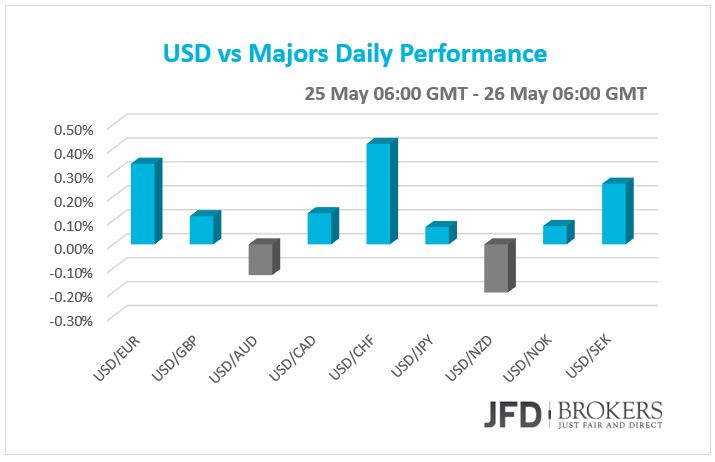

The liquidity in the market on Monday European trading session was extremely thin as the Markets were closed due to Memorial Day in US and Whit Monday in many European countries. Most of the cross pairs with these countries’ currencies remained virtually unchanged at the end of the session. The greenback was slightly higher versus most of its G10 peers during Monday’s and early Tuesday’s European trading session.

The US dollar declined marginally versus the Australian Dollar and the New Zealand Dollar. The major loser against the buck was the Swiss franc and the euro. Fed Vice Chairman Stanley Fischer said that the market pays too much weight on the first rate hike of Fed as it will take few years for the interest rates to go back to a normal level. He also said that when a first rate hike will take place depends on the data and not on the date. If the economy grows faster, Fed will raise interest rates quicker but if the economy has an extremely slow expansion Fed will wait.

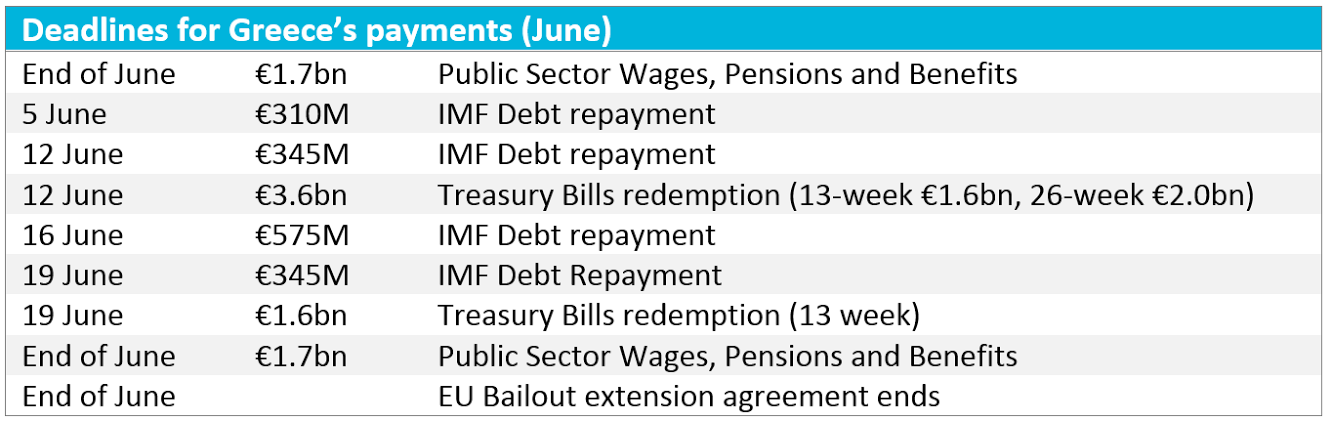

Euro continues to decline amid fears that Greece will not meet its debt obligations The shared currency continued its decline against all of its G10 counterparts during Monday’s and early Tuesday’s European trading session, with only exception the Swiss franc and the Swedish Krone, amid fears that Greece will not be able to meet upcoming debt repayments to the International Monetary Fund. The EUR/USD pair tumbled -0.21% below the ascending trend line, as well as below the 200-period SMA on the 4-hour chart. The sell-off seen so far this morning has brought us back into the key support zone of 1.0920 – 1.0970 and I expect the bears to add further pressure to the bulls, below the aforementioned obstacles. With that in mind, I do retain a moderate bearish bias, with the initial target being the 1.0850, a strong technical level for the bulls. On the other hand, if it does continue to edge higher it should find resistance along the way around the psychological level of 1.1000.

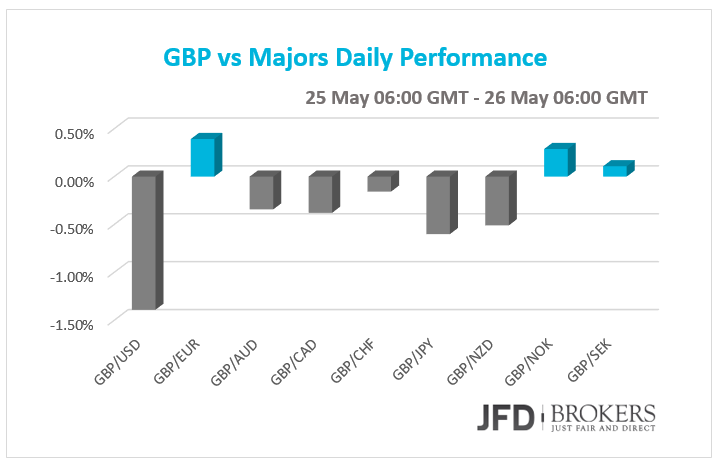

Pound slipped in the absence of economic data The British pound lost ground against the greenback in yesterday’s trading session following a quiet day in terms of economic data.

The US dollar bulls have come back to haunt the pound in recent days after several unsuccessful attempts to break the key resistance level of 1.5820, back in May 17, where the GBP/USD pair lost more than 1.5% from its value. The pair is trading below a significant zone of 1.5500 – 1.5520, which includes the ascending trend line that started back in mid-April, as well as the 200-period SMA on the 4-hour chart. Therefore, all of these obstacles will provide a significant resistance to the bulls preventing them to push higher. On the downside, the price is currently finding support around the 1.5450 level. A dip lower from here would trigger some stops and should open the door for further pressure on the key support zone at 1.5390 – 1.5400. MACD agrees with the bearish scenario since it moved lower below both its zero and trigger lines.

USD/JPY pushing higher; bulls in control Finally, the Japanese yen is looking weak against the US dollar over the past couple of weeks as the USD/JPY pair is trading negative for a fourth trading session in a row. It’s remarkable that the pair record its ninth negative week out of eleven, after rebounding from the key support level of 115.50, which includes the short-term ascending trend line and the lower boundary of the channel, which started back in mid-November 2014. With the pair trending mostly higher, the next few resistance levels will be high importance for the pair. Therefore, the psychological level of 122.00 and the 122.50 barrier would be the confirmation for the further USD/JPY appreciation. Such a move could easily spark a run towards the ultimate price target at 124.00.

USD/CAD extends its gains ahead of BOC Policy meeting

The US Dollar has extended gains from to trade higher against the Canadian dollar ahead of the ahead to the Bank of Canada's mid-week interest rate announcement. Market participants expect the BoC to leave rates on hold at 0.75% and to maintain a neutral stance. The USD/CAD pair is trading above the key support zone of 1.2180 – 1.2220, which includes all of the three moving averages, the 50, 100 and 200 SMAs. On the upside, the key descending trend-line is expected to provide resistance over the coming period near the 1.2350, where a break to the upside would likely bring a period of consolidation, between the 1.2420, a key resistance level, and the 1.2170 barrier a strong support for the bulls. Both of our momentum studies support a move to the upside since the RSI continued moving higher after crossing above its 50 level while the MACD lies above both its zero and trigger lines.

Gold supported above $1,200

Gold is once again unchanged today and continues to trade just above the psychological level $1,200. This is a big level for the bulls as it is a psychological number and it includes the 100-period SMA as well as the 200-period SMA on the 4-hour chart. Certainly, if the dollar does continue to appreciate in the near-term, the precious metal is going to find it hurt to sustain its recent gains above the aforementioned obstacles. A move below the $1,200 will test the next key support at $1,190, which coincides with the short-term ascending trend line that started back in mid-March.

WTI consolidates below $60

WTI continues to trade close to the psychological level of $60.00 and within a descending triangle formation. The commodity is seen struggling near these highs, striving to break above the latter level as well as above the $60.90, $61.70 and $62.60 levels, with the WTI establishing lower highs. On the downside, there is plenty of support now in the $58.00 area, a break of which would see run towards $56.00 and eventually, $55.00. However a break of the topside, beyond $60.00, could see a run towards $61.70 and possibly towards the $62.60 level.

U.S. Dollar Index

The U.S. dollar Index recorded gains of 0.16% following a strong week that gained 3.22% after five weeks of consecutive losses. The index is a measure of the U.S. currency against a basket of six major rivals and now as the dollar strengthens the DXY rises.

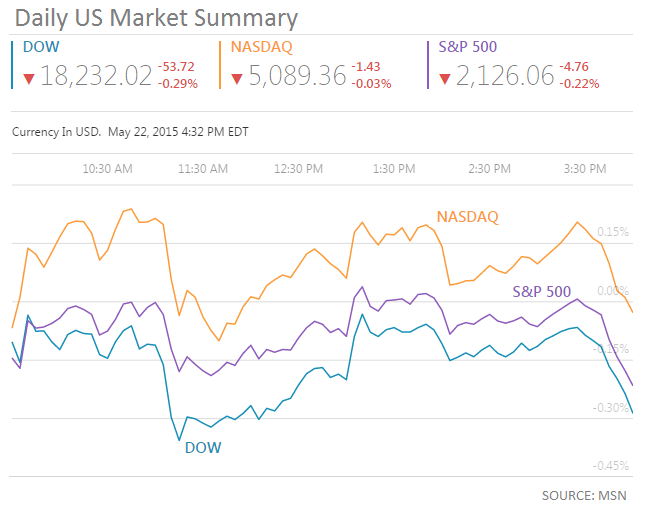

U.S. Indices

U.S. indices closed Friday’s trading session in the red with Dow Jones Industrial Average losing ground, 0.29% down closing at 18,232. Among the top five companies’ shares that pulled back the DJIA are the Boeing Co/The with losses of 1.72%, Microsoft Corp which slipped 1.10% and the Johnson & Johnson that declined 1.04%. The S&P 500, was down 0.22%, closing at 2,126 while the NASDAQ Composite Index decreased marginally by 0.03%, -1.43 points.

Economic Indicators

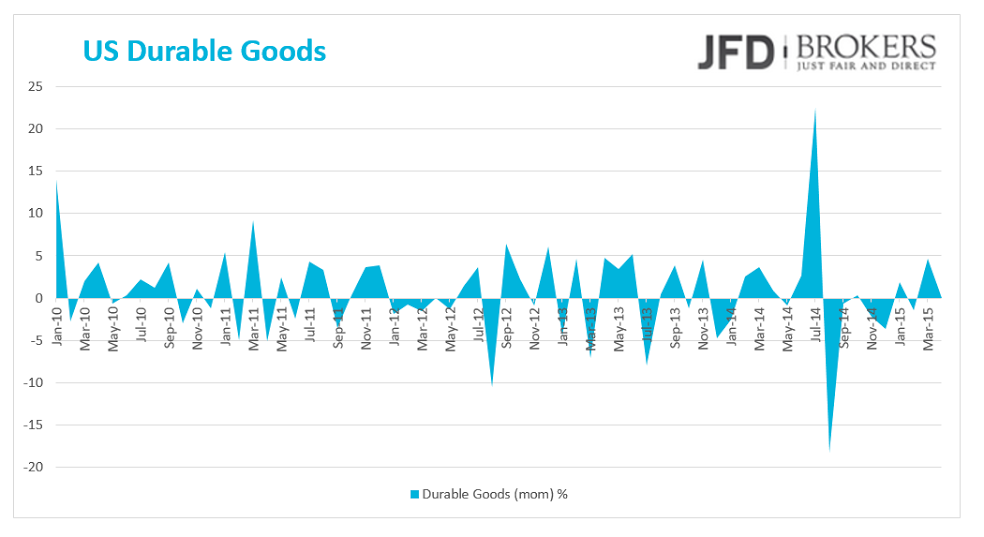

Today, there are no major indicators or speeches scheduled for Eurozone, thus I expect a quiet day driven mainly by technical factors during the morning European session. Later in the day, the US Durable Goods will be closely eyed from the investors. The market consensus for the Durable Goods is to have plunged by -0.4% in April from 0.4% increase in March while the Durable Goods ex Transportation are expected to have accelerated by 0.4% from -0.2% before. It the market’s forecasts come true the sector that the cost of orders slumped and dragged the whole indicator down is the Transportation.

In US, further to the weak Existing Home Sales numbers released last week, the New Home Sales for April will be out. The Standard and Poor’s will release the S&P/Case-Shiller Home Price Indices that will complete the March’s image in the Housing Sector. Moreover, the Consumer Confidence for May is expected to be out. Overnight, the Bank of Japan will release its Policy Meeting Minutes.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.