We leave behind the summer and head in September, which promises to keep our interest undiminished. Therefore with such a heavy economic calendar in September, traders should be prepared for more volatility than usual.

Prior to the major Central Banks Policy Meetings, a special report will be published on our website as well as here.

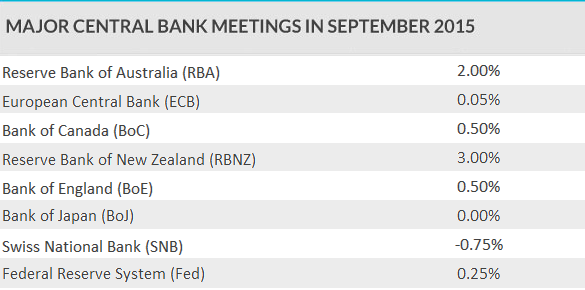

The month starts powerfully with Reserve Bank of Australia revise its benchmark Interest rate on 1st of September. The European Central Bank’s Policy Meeting is scheduled on 3rd of September. A while after the Interest rate decision announcement the ECB President and Vice President explain the decision at the press conference and answer questions from attendees.

Going forward, the Bank of Canada Rate Statement on 9th of September, will be keenly watched after the recent data on the global macroeconomic news for the commodity currencies. On the same day, the Reserve Bank of New Zealand will publish its Interest rate decision accompanied with a press conference. It’s notable that, the New Zealand’s Central Bank cut interest rates in both the last two policy meetings.

On 10th of September, Bank of England Monetary Policy Committee members will vote on the bank rate and the asset purchase facility. On the last policy meeting, while all the committee members voted unanimously to maintain the stock of purchased assets, not all the votes were in favour of keeping unchanged the bank’s repo rate.

On 14th of September, the Bank of Japan will announce its revised decision on its benchmark interest rate which was last changed in February 1999 to 0.0 percent.

Two policy meeting are scheduled on 17th of September. The Swiss National Bank will revise its Interest rate early in the morning. Switzerland’s benchmark interest rate is currently at the record low of -0.75 percent, following a double rate cut at the start of 2015.

Later in the day, the Federal Reserve meeting, perhaps the most closely-watched event of the year – especially after the recent China’s turmoil – will steal the thunder. September’s Fed rate decision is the epicentre of the headlines for many months now. All the traders strongly await to learn if the Federal Open Market Committee will vote for the first rate hike from the record low level that is being kept for more than five years. A press conference will succeed the publication of the decision to explain the reasons behind it.

On Friday, 4th of September the Non-Farm Payrolls Report will hog the limelight, amid the strong belief that the health of the labour market it takes a data-driven approach to the timing of the long-awaited U.S. first interest rate hike in nearly a decade. The markets are looking for another strong reading after a solid print in July - an increase of 222k jobs, a steady jobless rate of 5.3% and a solid 0.2% increase in wages.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD remains under pressure from RBA rate decision

AUD/USD spiked lower by more than 20 pips following the RBA rate announcement to test the key psychological support at 0.6600. Losing this key level could see the currency pair trek lower towards the 100-hour EMA support near 0.6580.

EUR/USD edges lower to near 1.0750 due to the upward correction in the US Dollar

EUR/USD snaps its four-day winning streak, trading around 1.0760 during the Asian hours on Tuesday. However, the Euro found support from higher-than-expected Eurozone Purchasing Managers Index data released on Monday.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.