EUR/USD

4 hour

The EUR/USD completed the wave X (blue) and broke above resistance levels (dotted red) yesterday. It is now at the 61.8% Fibonacci target, which is a break or bounce spot. A bullish continuation could price head towards the next Fibonacci target and daily resistance (red).

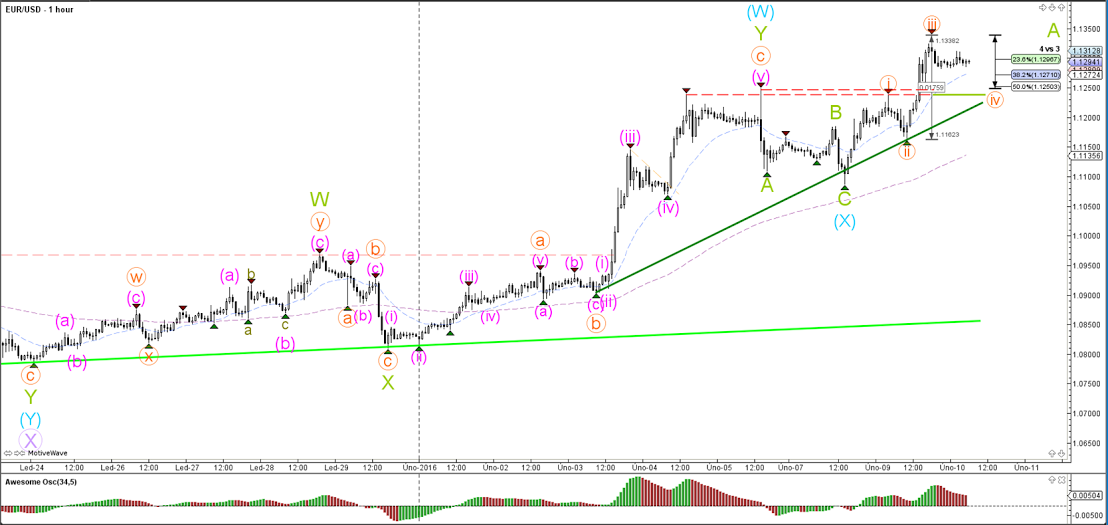

1 hour

The EUR/USD seems to be in a wave 4 (orange) now after completing the first 3 legs earlier this week. Price cannot retrace deeper than the 50% Fibonacci without invalidating the current wave count.

GBP/USD

4 hour

The GBP/USD is currently in a contracting triangle (orange/green). The Cable respected the 50% Fibonacci level of wave X (blue), but if price makes a bearish turn then the 61.8% and 78.6% retracements still represent support levels. This wave count is invalidated when price breaks below the support trend line (green).

1 hour

The GBP/USD break above the resistance trend line (orange) would change the current bearish wave count to a bullish one. A break above resistance confirms the completion of wave X (blue) at the most recent bottom. A bearish bounce could see price fall towards the Fibonacci targets and trend lines (greens), which represent support levels.

USD/JPY

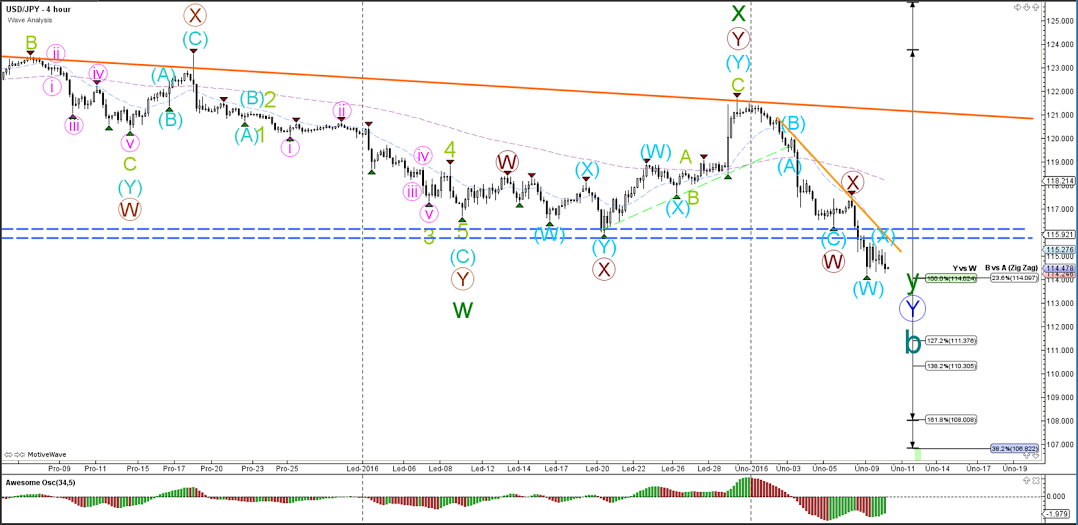

4 hour

The USD/JPY has broken the long-term daily and weekly horizontal support levels (dotted blue). Price has reached Fibonacci levels which have caused price to stall. A break below the Fib levels could see price fall further lower. A bounce at the Fibonacci levels could indicate a potential completion of wave B.

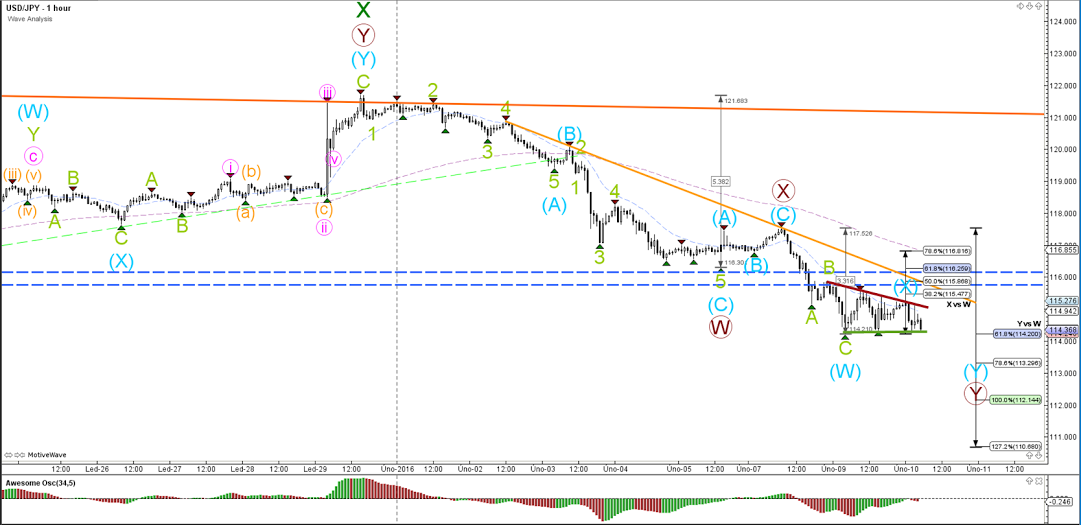

1 hour

The USD/JPY is building a contracting triangle (trend lines) in between the broken support and Fibonacci target.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 as US yields push lower

Gold price trades in positive territory above $2,310 in the American session on Monday. The benchmark 10-year US Treasury bond yield stays in the red below 4.5% after weaker-than-expected US employment data, helping XAU/USD hold its ground.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.