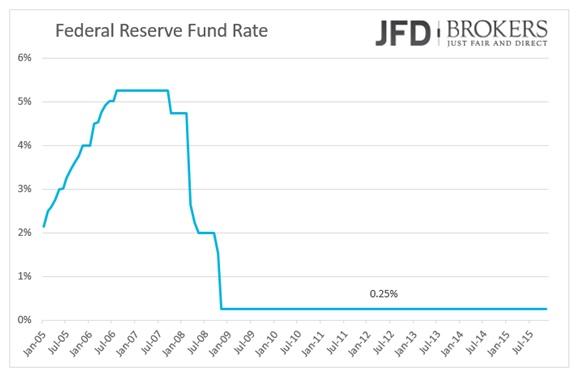

The day arrived! The two-day policy meeting ends today and will unveil if the Fed policymakers will fulfil traders’ forecasts for an interest rate hike. The Federal Reserve Bank is broadly likely to raise the Funds Rate for the first time in nearly a decade. This happened again throughout 2015, however, there were many “delays” for the first rate lift that disappointed the market.

Though, the surveys for this policy meeting show that the odds for such move are highest than even before and only a small part of economists have their doubts. The market forecasted a rate hike by a quarter percentage point to 0.50% from 0.25% that has been since December 2008. Last time Fed raised its benchmark interest rate was on June 2006.

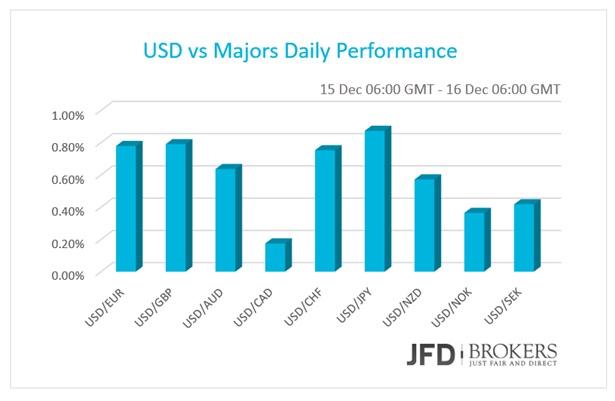

At 19:00 GMT Fed will announce its Interest Rate decision or any other adjustments to the monetary policy if there are any! One day ahead of the decision announcement the dollar gained significant ground against the other major currencies.

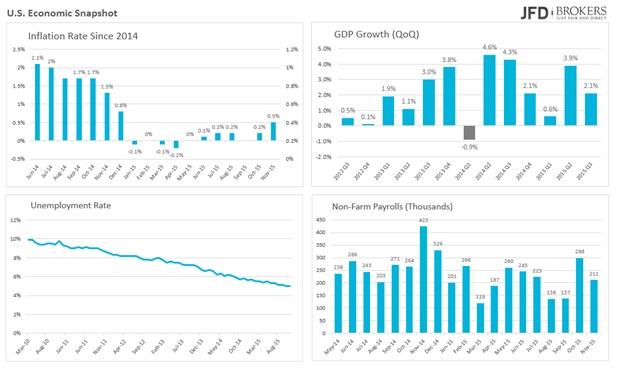

From one side, the macroeconomic data are appropriate for such a move now! The labour market is better than ever - record low unemployment rate, healthy wage growth, sufficient Non-Farm Payrolls jobs - and the last release of the inflation report showed that inflation picked up to 0.5% from 0.2% before. In addition, the economy is on a healthy and steady pace of growing over 2%.

If FOMC announces a rate hike will panic the markets despite the preparation from Fed policymakers’ comments. Alongside with the decision the central bank will publish the FOMC Economic Projections and a half hour later a press conference from Fed Chairwoman Janet Yellen will complete the picture.

From the other side, the fear of weakness hasn’t disappeared yet. If Fed leaves the monetary policy unchanged, it will have a serious impact on its credibility. At the last press conferences, the Fed Chair Janet Yellen expressed her worries that a late rate hike will have a bad impact on the economy.

Although, Fed may apply other measures to tighten the monetary policy out of lifting the benchmark interest rate.

EUR/USD - Technical Outlook

Since yesterday, the EUR/USD pair has been under a serious bearish pressure and amid the upcoming Fed rate decision we expect the pressure to continue. On the 4-hour basis, the bearish price action is very strong and until the decision is out we expect the pair to continue its downtrend set-up. First, we expect the prices to break below 1.0900 and if we see a rate hike, the volatility may skyrocket and pressure the pair towards the 1.0790 support zone. Our outlook for the pair is strongly bearish!

GBP/USD - Technical Outlook

The GBP/USD has been traded in a very well defined downtrend pattern and we expect the bearish pressure to continue. The Fed release may be giving a spike for further declines towards the support at 1.4880. In the case of a rate hike, we expect the pair to continue its bearish trend towards the main horizontal support at 1.4585. On the other hand, technically, a push above 1.5240 would indicate that bulls are trying to take an upper hand. However, fundamentally based this is a very unlikely scenario.

USD/JPY - Technical Outlook

The USD/JPY pair has rebounded strongly from the horizontal support level of 120.00 and the daily price action suggests that the bulls are having an upper hand over the cross. On top of that, we expect the pair to move in correlation with the other USD related pairs. Until the end of the day, we expect a rally towards the 123.50 resistance. Technically, only a drop below 120.35 would indicate that bears are being dominant.

Economic Indicators

There is also a lot of economic data being released today, although I’m not sure it will have quite the same impact that it ordinarily would. Today is the most important day of the week and not only for the dollar! Fed will announce its interest rate decision. Before that, during the European morning the preliminary Markit Manufacturing and Services PMIs for Eurozone, Germany and France will be released.

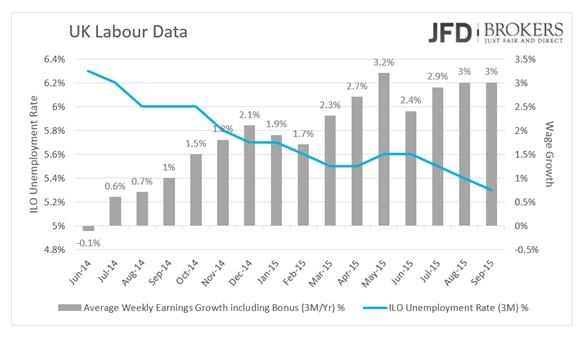

In UK, the employment report will be strongly eyed. The unemployment rate for the three months to October is predicted to have remained at the record low of 5.3%. The Claimant Count Change, the number of unemployment people in UK, is expected to have increased by 1.5k in November, lowest than the record high of 3.3k in October. The average weekly earnings are expected to have grown by 2.5%, slowest pace than before the 3% before.

The inflation rate in Eurozone is expected to show that consumer prices declined slightly by 0.1% in October. In US the Housing Markets and the Building Permits for November will be out as well as the Industrial Production and Capacity Utilization for the same month. The Swiss National Bank will release the Quarterly Bulletin for the final quarter of the year.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.