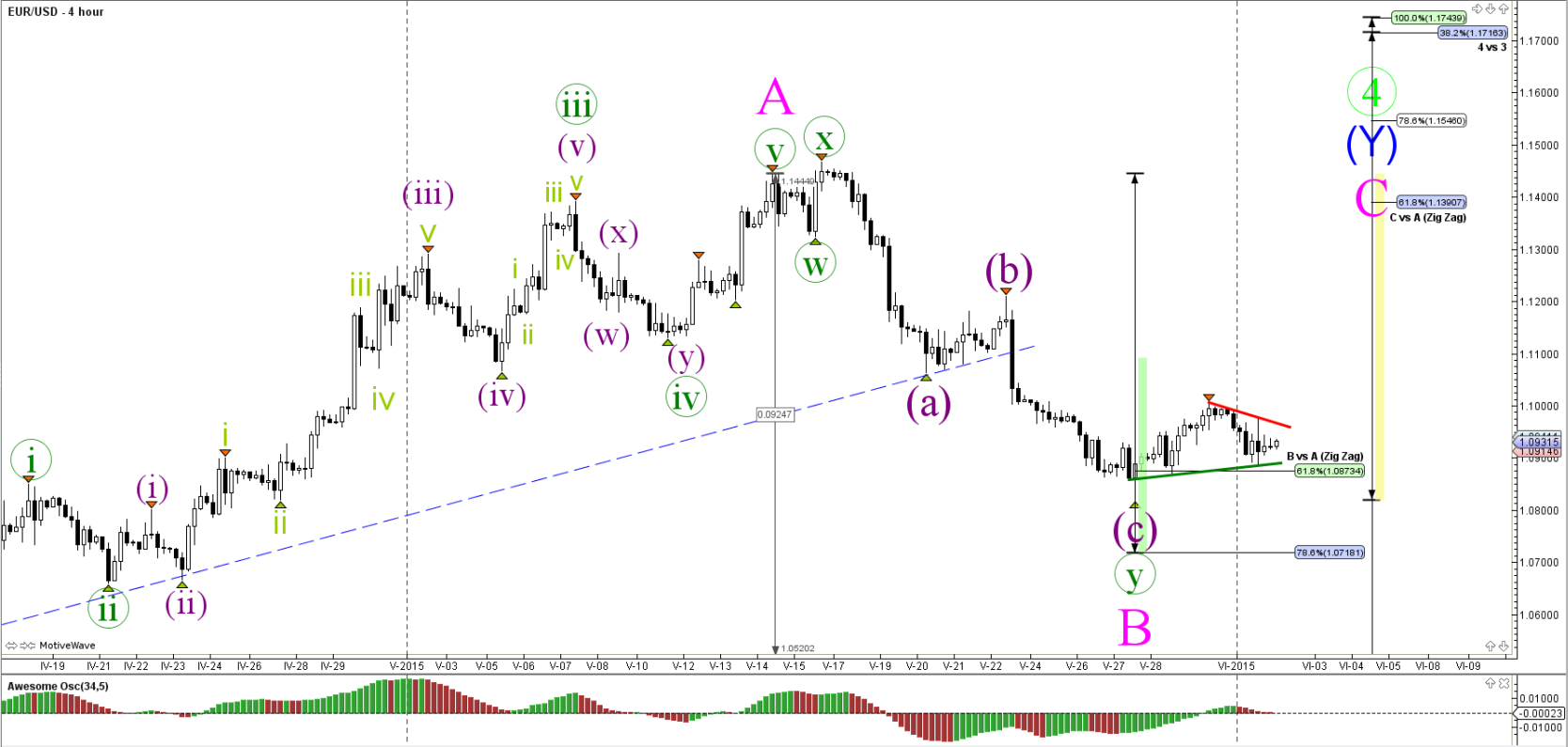

EUR/USD

4 hour

The EUR/USD is in a contracting wedge, which is indicated by the support (green) and resistance (red) trend lines. A break of these lines could indicate a potential movement towards the support or resistance.

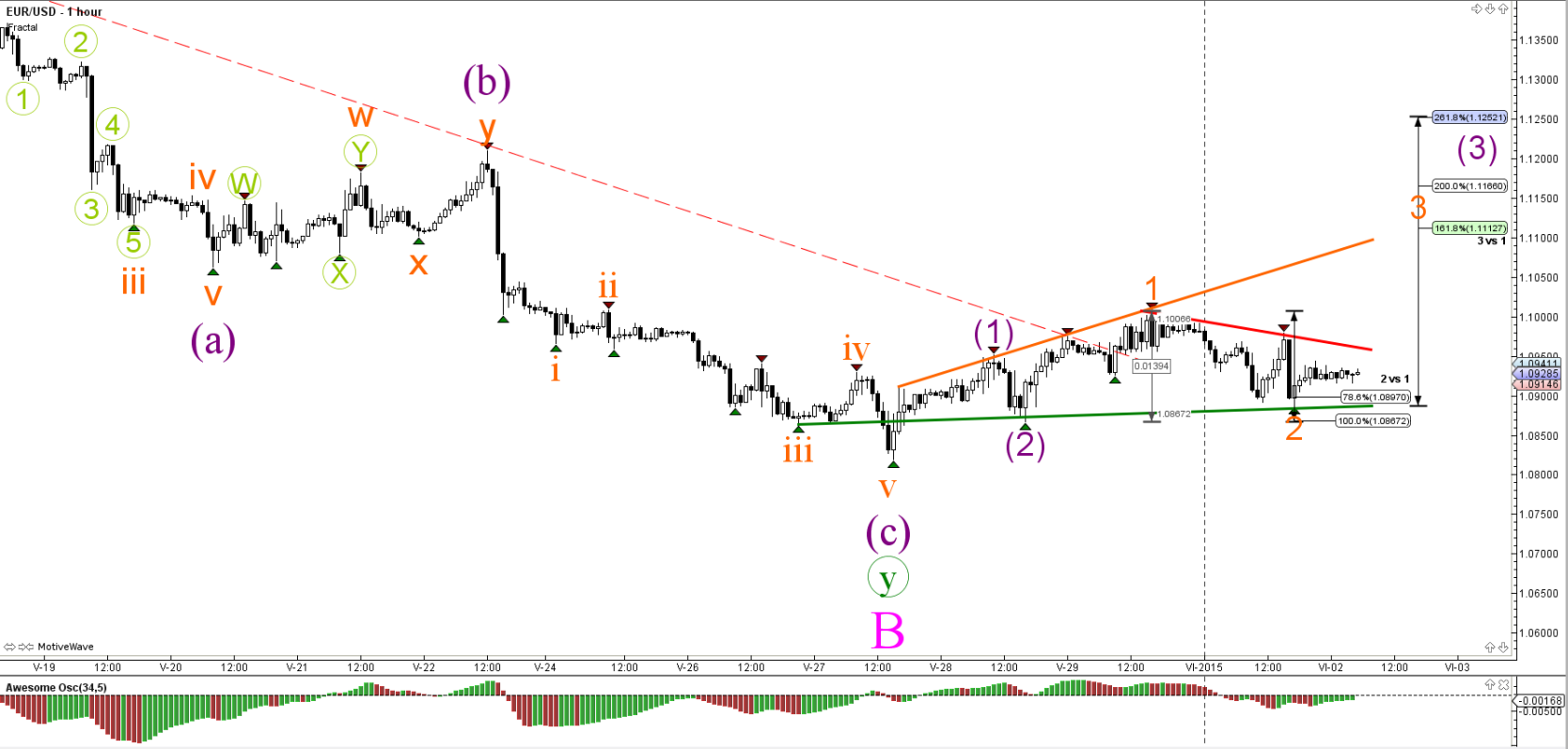

1 hour

The EUR/USD wave count still labels the bullish price action as a wave 1-2 but this will invalidated if price breaks below the support line (green). Price needs to break above the resistance (red) and accelerate to the Fibonacci targets to confirm a potential wave 3 (orange).

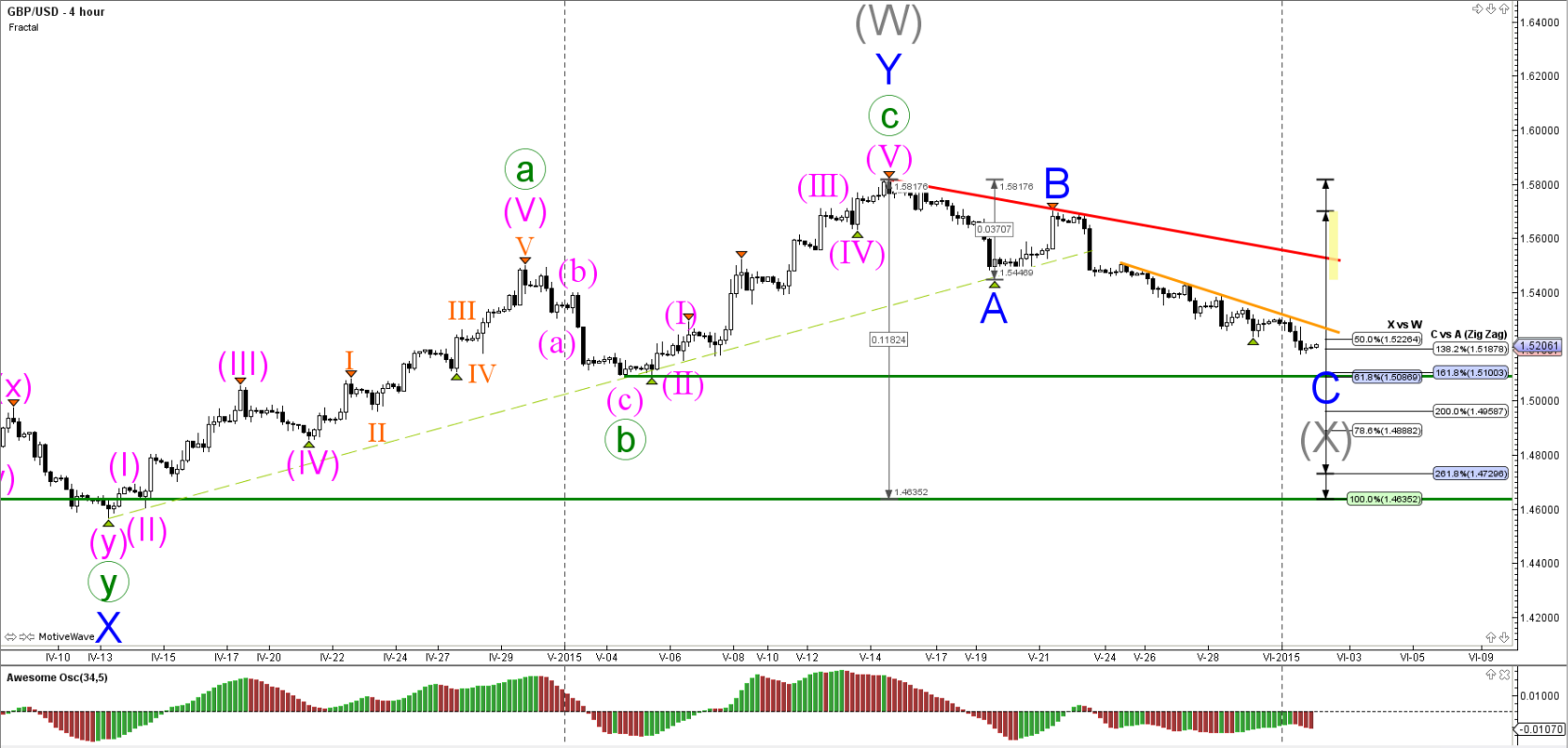

GBP/USD

4 hour

The GBP/USD keeps pushing lower and lower and remains solidly rooted in a downtrend, although divergence is present (purple line).

1 hour

The GBP/USD remains firmly anchored in the downtrend channel after yesterday’s break of the support trend line (dotted green). Price could make one more fall as part of wave 5 (orange) but a break of the downtrend channel indicates that the downtrend has been completed.

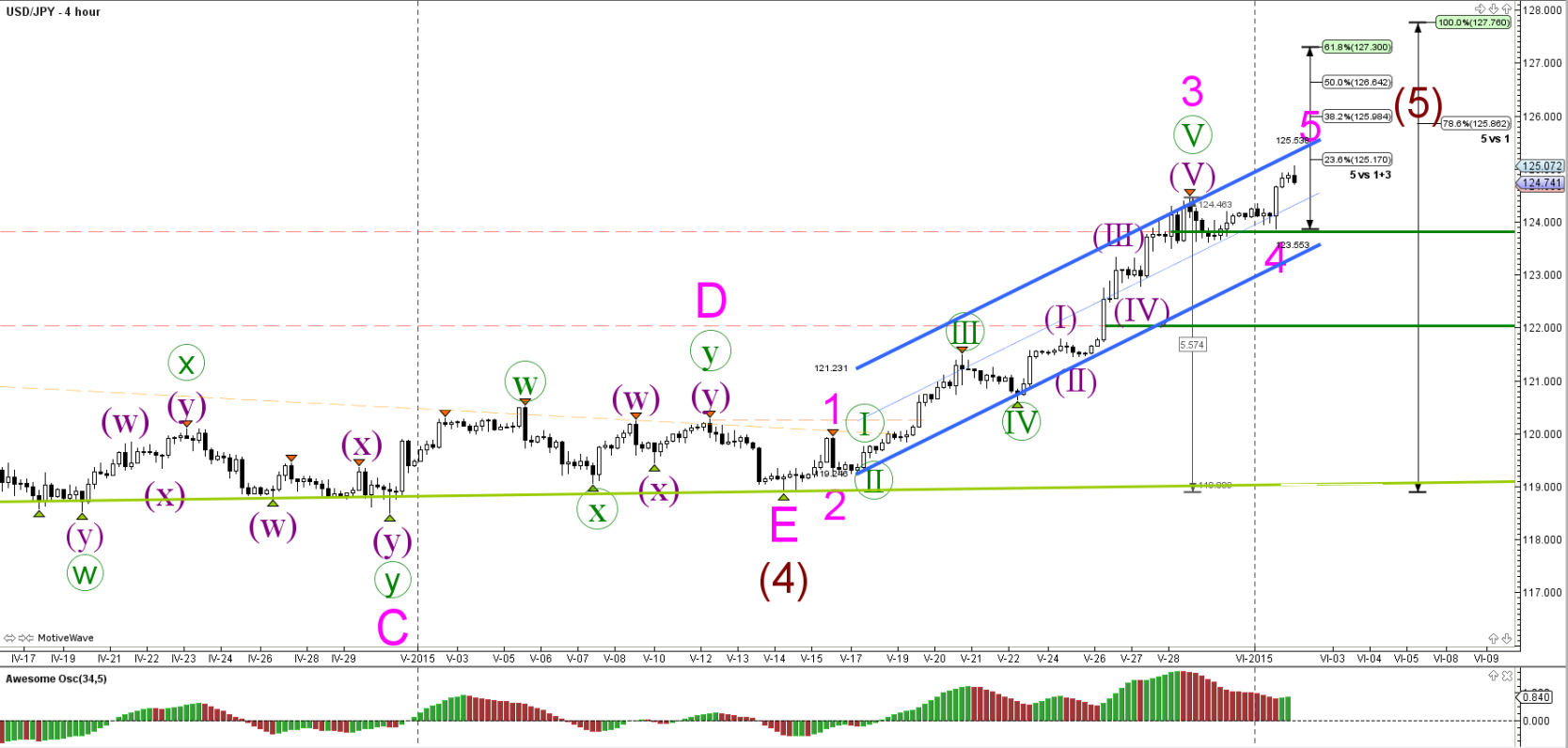

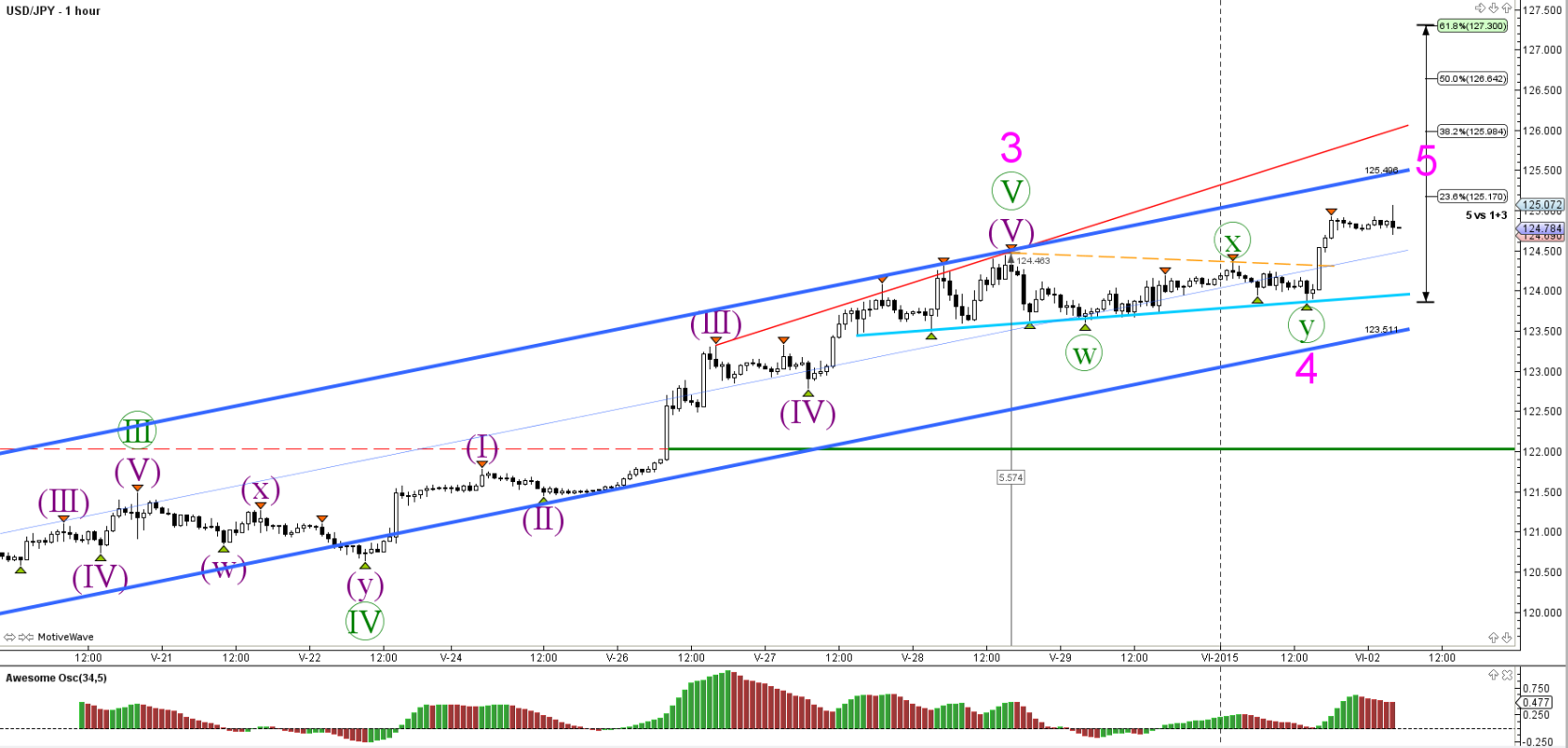

USD/JPY

4 hour

The USD/JPY has reached the psychological round level of 125 which could be a strong resistance. If price does retrace then the channel and broken resistance (green line) could provide support again. A break above 125 could see price move towards Fibonacci targets.

1 hour

The USD/JPY had a small sideways corrective zone with 3 internal legs which completed wave 4 (magenta).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.