EUR/USD

4 hour

The EUR/USD retraced back to the 78.6% Fibonacci retracement of the wave X (purple) correction. The wave count is vulnerable to change if price breaks below this level.

1 hour

The EUR/USD could have completed an ABC bearish zigzag (orange) down towards the wave X (purple) but a break above resistance is needed before the completion of the ABC becomes more likely.

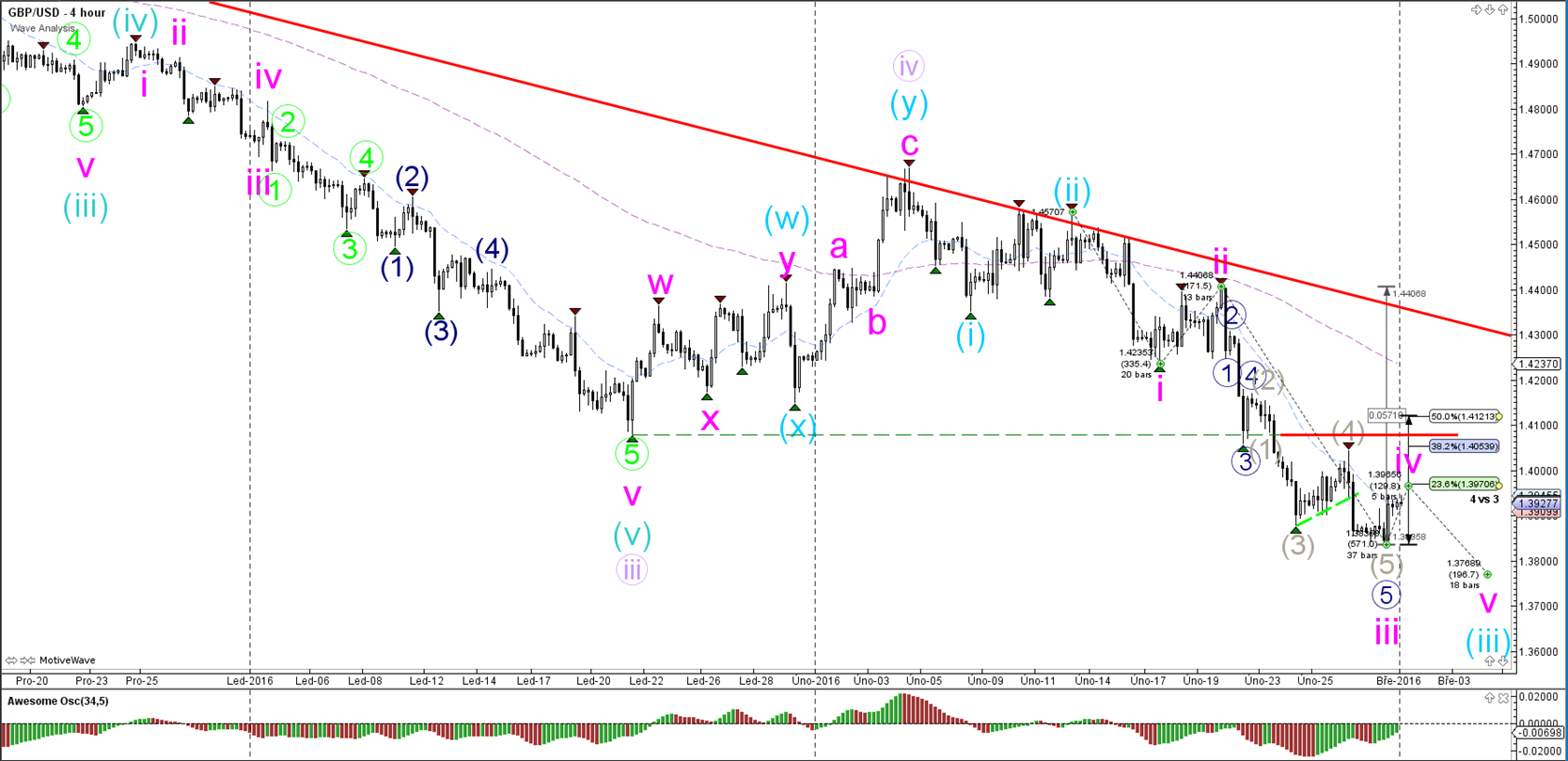

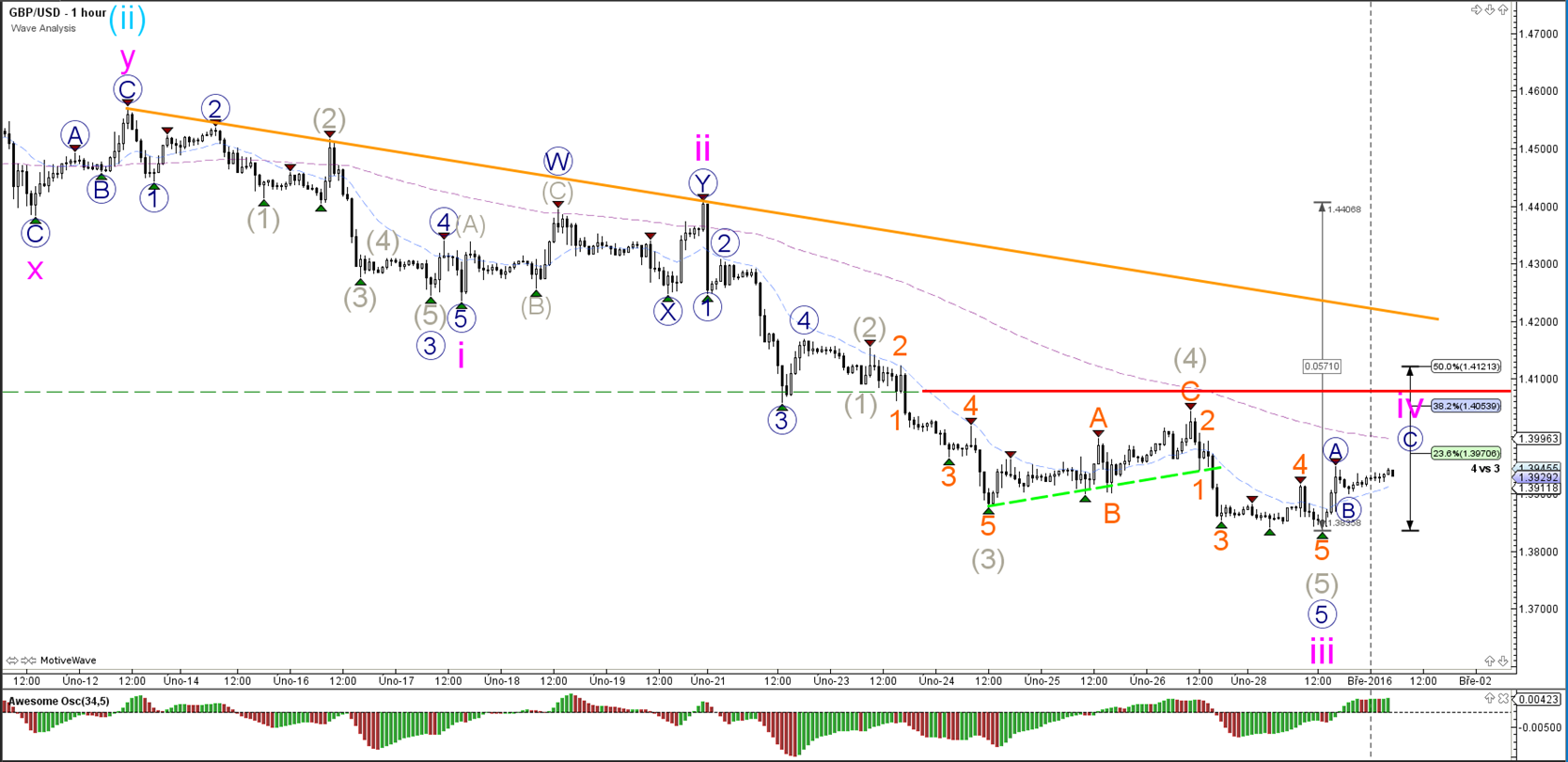

GBP/USD

4 hour

The GBP/USD seems to have completed a wave 3 (pink). Price could now be starting a wave 4 (pink) retracement with resistance at the Fibonacci levels of wave 4 vs 3.

1 hour

Within wave 3 (pink) the GBP/USD completed a bearish 5 wave (orange) as part of the wave’s 5 (grey/blue). An ABC correction seems to be unfolding as part of wave 4.

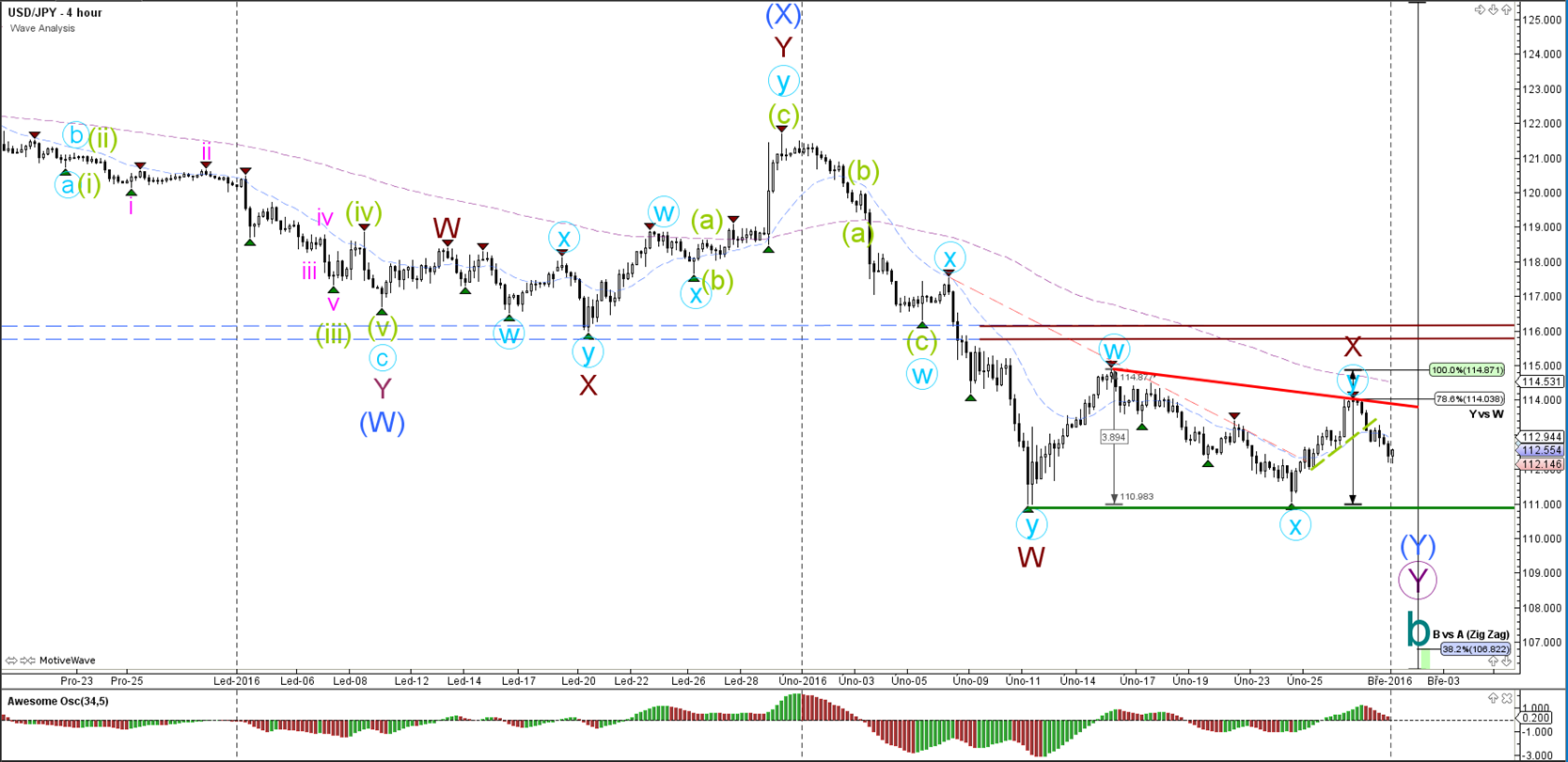

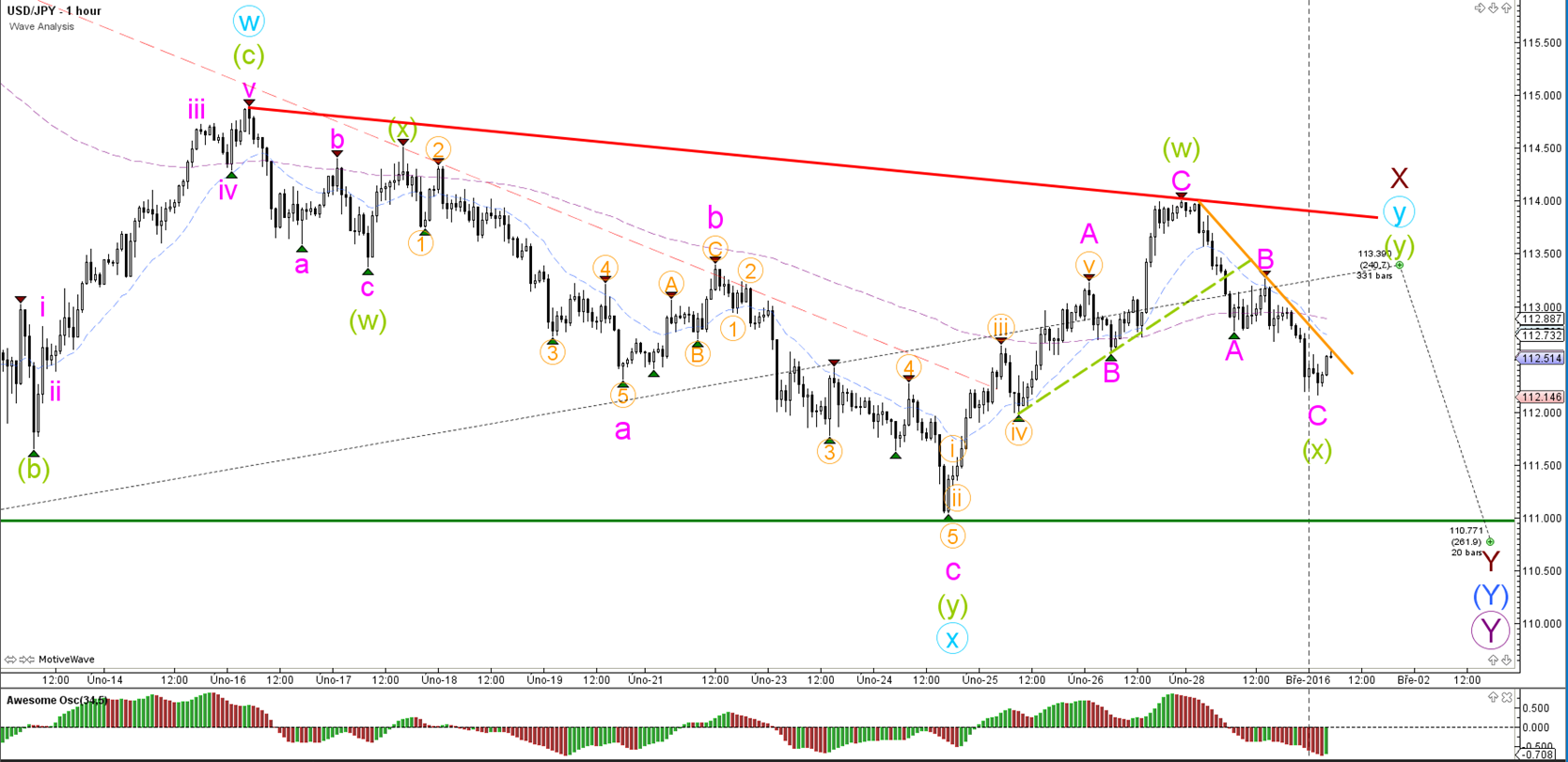

USD/JPY

4 hour

The USD/JPY break below the bottom (green) makes it likely that price has completed a wave X (brown) and is in wave Y (blue).

1 hour

The USD/JPY seems to have completed a bearish ABC zigzag (pink). If price keeps pushing lower and below the bottom (green), then the wave count can chance to a 123. If price makes a bullish correction, then this could lead to price moving higher as part wave X (brown).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.