EUR/USD

4 hour

Whether the EUR/USD completed its bullish price action and thereby wave 2 or wave B (greens) depends on whether price is able to push below the various layers of support (green trend lines).

1 hour

The EUR/USD is in a mini triangle chart formation (red / green lines). It has wave 2 resistance Fib levels above it and support trend lines below it. At the moment a bearish turn seems the most likely wave count (current 1-2 orange).

GBP/USD

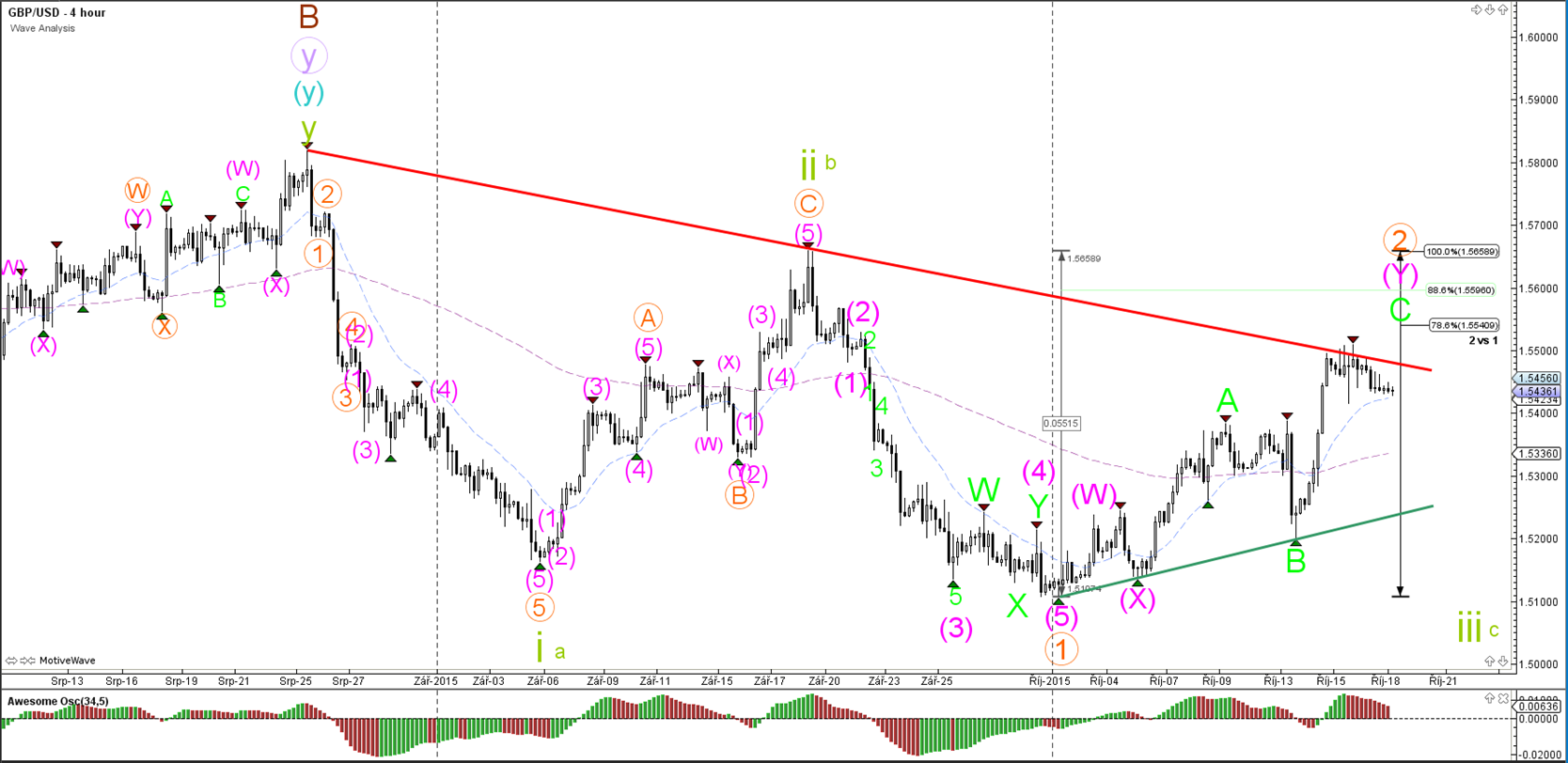

4 hour

The GBP/USD has not managed to break the resistance trend line (red) but if price does break it, then another resistance zone is higher at the 78.6% and 88.6% Fibonacci retracement. A move up towards that level could complete the expected ABC formation (green). A break above the 100% level invalidates the wave 1-2 (orange). A break below the support trend line (green) is needed before a wave 3 or C (green) becomes more likely.

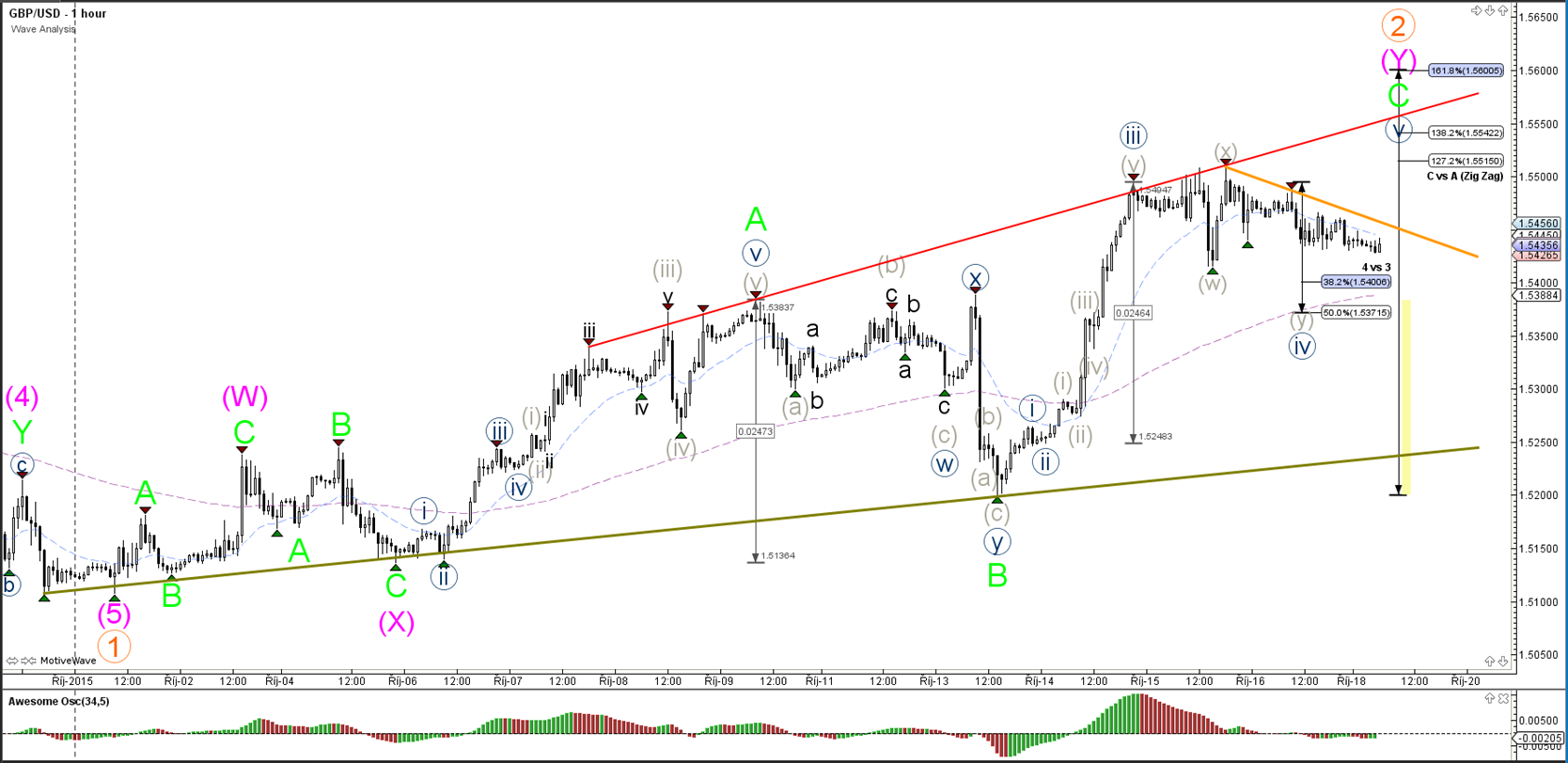

1 hour

The GBP/USD is building a wave 4 (blue) consolidation zone. A break above resistance (orange) would increase the chance of the development of a wave 5 (blue). A break below the 50% Fibonacci retracement level increases the likelihood that the ABC (green) has already been completed.

USD/JPY

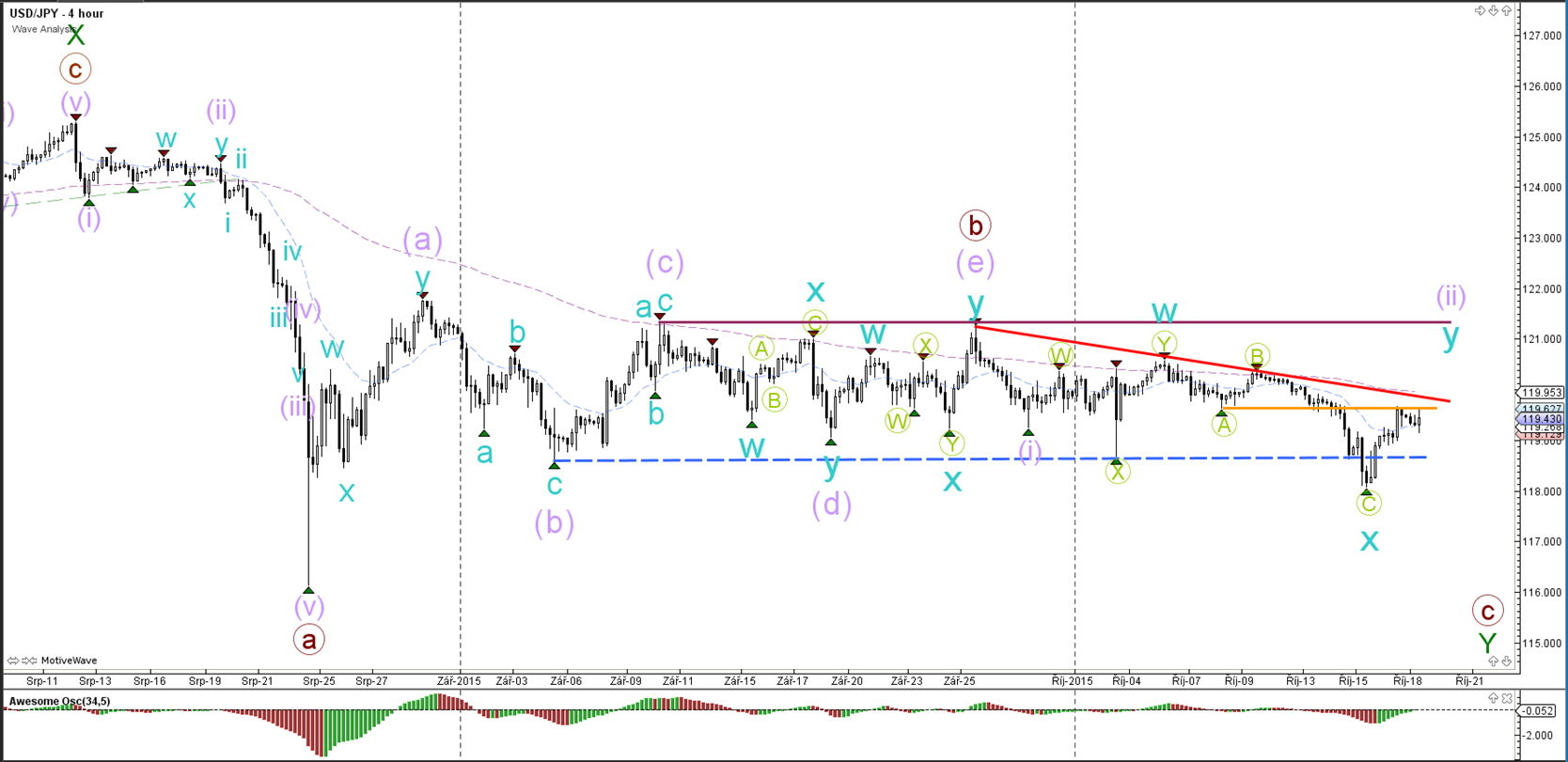

4 hour

The USD/JPY price action was not able to push away from the consolidation zone and price reverted back to the moving averages.

1 hour

The USD/JPY’s bullish rally developed in 5 waves, which could be explained by an ABC (green) rally within a larger wave 2 (green) correction.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure from RBA rate decision

AUD/USD spiked lower by more than 20 pips following the RBA rate announcement to test the key psychological support at 0.6600. Losing this key level could see the currency pair trek lower towards the 100-hour EMA support near 0.6580.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.