With two policy meetings (RBA, ECB) this week the Non-Farm Payrolls report stayed on the side lines for a while, but today, all the lights will be turned on it. This U.S. employment report would be added to Fed’s decision whether will raise its interest rate on the September 17 policy meeting. However, China’s currency devaluation and the plunging stock market is likely to hold back Fed policymakers to a more dovish stance.

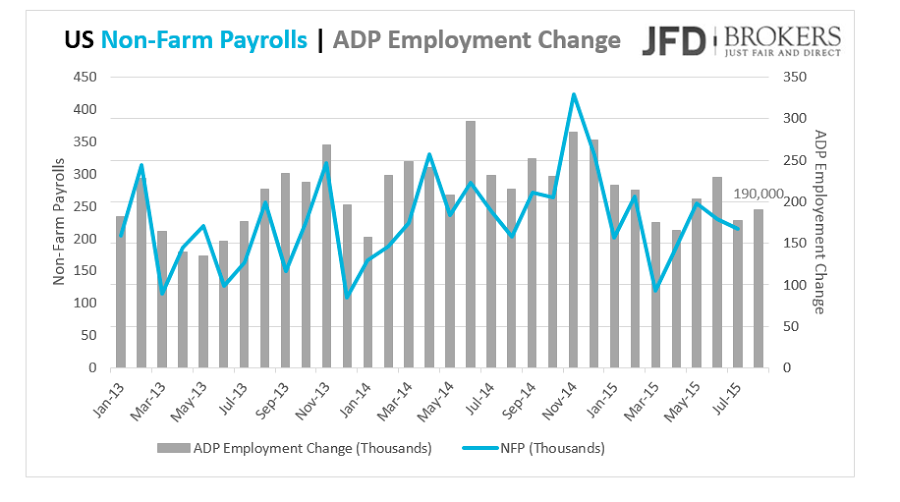

The market predicted that the NFP number, the number of jobs added in both the public and private sector in August, will be 220,000, stronger that July’s figure of 215,000. The ADP employment change disappointed the market on Wednesday. It showed that the pace of hiring in the private sector slowed down to four months low in August at 190,000 missing forecasts to have risen up to 201,000.

Euro declined as ECB cut growth and inflation outlook

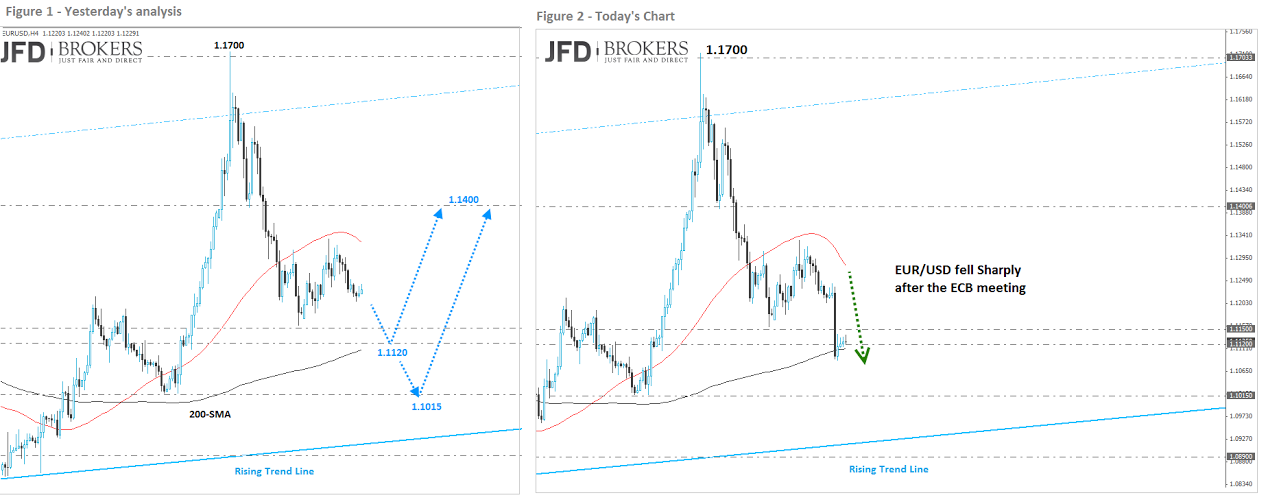

The euro declined 1.0% vs the US dollar on the comments of the ECB president and the decision that kept its interest rate unchanged at the record low of 0.05%. The ECB President, Mario Draghi for the first time stated clearly that the bond-buying program may continue beyond September 2016 to boost the economy, however, the size and the composition of the program will be adjusted accordingly. The central bank warned that the recession in the emerging market could drag the Eurozone back to deflation. Moreover, GDP growth downgrade indicates that Eurozone will not hit 2% growth by 2018.

The dovish press conference drove the EUR/USD pair below 1.1120 reaching the take profit level we suggested at yesterday’s report for the ECB Policy Meeting. (What to Expect in the ECB Policy Meeting ). Ahead of the U.S. NFP report things could be tough! Some traders preferred to remain on hold until seeing the NFP figures, given its importance of the NFP on shaping the Fed’s monetary policy. For the greenback to rally on the NFP report, we need job growth to exceed 200k and it will be even better if it exceeds the consensus which is at 220k. Furthermore, average hourly earnings will need to rise by more than 0.2%. If any part of this equation is off, investors will be reluctant to buy dollars. The downside target for the EUR/USD pair remains the 1.1050 level while to the upside the 1.1250 barrier could provide a significant resistance in case we get a weak NFP figure. Above here, the next level to watch will be the 1.1280 obstacle and then 1.1400.

GBP/USD plummeted!

The sterling was traded broadly lower against its G10 counterparts after the data indicated that activity in UK services sector expanded at a slower than anticipated pace in August. The GBP/USD pair plummeted on Thursday, settling -0.95% lower for the week, following a negative week of -1.94% on 23 Aug – 30 Aug. The pound is trading below the daily 200-SMA, which is very significant, as well as below some significant levels, including the 1.5330 and 1.5300 levels. If the shorts manage to maintain the rate below the aforementioned levels, they might drive the battle lower towards the key support zone of 1.5170 – 1.5190. Alternatively, if we see the 1.5300 level broken, as it will need a lot of effort from the bulls to lift the rate above that level, it should find further resistance around 1.5330.

Australian dollar hit a 6-year Low!

The Australian dollar plunged during yesterday’s session, extending its weekly gains and snapping a 4-day session losing streak against the U.S. dollar. The Aussie hit by concerns about China as well as the recent sharp of oil prices. U.S. oil prices have tumbled below $50 a barrel for the first time since July 2009. Oil prices fell more than 65% since October 01, 2013. The AUD/USD fell below the psychological level of 0.7000 a few days ago, as well as below the key support level of 0.6980. The pair was already looking bearish after breaking below the moving averages as well as below some significant levels. I am therefore bearish on AUD/USD while the price remains below the key level of 0.7000.

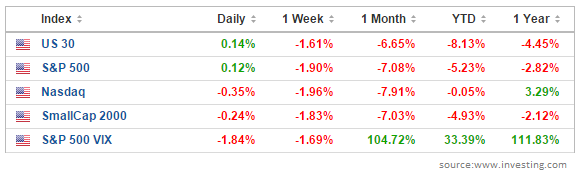

US Indices mixed ahead of the Employment Report

The Dow Jones Industrial Average closed marginally higher than its opening level on Thursday, +0.14% but the weekly performance stills negative at -1.61%. The S&P 500 also closed slightly higher with gains of +0.12% while the Nasdaq Composite fell 0.35% with weekly performance near -2.0%!

Economic Indicators

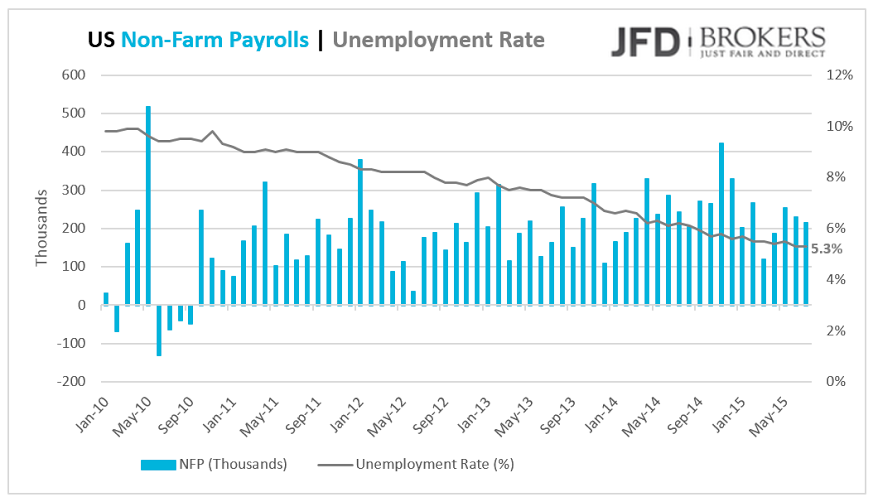

Today, early in the morning, Eurozone’s second estimation for the GDP Growth in the second quarter will be eyed, especially following yesterday’s comments from ECB for a gloomy economic growth. The US employment report, further to the NFP number mentioned above, is expected to publish a decrease in August’s unemployment rate to 5.2%. It’s notable that currently, the unemployment rate is at a seven-year low at 5.3%.

In Canada, the unemployment rate is anticipated to have kept unchanged at 6.8% in August while the net change in employment has forecasted to be -4.5k from 6.6k the month before.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.