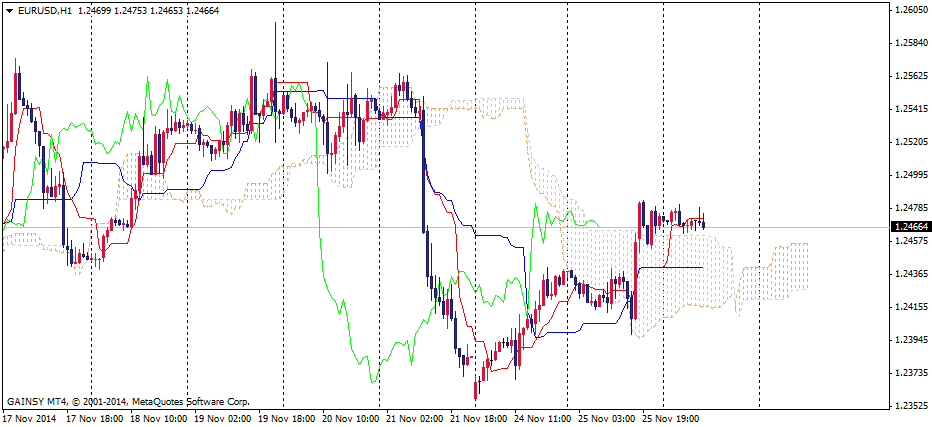

currency pair movement [main scenario]

For the past 2 months there was forming a correction, Tenkan and Kijun lines are bound below the price, the price has broken through the descending cloud and is moving above it, the further descending movement from the 1,2480 resistance levels is being expected. We should sell the pair below the 1,2480 resistance level, set take profit at these support levels - 1,2460, 1,2420, 1,2400.

currency pair movement [alternative scenario]

If the pair succeeds to break and get fixed above the 1,2480 resistance level, in such a case the further ascending movement till these resistance levels - 1,2500, 1,2535 is very possible.

LEVELS

Resistance: 1,2480; 1,2500; 1,2535.

Support: 1,2460; 1,2420; 1,2400.

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold climbs above $2,320 as US yields push lower

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.