BoE Interest Rates On Hold; U.S. Retail Sales in Focus

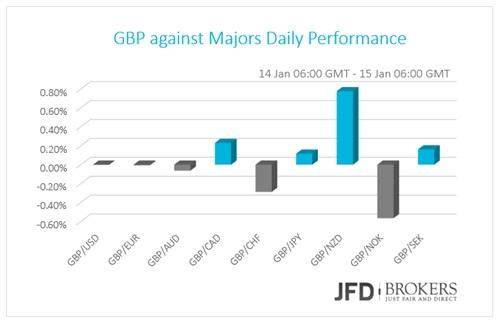

The dollar has experienced a low volatile trading week so far and the traders expect the retail sales today to trigger some volatility in the market. The EUR/USD, EUR/GBP and the GBP/USD pairs were virtually unchanged while all the other G10 commodities, except the New Zealand dollar and the Norwegian Krone, had a marginal change against the greenback on Thursday and early Friday.

The New Zealand dollar was the worst performing major on Thursday as the New Zealand economy as well as the Australian are strongly related to Chinese, thus, any weakness is mirrored in the commodity currencies. Moreover, the combination of the slowdown in the world’s second-largest economy, China, in combination with the plunging oil expanded the downside risks further.

The single currency has similar performance to the buck. As the ECB December minutes decreased the odds of any further action the euro remained subdued on Thursday. The EUR/USD pair was unable to rally above the main resistance at 1.0900 and the prices have rebounded from it as the bears took control over the trend. From a technical perspective, the pair should continue to depreciate towards the psychological support located at 1.0800 and a close below that level would be a sign for further declines towards the 1.0700 support zone. On the other hand, if we see a rally that extends above 1.0950, the scenario turns bullish.

BoE Left Monetary Policy on hold! Minutes underlined risks and weak data

The majority of the BoE policymakers voted to keep the interest rates unchanged at 0.5% where it has been since March 2009 with one voting for rise. The minutes revealed that the recent volatility in the market has underlined the risks to global growth and the rapid fall of the oil prices will cause inflation growth to be slightly more gradual than expected. All of these together push further away a rate hike scenario from the Bank of England.

Following Fed’s rate hike, economists believe that BoE will hike sooner, but we don’t see this happening until the end of the year. The National Institute of Economic and Social Research (NIESR) stated that the domestic economic growth slowed down to 2.2% during 2015 from 2.9% in 2014 while the UK industrial production suffered its sharpest fall since early 2013.

As the BoE Policy Statement has been quite dovish, the pair was unable to break through the 1.4450 resistance. The GBP/USD rebounded from the aforementioned level showing that the bears are still the dominant party despite the strongly oversold condition of the cross. For today, we expect the pair to remain in a range trading pattern between 1.4450 and 1.4350, near the five and a half year lows.

USD/JPY – Technical Outlook

The USD/JPY confirmed its bullish stance as yesterday the prices rallied by all most 80 pips up to 118.26. From a technical point of view, a daily close above 118.30 will be a strong indication that the bulls will continue to pressure and most likely we will see a test of the major resistance at 120.00. On the other hand, a drop below 117.30 will favour the bears and in such case, we will expect further declines towards the 116.00 support zone.

Gold to fall further

The price of gold broke below $1080.00 as this is a signal for further declines. Today, we expect the commodity to drop below its daily 50-SMA and head towards the $1060.00 support zone. A daily close below it would be a strong signal that the prices are going towards $1045.00. Only an extended rally above $1100.00 may indicate that the bulls are going for a push.

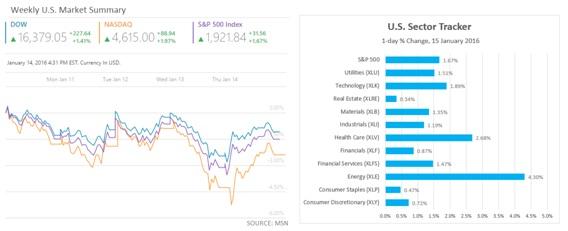

U.S. Indices Ended with Gains

Another volatile session for the U.S. stock market that finally ended with gains. The up and down of the indices performance keep their weekly change around zero, that today’s gains or losses will prevail. The Dow Jones Industrial Average gained 1.40% while the Nasdaq was up 1.96%. The best performed blue-chip stock was Chevron Corporation (NYSE: CVX) followed by Exxon Mobil (NYSE: XOM) with gains of 5.10% and 4.60%. The S&P500 ended 1.70% higher and the energy sector surged by 4.30%.

Yesterday, the DJIA rebounded from the 16,070 support level and on the 4-hour chart the prices formed a range pattern. However, the range is basically a trend continuation structure and we expect the bears to win the fight and the prices are likely to drop towards 16,270. Only an extended rally above 16,620 may indicate that bulls are being the dominant party and there might be a short-term trend reversal. However, for now, we do not see a price structure that suggests a change of the main downtrend.

Economic Indicators

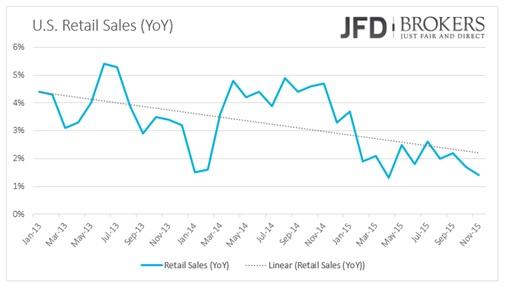

Today, the EcoFin meeting will take place. After Eurozone’s trade balance release, the traders will turn their attention to U.S. retail sales for December. The retail sales are predicted to slow down its growth slightly, to 0.1% from 0.2% before, month-over-month.

The Capacity Utilization, the Industrial production and the business inventories will be released as well. The preliminary Michigan consumer sentiment for January will be out.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.