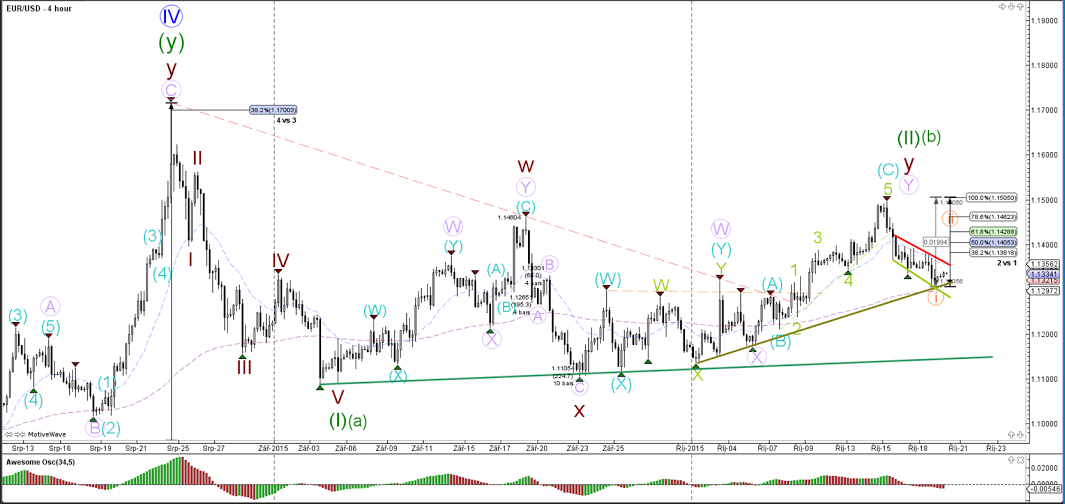

EUR/USD

4 hour

The EUR/USD price action has been moving choppily within the wave 2 or wave B (green). A downtrend is confirmed when price has made a clear higher low via a potential wave 2 (orange) or when price breaks the 2 support trend lines.

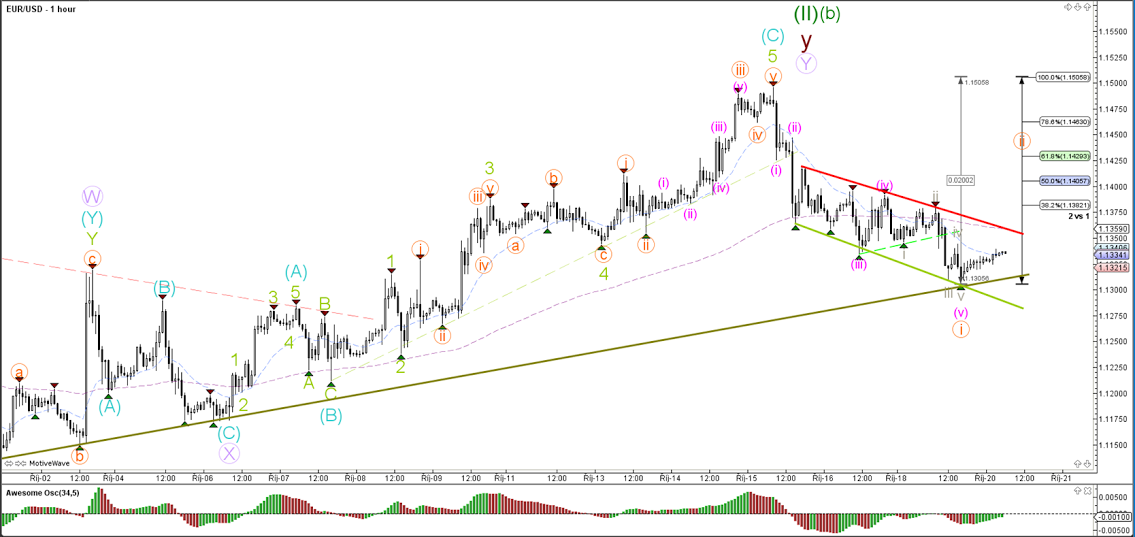

1 hour

The EUR/USD broke the mini support trend line (dotted green) and moved down lower to the next support (olive green). A break below it could see another extension of wave 5 (pink) of wave 1 (orange). A break above the top of the channel (red) could see price move towards the wave 2 resistance Fibs.

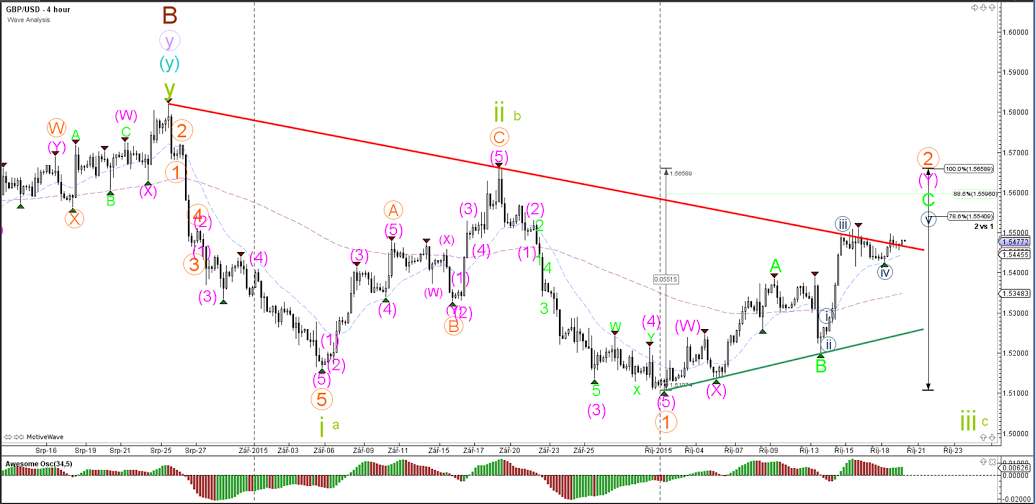

GBP/USD

4 hour

The GBP/USD is attempting to break the resistance trend line (red) and if price does break it, then another resistance zone is higher at the 78.6% and 88.6% Fibonacci retracement. A move up towards that level could complete the expected ABC formation (green). A break above the 100% level invalidates the wave 1-2 (orange). A break below the support trend line (green) is needed before a wave 3 or C (green) becomes more likely.

1 hour

The GBP/USD is building a wave 4 (blue) triangle formation. A break above resistance (orange) would increase the chance of the development of a wave 5 (blue). A break below the 50% Fibonacci retracement level increases the likelihood that the ABC (green) has already been completed.

USD/JPY

4 hour

The USD/JPY price action is back in the middle of consolidation zone (purple and blue dotted lines).

1 hour

The USD/JPY price action has slowed down substantially and is now building an ascending wedge chart pattern (orange and green lines). A break above resistance could see price move higher as part of wave C (green) whereas a break below support could see price struggle at the wave B support Fibonacci levels.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.