Yesterday, the US dollar traded lower against other major currencies, such movement is caused by the publication of economic data for the US, which were lower than expected, which reduced investor confidence in the fact that the economy will begin to recover in the 2nd quarter. Sales of existing homes fell to a level of 5.04 million homes per year with expected to grow to 5.24 million homes a year, and the index of business activity in the manufacturing sector from the Philly Fed fell to 6.7 in May, remember, that the April figure was 7.5.

Today, it's going to be a press conference of the Bank of Japan, which will illuminate the further course of monetary policy, most likely the Bank of Japan will leave the current policy of increasing the money supply by 80 billion yen per year. Later is expected to publish the base Consumer Price Index for the United States, if the data is worse than expected, there is no doubt that the pair will continue to decline.

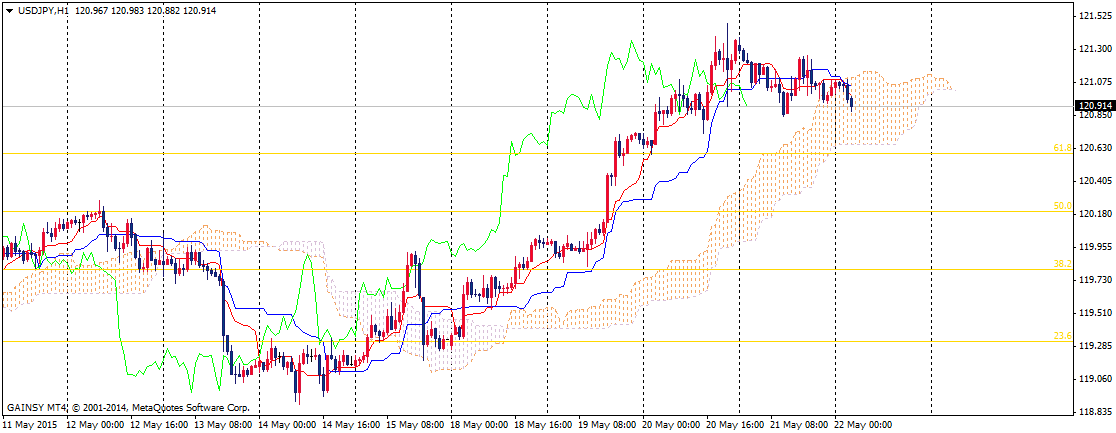

I am considering to sell the currency pair from the resistance level of 121.10, with the objectives of profit 120.90; 120.65; 120.40.

If the pair breaks and consolidate above 121.10 resistance level, then it is paving the way for the following levels of 121.50; 122,00.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.