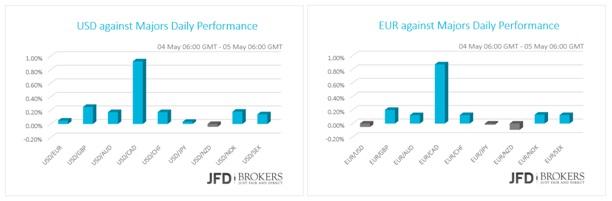

Not much volatility in the G10 currencies on Wednesday with only exception the Canadian dollar that plunged following the release of the poor trade figures from Canada. The downbeat manufacturing and Retail Sales numbers weighed on euro preventing it from locking gains, however, it ended the day marginally higher against its peers.

The U.S. dollar performed similarly on the back of the mixed data and the weak ADP employment change that came out as many traders categorize it as a safe-haven currency. The pound was virtually unchanged versus its counterparts with very little losses as the PMI Construction for April disappointed.

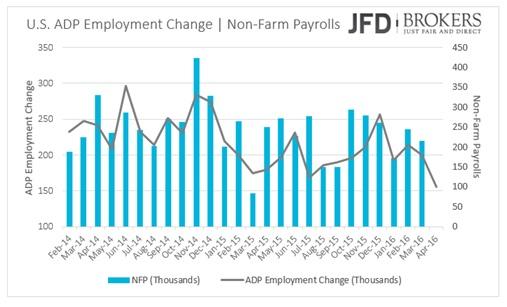

U.S. ADP Employment Change Missed Forecasts

Two days ahead of the Non-Farm Payrolls report the ADP Employment Change announced to be 156k in April, missed expectations of 196k by far and recorded the weakest number over the last eight months. The NFP is forecasted to show that the U.S. economy has added 200k jobs in April from 2015k before and the average hourly earnings to keep the same pace of growth at 0.3%. On the other hand, the rest of the economic indicators released on Wednesday bolstered the dollar’s value. The Trade Balance surpassed expectations in April while the Services sector expanded for the second consecutive time following a 28-month record low in February. The Non-Manufacturing sector also expanded more than the market consensus to 55.7 in April from 54.5 before, according to the ISM PMI survey.

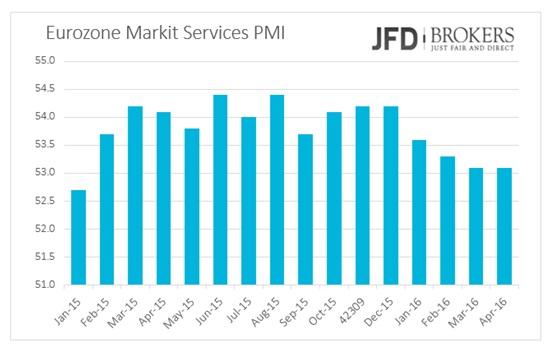

Soft Eurozone’s data points to slower growth in Q2

The shared currency closed the day marginally higher against the G10 currencies despite the signs that point to weaker growth in the second quarter for the Eurozone, while it outperformed against the Canadian dollar. April’s manufacturing activity barely grew in April at 53.10 slightly lower than forecasts of 53.20. In addition, the Retail Sales for March contracted by 0.5% mom versus an increase of 0.3% the month before. The Retail Sales figure compared to the same month the year before, rose by 2.1% recording a 4-month low. All these point that growth may be limited in the second quarter for the Eurozone.

The EUR/USD pair, unexpectedly, had a muted reaction to the release of the U.S. ADP report. The pair recorded an intraday low at 1.1465 before surpassing 1.1500. However, few minutes later the bulls failed to sustain their gains above that barrier and came back to close below 1.1500. The pair has had a range-bound session ahead of tomorrow’s NFP report. Technically there is no change to the outlook. The EUR/USD pair has been trading within an upward formation over the last couple of months or so, following a strong start to 2016. It is very significant that the bulls managed to maintain the pair above the ascending trend line and the 50-SMA on the daily chart. For now, I would expect another range-bound near the 1.1500 level as most traders will not take any risks ahead of the NFP.

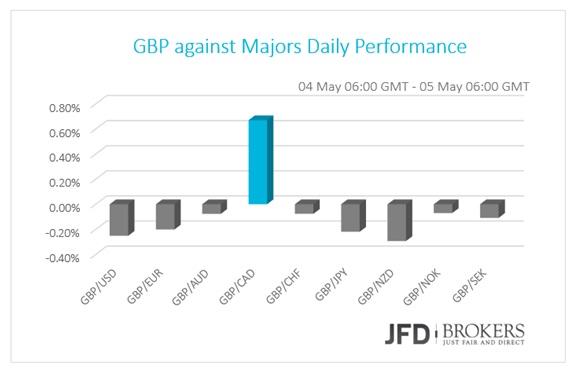

UK Contraction growth adding to worries over UK economy’s strength

The pound was traded slightly lower on Wednesday session and early Thursday as the Construction PMI for April disappointed adding to the worries over UK economy’s strength following the soft Manufacturing PMI also for April that released on Tuesday. The Construction PMI declined to 52.0 from 54.2 expected before and 54.0 the market expectations.

The British pound is trading higher the last couple of hours against the U.S. dollar as it looks to make its way back towards the 1.4600 level, following its unsuccessful attempt to break below the 1.4460 barrier during yesterday’s session. It’s worth noting that the pair is down 0.70% so far this month, following a positive April +1.75% and a positive March +3.20%. Yesterday the pair closed down 0.20% following a negative Tuesday 0.95%. Today and tomorrow will be a bit thin for data for the UK, although from the U.S. the NFP report for April could cause some waves for the pair.

According to the 4-hour momentum indicators further winnings look possible, which I would expect the winnings to be limited, where the initial target will be at 1.4550. The higher timeframes are still showing some bearish divergence so some caution is warranted on the downside.

Canadian dollar Plunged as Canadian Trade Deficit Widened

The U.S. dollar continued its rampant advance versus the Canadian dollar on Wednesday after the Canada’s trade deficit In March widened to a record $3.41 billion as exports plunged for a second month on weak demand by the U.S. market. In particular, exports in March fell 4.8% to $41 billion while imports plunged 2.4% to $44.4 billion as eight of 11 sectors fell. March’s exports were 5.1% lower than the same month a year earlier.

The USD/CAD rose 2.5% in the last 48 hours adding to the monthly gains of 2.20% following three consecutive negative months (Feb. -3.1%, Mar. 3.95%, Apr. -3.48). The pair surged above the suggested entry level at 1.2770 during yesterday’s session and finished the day at 1.2887, slightly below the suggested target at 1.2900. The latter is a significant level since it coincides with the 4-hour 200-SMA and the weekly 50-SMA. We could now see a retracement below the 1.2850 level ahead of the Canadian Building Permits, as well as ahead of tomorrow’s U.S. NFP report and Canadian employment data. In the medium-term the bias has changed to bullish since the price surpassed the descending trend line, which started back in mid-January, as well as it crossed above the 50-SMA on the 4-hour chart.

Having in mind the above, I would expect the pair to trade quietly during today’s session, as traders will book profits ahead of the significant events coming from both, the U.S and Canada. Therefore, our recommendation for today’s session is no position we remain flat until we see the final reaction of the price below the 1.2900.

Economic Indicators

Thursday the markets will also be pretty quiet in the absence of heavyweight indicators. In UK, the Halifax House Prices for April will be released and in Eurozone the Economic Bulletin.Going to U.S., there is a noticeable number of central bank speakers to keep the calendar alive: St. Louis Federal Reserve Bank President James Bullard is speaking about the economy in Santa Barbara, California.

Later in the day, San Francisco Fed President William and Atlanta Fed President Lockhart will also have a speech. The weekly Jobless Claims will be published as usual and in Canada, the Building Permits for March. Later in the Asian session, Reserve Bank of Australia will publish its monetary policy statement.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.