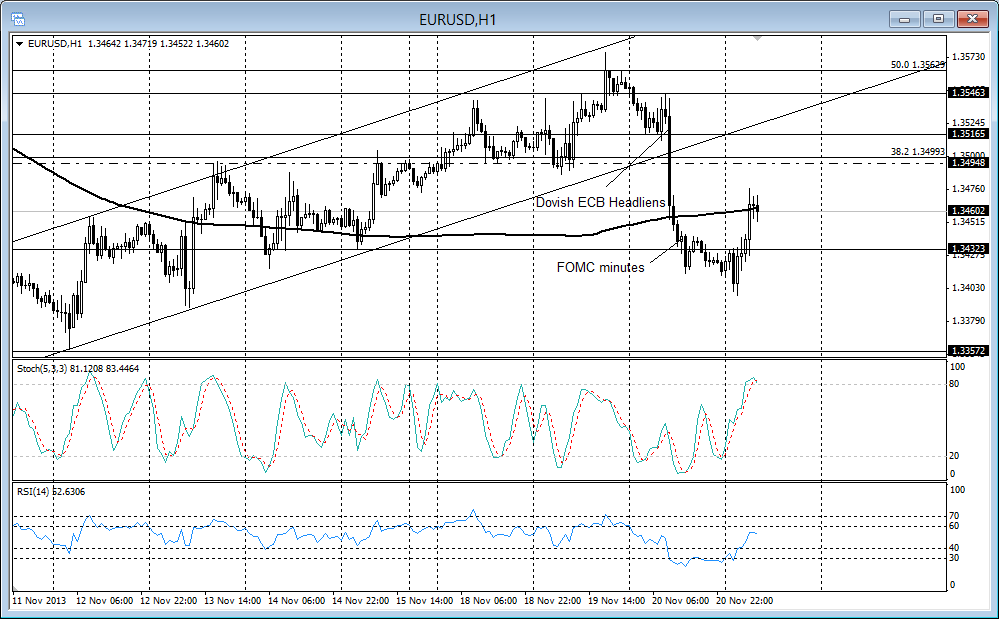

EUR/USD 1H Chart 8:25AM ET 11/21/2013

ECB, FOMC: During the 11/20 session, EUR/USD stalled at 50% retracement of the 1.3832-1.3293 dip that occurred just a few weeks ago. Then it fell on dovish ECB headlines that noted the bank considering a range of options in increase liquidity. The FOMC minutes also gave the USD a boost towards the end of the 11/20 session, but EUR/USD found support just above 1.34 during the 11/21 Asian-European session.

Breakdown: This downswing broke below a rising channel from 1.3293 (11/6 low). This break can be reviving a bearish outlook that preceded the rising channel, which retraced 50% of the prevailing bearish swing. There might still be some near-term upside toward 1.35 or a tad higher, but EUR/USD looks bearish at the moment. As we start the 11/21 session, it is kissing the 200hour SMA, awaiting next intra-session swing.

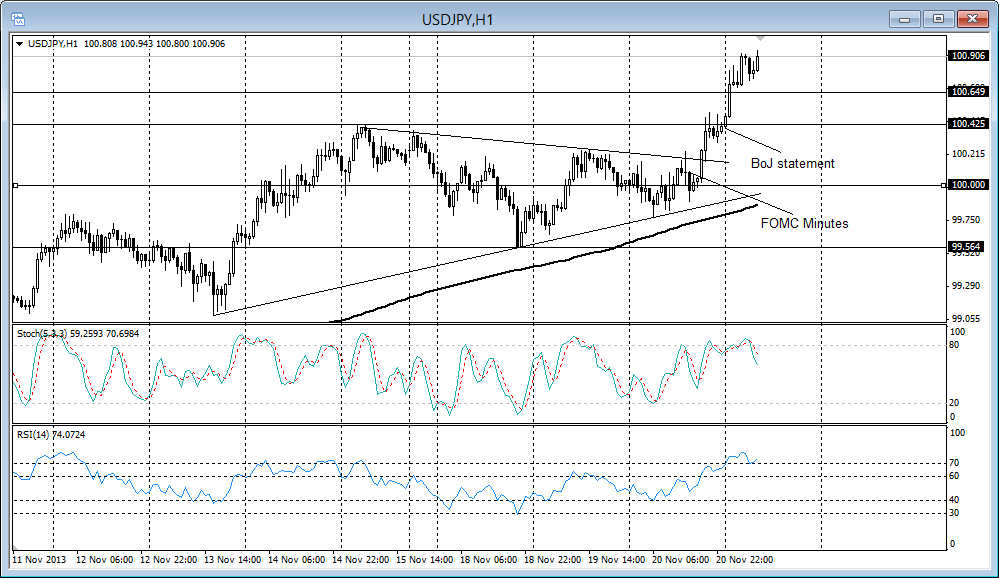

USD/JPY 1H Chart 8:30AM ET 11/21/2013

FOMC, BoJ: The USD/JPY was not boosted immediately after the FOMC minutes. However it may have stored some “potential energy” ahead of the BoJ policy statement.You can see the market coiling a bit throughout the week into somewhat of a triangle.

As expected the BoJ held steady, which allowed that “stored bullish USD energy” to push through the week’s high and continue toward the 101 handle, which is about to be captured as we begin the 11/21 session.

The next resistance pivot is around 101.50. The 2013-high is 103.70. These previous highs are in sight as the USD/JPY moves away from the 100 handle, and we might not get any significant throwbacks.

The information used by ForexMinute.com including any opinions, charts, prices, news, data, Buy/Sell signals, research and analysis is provided as general market commentary and does not constitute any investment advice. ForexMnute.com is not liable for any damage or loss, including but not limited to, any loss of investment, which may be based either directly or indirectly on the use of or reliance on such information. Before deciding whether or not to take part in foreign exchange or financial markets or any other type of financial instrument, please carefully consider your investment objectives, level of experience and risk appetite. Do not invest more money than you can afford to lose.

Note that the high level of leverage in forex trading may work against you as well as for you. Please seek advice of an independent financial advisor if you are not fully aware about the risks associated with foreign exchange trading. Forex trading on margin involves considerable exposure to high risk, and may not be suitable for all investors. Global Invest does not endorse any companies, products or services which are represented on Forexminute.com The information on this website is subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.