DAILY USD/JPY TECHNICAL OUTLOOK

DAILY USD/JPY TECHNICAL OUTLOOK

Last Update At 25 Nov 2020 01:44GMT

Trend Daily Chart

Sideways

Daily Indicators

Turning up

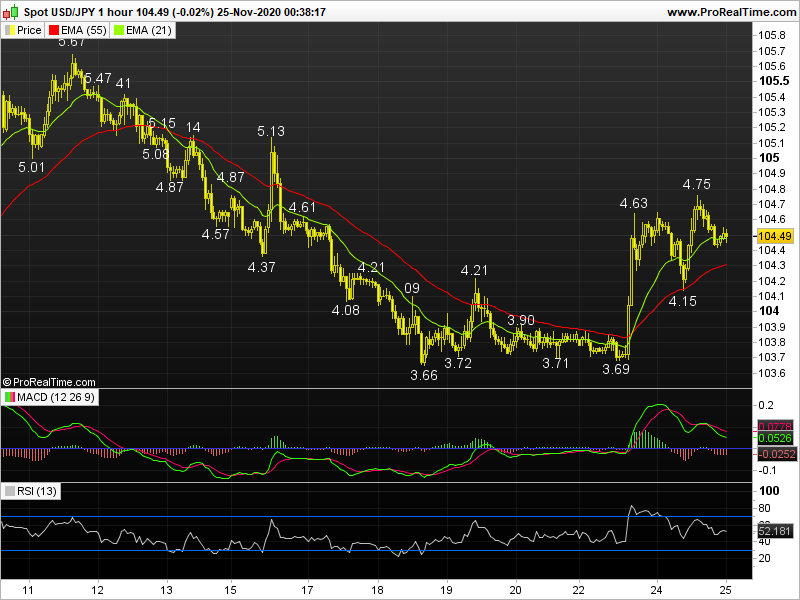

21 HR EMA

104.48

55 HR EMA

104.30

Trend Hourly Chart

Near term up

Hourly Indicators

Bearish divergences

13 HR RSI

52

14 HR DMI

+ve

Daily Analysis

Consolidation with upside bias

Resistance

105.67 - Nov's high (11)

105.13 - Last week's high (Mon)

104.75 - Tue's high

Support

104.15 - Tue's low

103.90 - Last Fri's high (now sup)

103.66 - Last week's low (Wed)

USD/JPY - 104.50.. Dlr swung wildly in hectic trading on Tue. Despite climbing one tick abv Mon's 104.63 high at Asian open, price fell to 104.15 in Europe b4 resuming Mon's impressive rally to session highs of 104.75 in NY.

On the bigger picture, dlr's fall fm 118.66 (Dec 2016) to 2019 low at 104.46 (Sep) confirms early uptrend fm 2016 29-month bottom at 99.00 has hit a top there. Despite hitting a 3-1/2 year bottom of 101.19 in Mar on risk-off trades due to COVID-19 pandemic, dlr's rise to 111.71 due to broad-based usd's rally signals low has been seen. Having said that, dlr's erratic fall to 104.01 (Sep) indicates correction has possibly ended n below Nov's 7-1/2 month 103.18 trough would add credence to this view n price is en route twd 101.19. On the upside, a daily close abv 105.13 would prolong choppy sideways swings, risks re-test of 105.67 but break needed to head twd 106.10 in Dec.

Today, dlr's Mon's rally fm 103.69 n then break of 104.21 res to 104.75 y'day suggests further volatile swings abv last week's 103.66 low would continue with upside bias, however, 'bearish divergences' on hourly indicators would cap price at 105.13/15. Only below 104.15 signals top is made n risks 103.86/90.

Trendsetter does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Trendsetter does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Trendsetter shall not be responsible under any circumstances for the consequences of such activities. Trendsetter and its affiliates, in no event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.