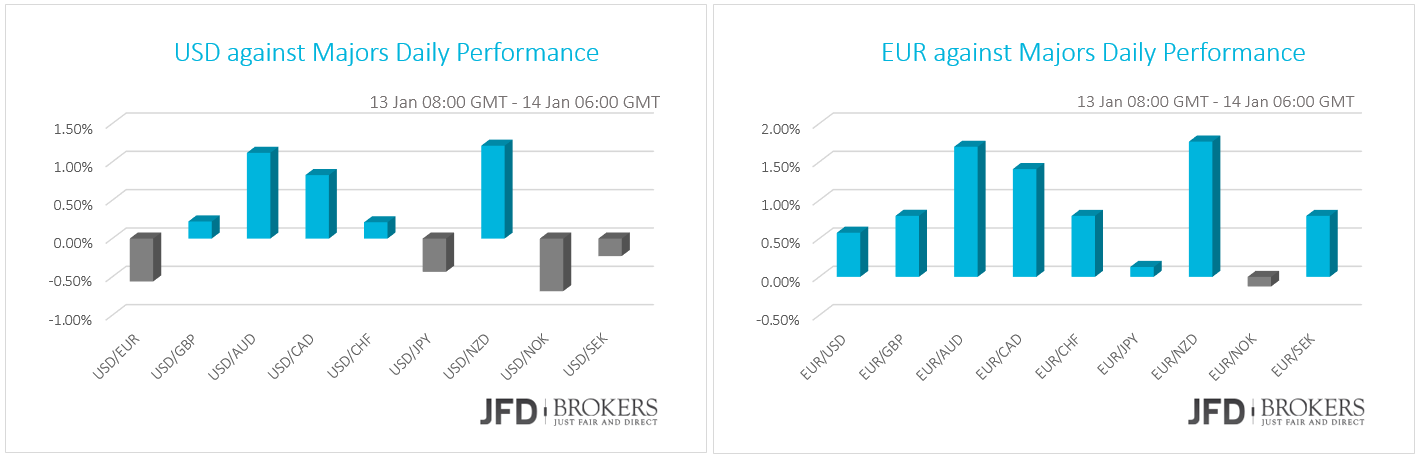

The greenback gained ground against the three commodity currencies - Australian, Canadian and New Zealand dollar - on Wednesday and early Thursday as the oil continues to depreciate and was traded temporarily below $30 per barrel. The Fed Beige Book released yesterday once again pointed the modest growth in most of the U.S. regions. Even though the labour market is at a healthy pace, wages remained subdued in most of the states. The consumer prices have risen slightly, triggering a discouraging signal for Fed officials to continue the gradual rate hikes.

Euro surged despite the weak industrial production

The euro surged against all the other major currencies despite the disappointing industrial production figures for Eurozone. In November, the industrial production was down by 0.7% worse than forecasts suggestion of being down 0.3% from an increase of 0.8% before, on a monthly basis. The ECB monetary meeting accounts that will be out later in the day will unveil whether the stimulus measures for the central bank started to have a positive impact on the economy.

Currently, the EUR/USD pair is traded in a tight daily range between the support at 1.0730 and the resistance below 1.0900. The daily 50-SMA is acting as a dynamic support level and as long as the prices are traded below it, we will support further declines. The major trend is bearish so we expect the pair to dip towards 1.0730 as a close below 1.0730 would indicate further declines towards the 1.0500 support zone.

BoE Policy Meeting in focus!

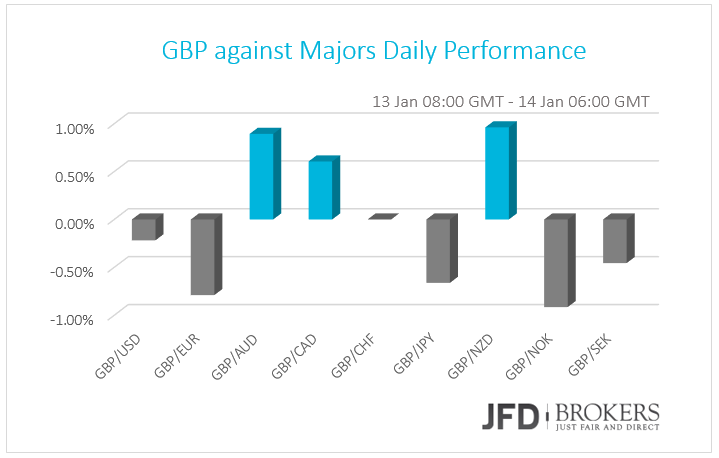

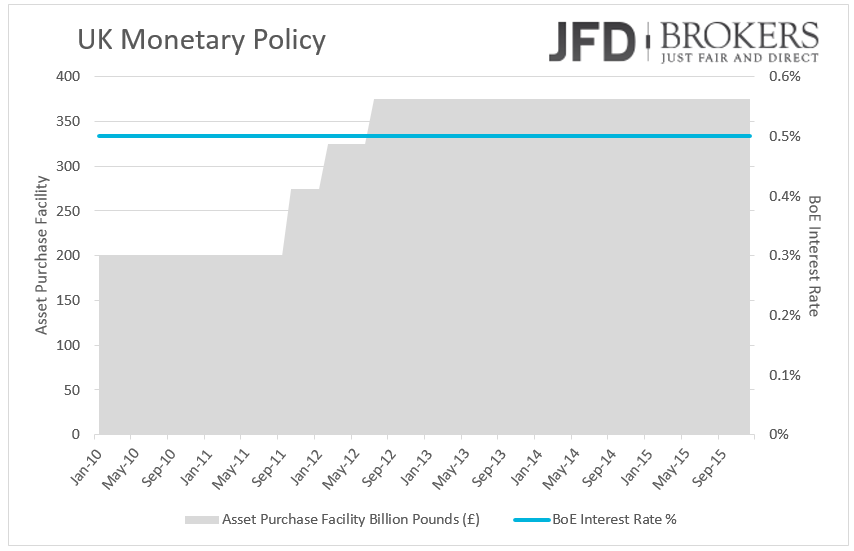

The sterling was traded mixed versus the G10 currencies on Wednesday on the absence of macroeconomic British data. However, all the attention will be on the GBP as the BoE policymakers will revise the domestic monetary policy. Even though, no changes are expected on the voting pattern, traders will give emphasis on the monetary policy summary to gauge if the central bank will raise interest rates in 2016, following Fed’s historical rate hike.

The GBP/USD pair continues to be traded in a strong bearish fashion. The downtrend is very strong and for now, there aren't any signs that the prices are going for a rebound. Technically, we expect a drop towards 1.4400 as a close below that support zone would be a signal that the pair is going towards the main daily support level located at 1.4200.

USD/JPY – Technical Outlook

On a daily basis, the USD/JPY pair has rebounded from a major support located at 117.00 and we expect the bulls to continue the push towards the 118.40 resistance. If we see a daily close above that level it would be a confirmation that the prices will continue to rally towards the next major resistance located at 120.00. However, a drop below 116.50 would open the paths towards further declines.

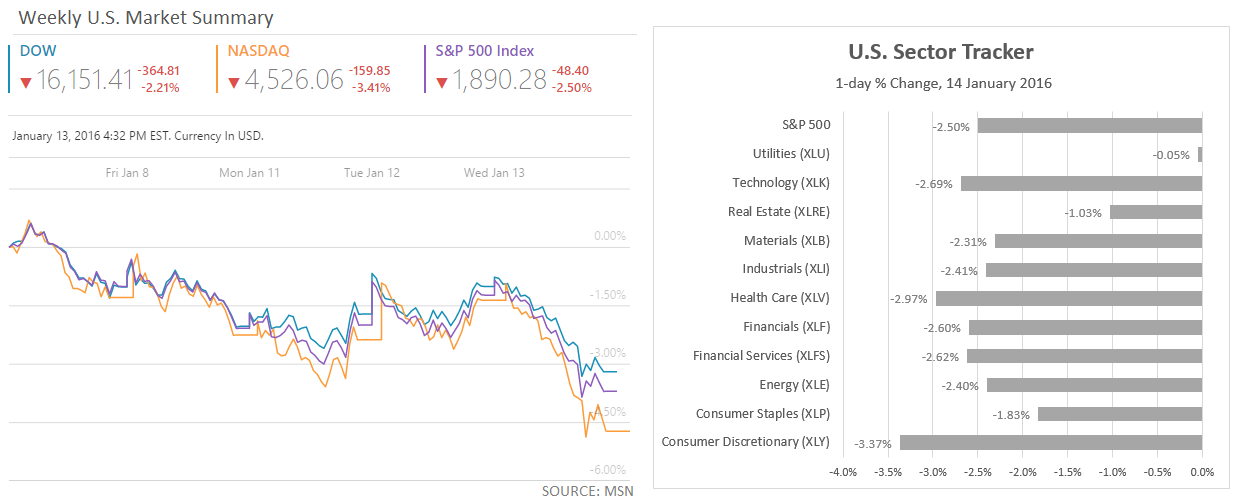

U.S. Indices crushed Tuesday's gains

The U.S. indices performance on Wednesday collapsed Tuesday’s optimism that the U.S. stock market will start to pick-up again. All the yesterday gains have lost and the indices depreciated even further. Nasdaq, after eight consecutive negative trading days, had rose by 1% on Tuesday but lost more than 3.4% of its value on Wednesday. Dow Jones suffered a triple digit loss of 365 points which means it closed 2.2% down of its opening level. The S&P500 tumbled by 2.5% with almost all of the stock sectors to have declined roughly evenly around 2.6%.

Yesterday, the Dow Jones Industrial Average has confirmed its bearish stance and the daily candlestick closed by forming a ‘ross’ hook pattern. This set up is very dovish and we expect the prices to continue depreciating towards the support at 15,880. Moreover, if we see a daily close below that level that would indicate a possible drop towards the psychological support at 15,500.

Economic Indicators

During the morning, Germany will release its real GDP growth. A Eurogroup meeting is scheduled to start. During the European noon, the Bank of England will have its monetary policy meeting and will release its monetary policy summary alongside with the BoE interest rate decision and the asset purchase facility. No changes are expected to the monetary policy and the voting pattern.

A while later, the European Central Bank will publish its meeting accounts. In U.S., the weekly jobless claims will be out as usual.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.