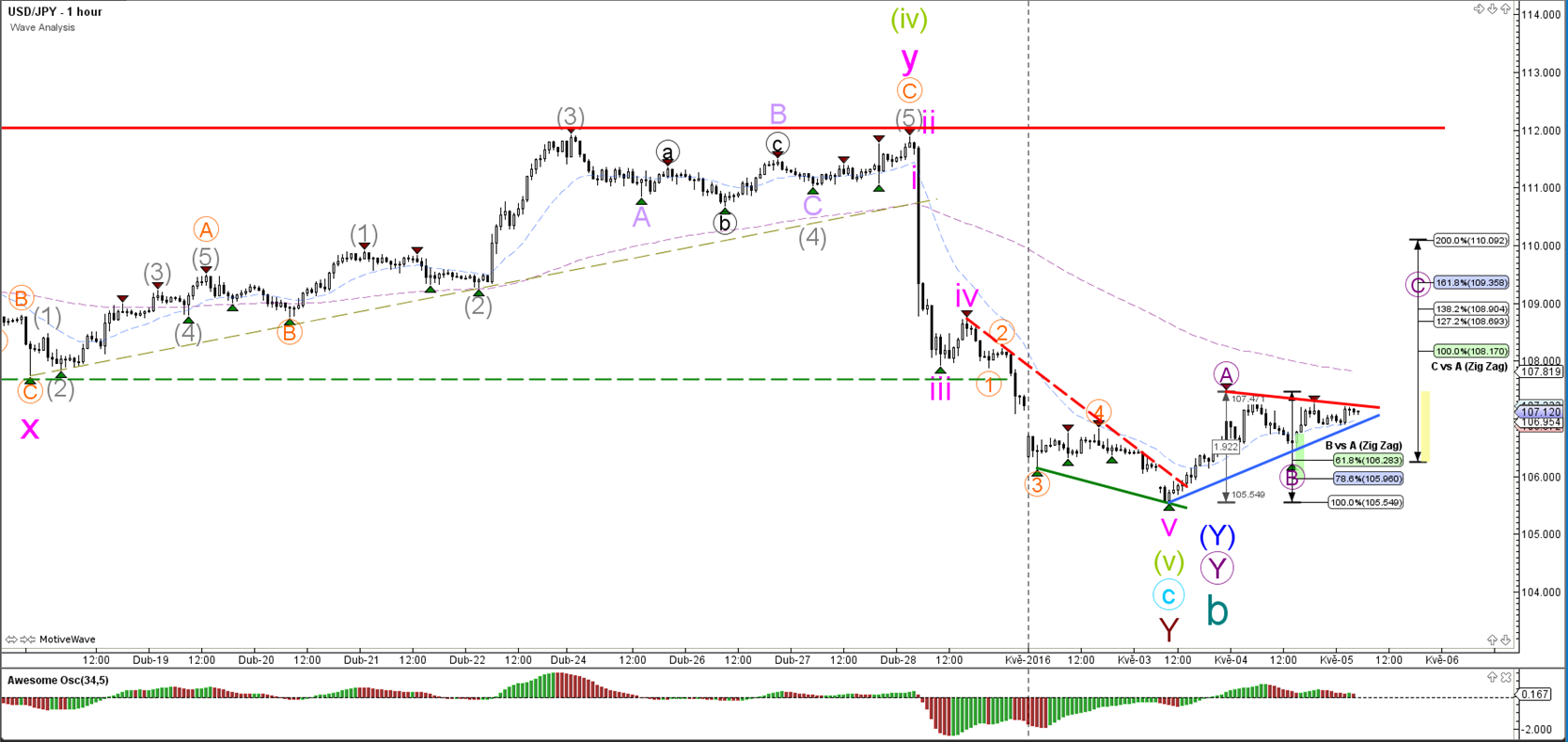

USD/JPY

4 hour

The USD/JPY is showing a strong bullish bounce after breaking a resistance trend line (dotted red). The bullish price action could be a first signal that the US Dollar can make a decent rally.

1 hour

The USD/JPY has respected the 61.8% Fibonacci level of wave B (purple). A break above the resistance trend line (red) could see the continuation of wave C. A break below support (blue) could see price fall towards the Fibonacci levels of B vs A or break the bottom and extend the downtrend.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Will Bitcoin ignore major macro market developments this week?

Bitcoin price will be an interesting watch this week, with increased volatility expected amid crucial events lined up in the macro market. On Tuesday, Hong Kong will be debuting its BTC and ETH ETFs while the next day will see FOMC minutes make headlines.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.