UK Manufacturing Production and GDP to Hog the Limelight; USD to be Quiet Until Friday

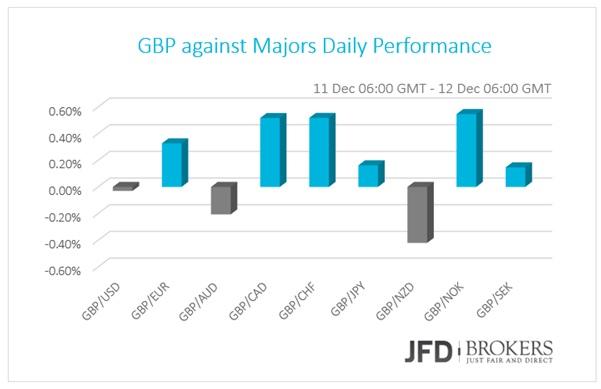

The greenback gained ground versus all of the G10 currencies, out of the Australian dollar and the New Zealand dollar. The two commodity currencies are under heavy pressure on the back of the falling oil while the single currency was slightly lower versus the majority of the other G10 currencies on Monday and early Tuesday.

The strong U.S. Non-Farm Payrolls report provided support to the USD pairs but failed to push the dollar higher amid China's stock turmoil and the plunging oil prices. The next scheduled significant fundamental update for the greenback is the retail sales due to Friday, until then, no major changes are expected.

Following the ECB announcement of the fresh stimulus measures the first days of December, the EUR/USD pair is traded in a sloping short-term channel between 1.1060 and 1.0710. I would expect the pair to test again the 1.0700 support level and if the bears manage to push the price below the aforementioned level, the paths for further depreciation will open. Alternatively, a break above the 1.0950 will signal further appreciation towards 1.1060.

GBP ahead of significant economic releases

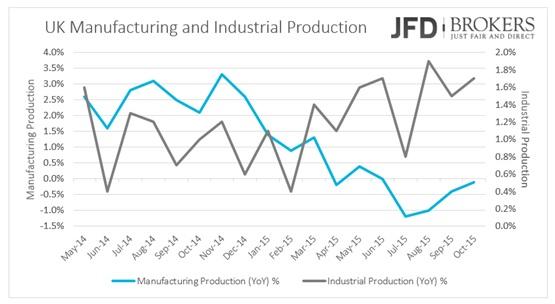

The British Pound rose against the most major currencies on Monday and Tuesday overnight, despite the absence of fundamental news. The “Brexit” campaigns for the referendum that is scheduled to take place later in the year started to concern the investors. The rest of the week contains significant news for the British pound. Today, the industrial and manufacturing production for November will be released followed by NIESR GDP estimate for the three months to November and a speech of the BoE Mark Carney.

Both indicators of production will be closely watched as the sectors are important for the domestic economic growth. The two sectors started to pick up in August, after weakness the sectors faced the first half of 2015 that increased in August. On a yearly basis, the industrial production is expected to grow on the same pace as before at 1.7% in November while the manufacturing production is predicted to reveal a bigger contraction than before, of 0.8% from 0.1% in October. No forecasts are available for the NIESR GDP. However, I would not expect the figure to be extremely different of the last releases which were around 0.5%. Later in the day, the BoE Governor Mark Carney will speak in Paris at a Farewell Symposium, but he is not expected to comment on economic issues.

The GBP/USD pair is traded in a steep downtrend the last month without any reversal indications yet. The pair managed to close the week below the 1.4560 level, making stronger the bearish perspective. Even though the pair may the pair may experience some consolidation in the next days, the bears will continue to be the dominants. After the temporary consolidation, I would expect the pair to drop further towards the next main support level at 1.4200. As long as the greenback gains momentum against the other G10 majors, further declined are ambushing. On the other hand, if we see an extended rally above 1.4950, we could say that the bulls took the upper hand over the trend.

USD/JPY – Technical Outlook

The USD/JPY pair had been in a consolidation between 123.70 and 122.20 in November. A decisive break below the lower boundary of the range was the beginning of a strong sell-off. Even though, the bulls managed to push the price back to test again the 123.70 level, they failed to sustain the price around there. The U.S. dollar depreciated more than 5% the last month and is currently found support slightly above 116.50, where I would expect the pair to rebound towards the resistance level at 120.00 and in a longer-term perspective to head towards 124.00.

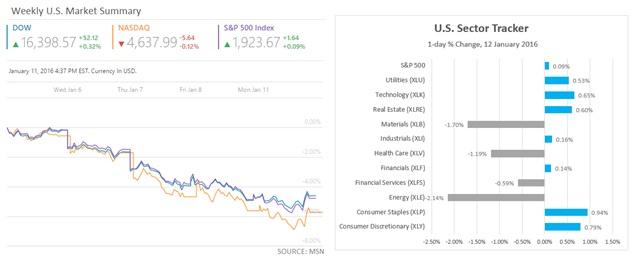

U.S. Indices didn’t close with losses

After significant weekly losses, the three U.S. indices managed to close the first trading day of the week without severe losses. The Dow Jones industrial average ended the day positive with gains of 0.32% and the S&P500 0.09% up. The Nasdaq Composite was down 0.12%. The worst performed sector was the energy sector again as the stocks related to energy fell by 2.14% overall. The materials related stocks followed plunging by 1.70%.

Economic Indicators

The UK manufacturing and industrial production for November will have an impact on the GBP cross pairs, as well as the NIESR GDP estimate for the three months to November that will be published later in the day. The industrial and the manufacturing sectors started to pick up in August, after weakness the sectors faced the first half of 2015 that increased in August. On a yearly basis, the industrial production is expected to grow on the same pace as before, at 1.7% in November while the manufacturing production is predicted to reveal a bigger contraction than before, of 0.8% from 0.1% in October.

Later in the day, the BoE governor Mark Carney will speak in Paris at a Farewell Symposium, but he is not expected to comment on economic issues.

Going to U.S., the JOLTS Job Opening in November are expected to increase slightly. The domestic economic optimism for January will be also out. During the night, China will release its detailed trade balance data.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD stays firm above 1.2500 amid US Dollar weakness

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair's uptick is supported by a broadly weakness US Dollar on dovish Fed signals. A mixed market mood could cap the GBP/USD upside ahead of mid-tier US data.

Gold price trades with modest losses amid positive risk tone, downside seems limited

Gold price edges lower amid an uptick in the US bond yields, though the downside seems cushioned. A positive risk tone is seen as another factor undermining demand for the safe-haven precious metal.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.