For the last four months, the value of the euro has been falling steadily against the Canadian dollar. Some might say that the “loonie has been on a tear”, but in fairness, most currencies have suffered a similar recent fate. Our analysis suggests it’s time for a pullback, so this trade is looking to buy EUR/CAD as a short term countertrend setup.

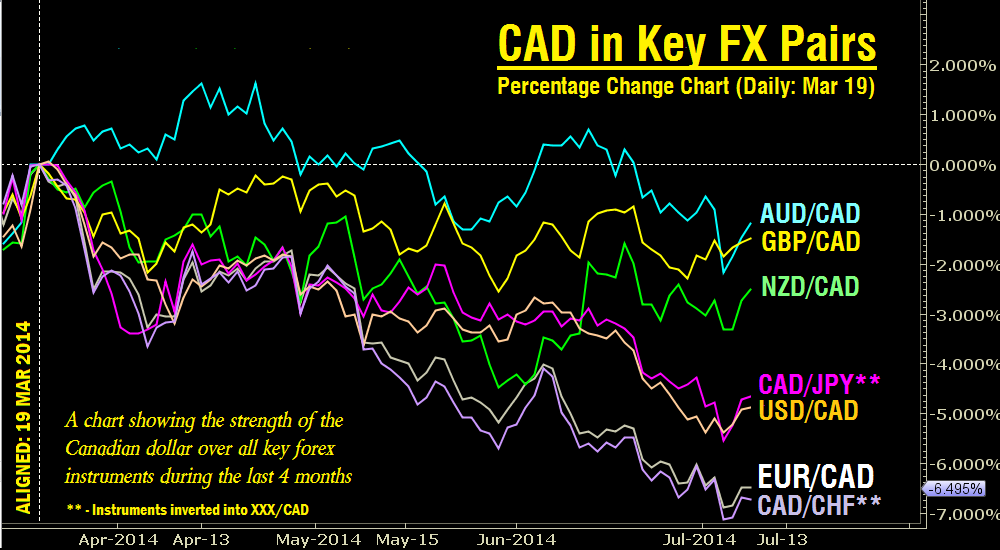

This percentage change chart shows how strong the Canadian dollar has been over the past few months against all the key forex currencies. The data has been aligned on March 19, the date a number of CAD pairs were at significant highs. We can see that during the last four months, the Canadian dollar has appreciated between 1% and 7% against these key currencies, with the euro and Swiss franc suffering most.

While EUR/CAD is currently trading around 1.45, it was trading at 1.55 in mid-March. The fall has been steady with a noticeable pullback during April. We’ve conducted an Elliott Wave analysis since the 1.55 high and it suggests another pullback is due. We’ll look to corroborate that with other forms of analysis.

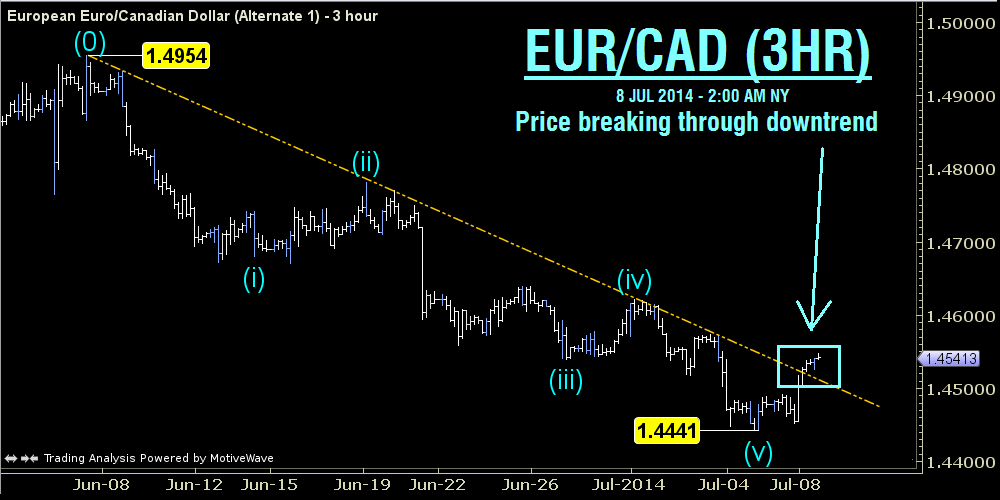

This is our three-hour EUR/CAD chart from the early June high of 1.4954. It shows a completed five wave sequence (also called an impulse) from 1.4954 to the recent low at 1.4441. Five wave moves are typically followed by three wave moves in the opposite direction, so we’re looking for impulsive price action to the upside from a significant low.

We’re working on the basis that 1.4441 is that significant low. This is based on a few things. Firstly, a downtrend line has contained price action for over a month since the 1.4954 high, until today. Next, we’ve seen a move above 1.4517. Within wave ‘blue (v)’, there are five smaller waves, and the first of these ends at 1.4517. The fact that price has moved above that level also suggests the move lower is likely over for now. Further, we’ve looked at the price action on various longer and shorter timeframes and from an Elliott Wave perspective, it suggests much more upside to come. The combination of these and other factors is why we believe 1.4441 is a significant low.

This is our fifteen-minute EUR/CAD chart from the recent low at 1.4441. It shows three yellow waves higher (wave ‘yellow i’ to ‘yellow iii’) with price currently pulling back in wave ‘yellow iv’. It also shows the five smaller green waves within wave ‘yellow iii’. Unusually, the first green wave is the longest of green waves one, three and five. It means that the current pullback should find support at the low of that second green wave being 1.4498. We will place our stop slightly below this level at 1.4492.

The size of a fourth wave is typically related to the second and third waves. As waves ‘yellow ii’ and ‘yellow iv’ are travelling in the same direction, it’s common to see the size of these two waves related, either about the same size of related by a factor of 1.618. The green “4vs2”:100% ratio on this chart shows where the fourth wave would be the same size as the second wave. It’s also the case that the size of the fourth wave can be related to the size of the third wave, and the most common relationship is 38.2%. Note how the green “4vs3”:38.2% ratio is perfectly in line with the “4vs2”:100% ratio at 1.4511. Where two keys ratios are so close, it suggests a likely area for the pullback, so our entry will be a few pips above this at 1.4518 (which allows for the spread).

Therefore, we’re looking to buy EUR/CAD at 1.4518 or lower. Our stop will be at 1.4492. The ‘take profit’ target will be 1.4557. This setup is looking to risk 26 pips to try to make 39 which equates to a reasonable risk/reward ratio of 1.5.

There is an Elliott Wave rule that clearly states that a fourth wave can’t enter the territory of a first wave. Here, it would mean that the pullback of wave ‘yellow iv’ should stay above the high of wave ‘yellow i’ (i.e. above 1.4488). While the trade would be safer if our stop were placed below 1.4488, it would also provide a lesser risk/reward ratio. Both need to be considered when providing trading levels. In practice, price does sometimes briefly cross over this boundary, but intraday incursions are tolerated. Placing a stop at say 1.4483 (five pips below the first wave high) would mean the trade seeks to make 39 pips but risk 35 pips, practically a 1:1 trade. That’s not the sort of risk/reward we consider reasonable for a trade.

Long Setup for EUR/CAD

- Trade: Buy at (or below) 1.4518.

- Stop Loss: Place stop at 1.4492.

- Take Profit: The single take profit level is 1.4557.

- Trade Management: Cancel the orders before key Euro or Canadian news is released if the entry hasn’t been triggered (and re-enter the orders when the price action calms down after news.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.