The two-day Fed monetary policy meeting that ended on Wednesday was unlikely to stoke much volatility to the greenback, as it wasn’t followed by a press conference as usual. The Fed left its interest rate unchanged and shifted to the wait-and-see mode for the next policy meetings.The FOMC statement said that it is “closely monitoring global economic and financial developments” while “assessing their implications for the labour market and inflation, and for the balance of risks to the outlook”. Fed sees lower growth and does not expect the inflation rate to rise towards 2% as far as it thought in December. This dovishness doesn’t mean the abandonment of the plan to tighten the monetary policy this year but to raise interest rates at a slower pace. However, a tightening move in March is not out of question but it is heavily data-dependent and less likely than before.

EUR/USD failed to keep its earlier gains

The shared currency ended the day slightly higher against almost all the other major currencies on Wednesday, despite the absence of heavyweight numbers for Eurozone. The EUR/USD rose up to the psychological level at 1.0900 as we expected but failed to keep its gains. It is currently finding support at 1.0870 which coincides with the 200-SMA on the 1-hour chart.

The FOMC meeting yesterday failed to push the price either way. Today, the various sentiment indicators for Eurozone that are expected to come out, are also not expected to affect importantly the pair to help it get out of its medium-term range between 1.0700 and 1.1000 where it has been for the last two months.

If the 200-SMA on the 1-hour chart provide sufficient support to the pair, I would expect the pair to test the level at 1.0920. On the other hand, if the USD bulls push the price below 1.0820, we may see a fall towards 1.0710.

UK GDP in Focus!

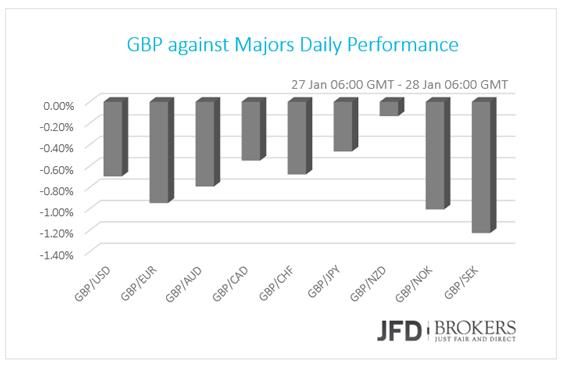

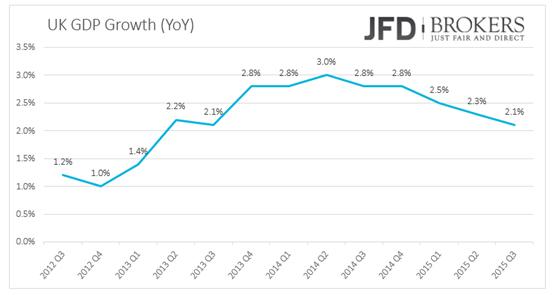

The pound was broadly lower on Wednesday and early Thursday, as the GBP traders are expecting the first flash estimate of the GDP for Q4. Following Fed rate hike and Carney’s comments that Brexit will trigger financial instability as it has done the important indicators that mirror the situation of the domestic economy will be closely eyed. The year-over-year indicator is forecasted to show a slower growth of 1.9% from 2.1% in Q3, while the quarter-over-quarter growth is expected to accelerate up to 0.5% from 0.4% before.

The GBP/USD is at its first retracement since its heavy sell-off started early in December. The pair found support at the significant level of 1.4060 and found resistance on the 100-SMA on the 4-hour chart, slightly below 1.4370 and returned below 1.4300 as we recommended yesterday. The 50-SMA, that provided important resistance these two months, has now turned to support on the 4-hour chart. I would expect the pair to test again the 1.4340 level which coincides with the 100-SMA before it continues its downward move towards 1.4060.

U.S. Indices at an On-and-Off Mode

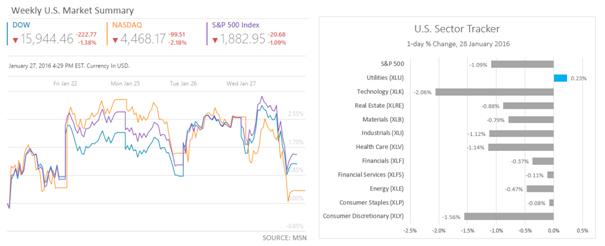

The U.S. indices are at an on-and-off mode heavily affected by the oil prices and the earnings report coming out. On Wednesday, the three indices closed with significant losses. Nasdaq Composite was down by 2.18% while S&P500 dropped by 1.09%. All the stock sectors, contained in S&P, depreciated in the trading session except utilities that rose marginally.

The Dow Jones ended the day with 223 points, 1.38%. The Boeing Company (NYSE: BA) and Apple Inc. (NASDAQ: AAPL) were by far the biggest drag of the blue chip index. Both companies fell short of their earnings forecast. The Boeing EPS for Q4 2015, released on Wednesday, was expected to be $2.17 while it was by far lower at $1.60. The Apple had lower revenues than expected, $75.87B versus $76.54B expected, and revealed that the high-tech company lose significant sales ground from China.

Economic Indicators

On Thursday, the preliminary British GDP for the fourth quarter is forecasted to show a slower growth of 1.9% from 2.1% year-over-year.

In Eurozone, the sentiment indicators from different sectors are expected to show a decrease or a stability of the optimism in the Eurozone. In Germany, the preliminary inflation rate for January is expected to have increased to 0.5% from 0.3% before. On the second half of the trading session, the Durable Goods Orders for December are scheduled for release for which the market expects a decrease of 1%. The pending home sales are also coming out.

During the night, the japan employment and inflation report are coming out. The consumer prices are expected to rise by 0.2% in December, lower than 3% before. The unemployment rate is anticipated to remain steady at 3.3%. The flash Japanese industrial production for December will improve to -0.3% from -0.9% the month before. A few hours later, the Bank of Japan will have its policy meeting. No changes are expected to the interest rates but the press conference will follow will attract some attention.

-------

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.