Yellen: Fed Must “Proceed Cautiously”; Dollar Plummet while U.S. Shares Surged!

Fed Yellen’s dovish comments contradicted the hawkish comments from Fed policymakers last week and wreaked havoc to dollar’s exchange value. However, that was a push for the U.S. shares to enjoy a gainful trading day. Other main beneficiaries of her comments were the commodity bloc currencies versus the greenback and the metals. The major currency pairs which do not involve the dollar were traded mostly unchanged in the absence of heavyweight numbers from most economies.

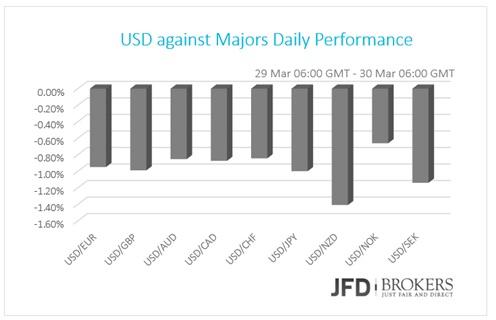

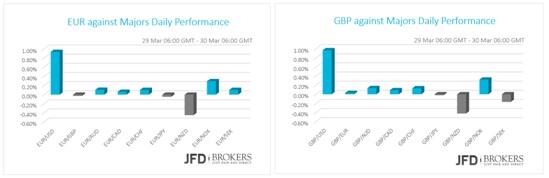

On Wednesday, the dollar plunged by 0.79% versus the euro and 0.86% against the pound. The U.S. Federal Reserve chair Janet Yellen said that Fed should “proceed cautiously” before tightening the monetary policy as she expects that global risks to have a deep impact on U.S. economy. She also justifies the slower than initially forecasted rate rises due to the global developments and the increased risks. Moreover, she explained again that China’s slowing growth, volatile oil prices and the perspective that inflation will not reach Fed’s 2% target soon, forced the central bank to gradual and slow rate hikes.

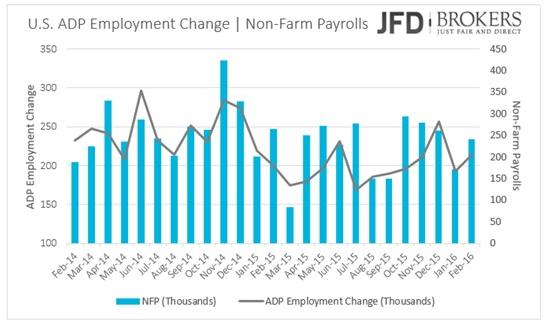

The Case-Shiller Home Price Indices rose by 5.7% in January, the same rising pace as the month before, despite market’s consensus that would have risen by 5.8%. The CB Consumer Confidence rose to 96.2 surpassing markets forecasts to remain stable at last month’s soft number of 94.0. The ADP Employment Change coming out today, two days ahead of the Non-farm payrolls report, will be closely eyed.

EUR/USD – Technical Outlook

EUR/USD surged above the significant level of 1.1220 and is currently trading slightly above 1.1300.

Looking ahead, there is a fair bit due today from the U.S., including the ADP Employment Change and the Crude Oil Stocks Change. On top of this, traders will also be looking to the release of the Consumer Confidence, Services Sentiment, Business Climate and Industrial Confidence for Eurozone. Technically, the single currency has filled the bids above 1.1220 and 1.1300 support levels, ahead of the 1.1345 which will again see some buyers. A break above 1.1345 would head towards 1.1377 (11 Feb high), a strong technical level. From here we need to make a sustained effort to get back above the latter level to provide confidence of a medium term base. If so, a break of 1.1377 would open the way towards the significant level at 1.1500. Meanwhile, the 50/100 SMAs are crossing at around 1.1030 – 1.1100 and will provide the initial resistance for the pair.

GBP/USD – Technical Outlook

The GBP/USD has had a strong run higher over the last 4 days, following the strong rebound from the 1.4030 area. While the uptrend currently remains intact, which started from 1.3837 (29 Feb low) the daily momentum indicators are now turning to point higher, above their mid-levels, and there is a fair degree of further bullish movements suggesting that we could see further gains, which could test yesterday’s suggested target at 1.4435. A break above that could then head towards 1.4515 (18 Mar high).

Commodities jumped against the greenback!

The commodity currencies continued to extend their gains against the greenback with the Australian dollar rising to a fresh 9 month high and the New Zealand dollar closing on a multiyear high, following the break above the significant obstacles, including 0.6875 and 0.6900. The USD/CAD made a partial recovery in volatile conditions following Yellen’s speech with the Canadian dollar adding 0.85% to its value against the U.S. dollar, following a 0.75% gains the previous day. I would expect the commodity currencies to continue moving upwards versus the U.S. dollar. Investors are nervous about the upcoming events this week, with the key event to be the U.S. NFP report this Friday.

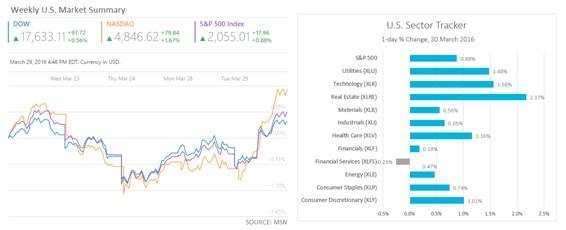

U.S. Indices are traded near 2016 high levels

Moving to the U.S. indices, the day for the U.S. stocks benefited from Yellen hawkish comments and are traded near year-to-date high levels. The NASDAQ Composite Index soared 79.84 points, +1.67% on Wednesday and had its second failed attempt to break above the resistance level at 4,480.

The Dow Jones Industrial Average surged 97.72 points, +0.56% during yesterday’s session but it stacked slightly below 17,670. Apple Inc. (NASDAQ: AAPL) and Microsoft Corporation (NASDAQ: MSFT) were by far the biggest drag of the blue-chip index with gains of 2.37% and 2.19% respectively. The S&P 500 gained 0.88%, 17.96 points up closing slightly below the 2.060 level. All all the share sectors closed the session with gains, with exception the Financial Services stocks which fell by 0.25% on average.

What to watch today

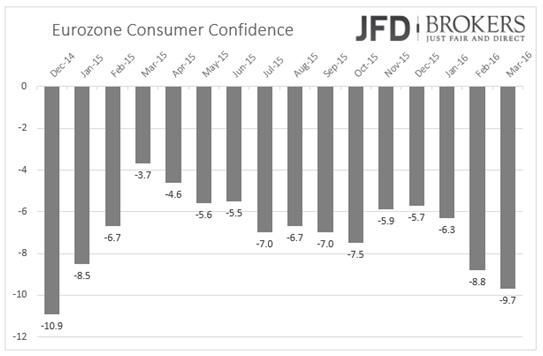

Early today, traders will eye sentiment indicators coming from Eurozone for March. The Consumer Confidence is expected to decrease further in the negative territory, to -10.0 from -8.8 the month before.

Services and Industrial sentiments are forecasted to show a small improvement. In Germany, Inflation Rate is scheduled for release. Two days ahead of the U.S. Job Report, the ADP Employment Change is coming out and is forecasted that that the non-farm, the private sector added 194k jobs in February from 214k jobs prior.

Later in the day, the UK Gfk Consumer Confidence for March is predicted to show a decline in the negative territory at -1.0 from a 14-month low February at 0.0. Nothing surprising as the sentiment in UK declines due to the Brexit fears. The last time, the confidence among the investors was below zero was the last quarter of 2014. Overnight, in Australia, the ANZ Business Confidence for February will be out as well as the New Home Sales.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.