Market Overview

It was never going to be easy. When the euphoria of the new proposal for Greece swept the markets higher on Monday it all seemed too good to be true. The DAX and CAC up almost 4% on the day seemed a touch excessive without the deal rubber stamped. And so it is proving now as the political bickering continues and there is still a lack of tangible progress. Markets have begun to unwind some of their euphoria of the earlier part of the week and this move seems to be playing out today. The yield on the German 10 year Bund has fallen back a touch and can also be used to gauge sentiment for equities. Wall Street fell last night with the S&P 500 off by 0.7%, whilst Asian markets were also trading lower overnight. European indices have begun the day on the back foot too.

In forex trading there is more of a consolidation in the markets, with a number of major pairs still lacking the overall direction. The Aussie and the Kiwi are both stronger today, perhaps with reaction to the news of the US Senate’s agreement to allow progress on President Obama’s Trans Pacific Partnership trade, in addition to China scrapping its loan-to-deposit ratio (which will improve business lending). After four days of declines, gold is beginning to build some support this morning.

The main focus for traders (aside from the ongoing negotiations with Greece) will be the US Personal Consumption Expenditure data released at 1330BST. This is the Fed’s preferred measure of inflation and any pick up in the core data from the 1.2% (Year on Year) last month would be a signal that the hawks would be looking for.

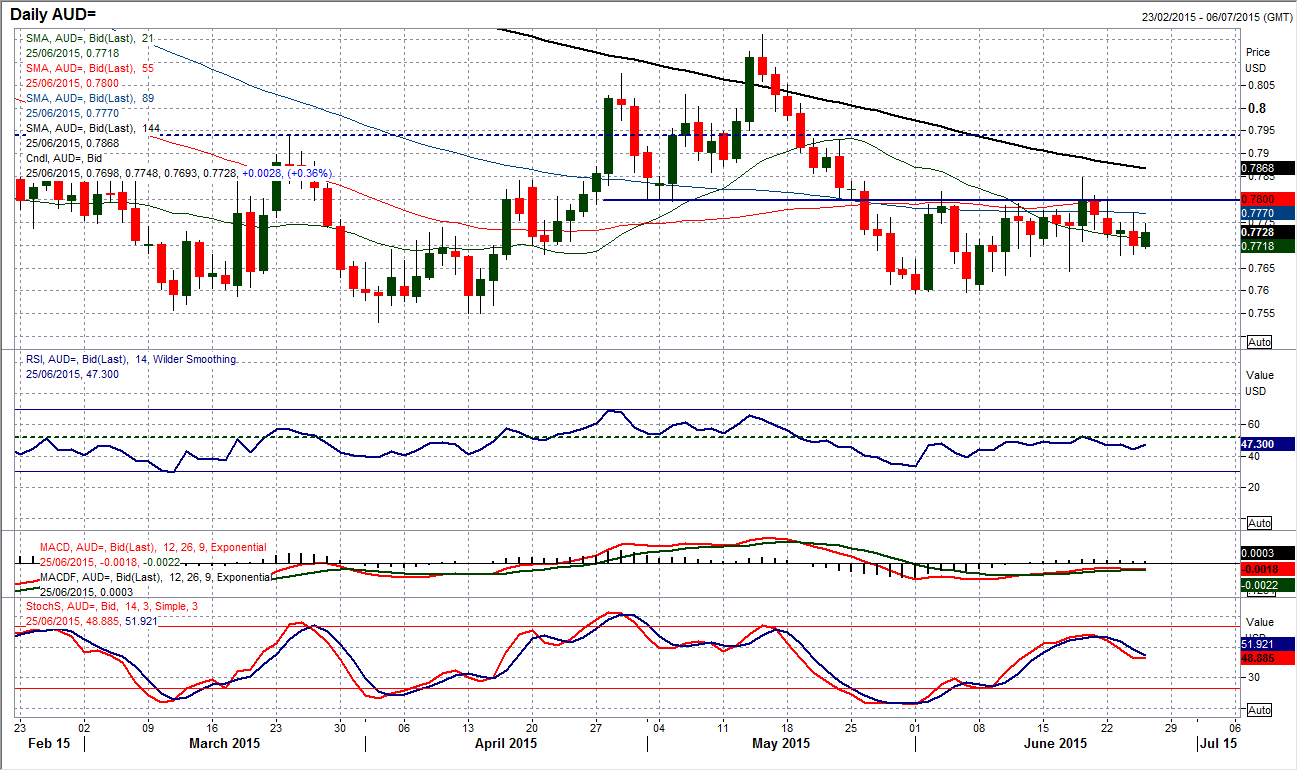

Chart of the Day – AUD/USD

The Aussie/Dollar is an interesting pair as despite the Federal Reserve apparently moving closer towards monetary tightening there has actually been very little trend over the past few months. However there is still a bearish bias to the Aussie which is depicted by its continued failure to be able to muster a rally above the old support at $0.7800. The past few weeks have seen numerous attempts at the resistance but to no avail. The RSI has continued to fail just above 50 (interestingly the old level that was used during early May when the support was forming above $0.7800). The other momentum indicators have a more neutral outlook as the Aussie has basically gone nowhere for the past couple of weeks now. The intraday hourly chart shows this consolidation which is interestingly using the old support around $0.7680 as a near term floor. It would appear that near term trading on the Aussie is probably best, moves towards the $0.7800 ceiling seen as a chance to sell. Until there is a closing break above $0.7800 then I see the range continuing.

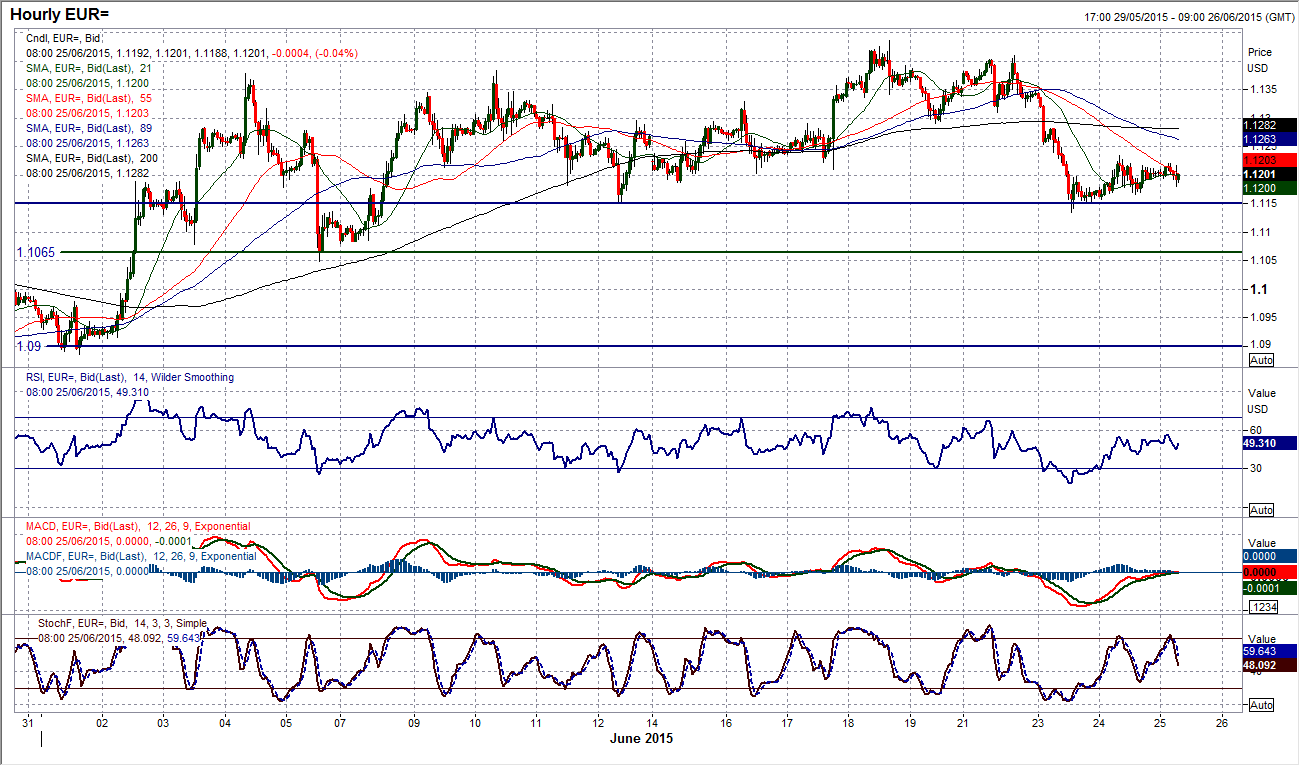

EUR/USD

As the selling pressure of Tuesday has been contained, once more the euro has a look of a market in ponderous mode. Taking a step back, the technicals have been relatively benign for the past couple of weeks, fluctuating around 300 pips of range and showing little concept of a trend. The RSI is settling and the MACD lines are basically flat, whilst both indicators have a marginal positive bias that comes with a market that is trading towards the upper end of a medium term broad trading range. The Stochastics are the balancing factor in, being in decline over the past few days. The intraday hourly chart shows that the breakdown of the small top that formed below $1.1290 has completed its downside target of c. $1.1170 and whilst the support around $1.1150 was briefly breached on an intraday basis yesterday this remains a basis of support near term. Trading above the $1.1065 pivot still leaves a mildly positive outlook. I anticipate the market is waiting for the further news of Greece before making the next move.

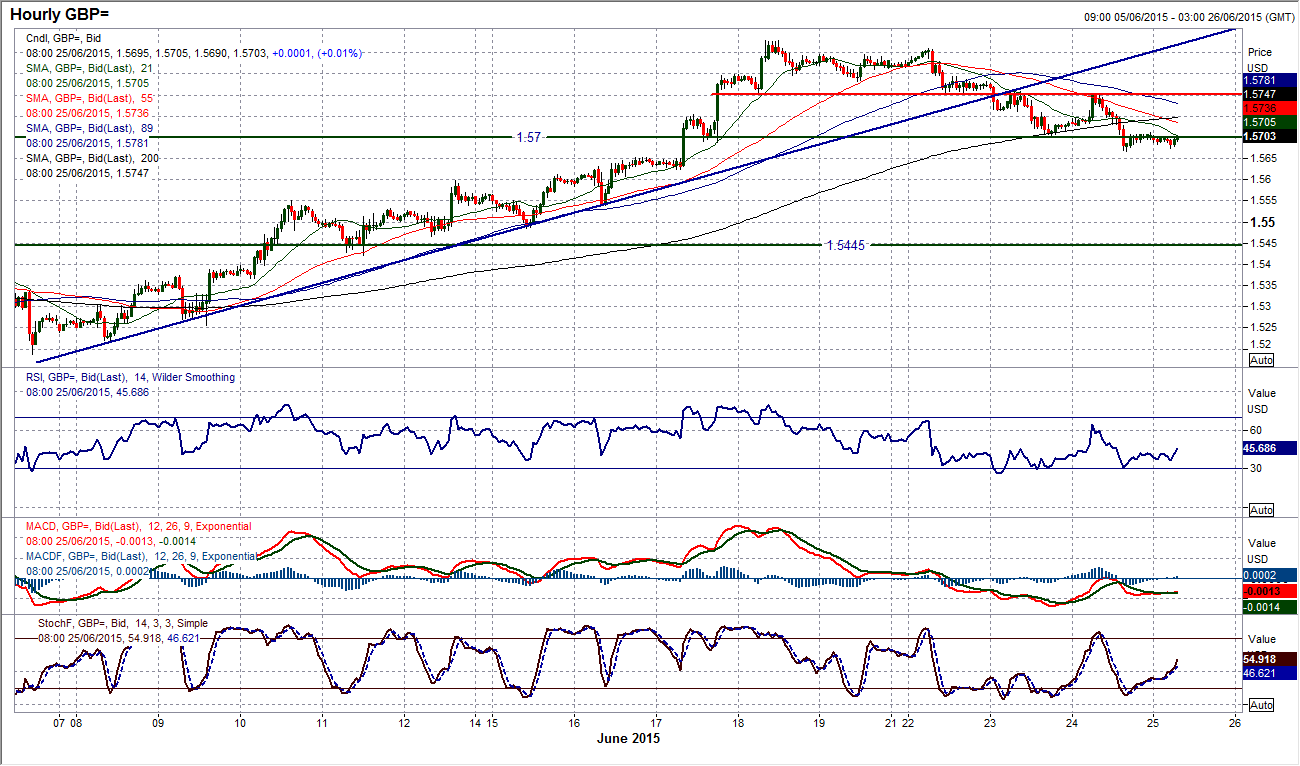

GBP/USD

Having rolled over and topped out below $1.5800 the Cable chart has been falling now with three consecutive negative candles in a row. I have spoken previously about the tendency in recent weeks for Cable to go on a run (in either direction) once the move has become established and once more this seems to be the case. The Stochastics have now completed their near term sell signal and with the MACD lines on the brink of crossing over the outlook for a correction is growing. Once the pair drops consistently clear of the support around $1.5700 then the retracement can continue. The intraday chart shows a very interesting chart feature that following on from the completed top below $1.5800 the resistance yesterday came almost to the pip there again as old support became new resistance and what we are now seeing is the minor old support around $1.5700 is again being a resistance early today. The next support comes in a range $1.5550/$1.5600. The outlook is corrective with the RSI and MACD lines all with a near term negative bias. Look to use rallies as a chance to sell now.

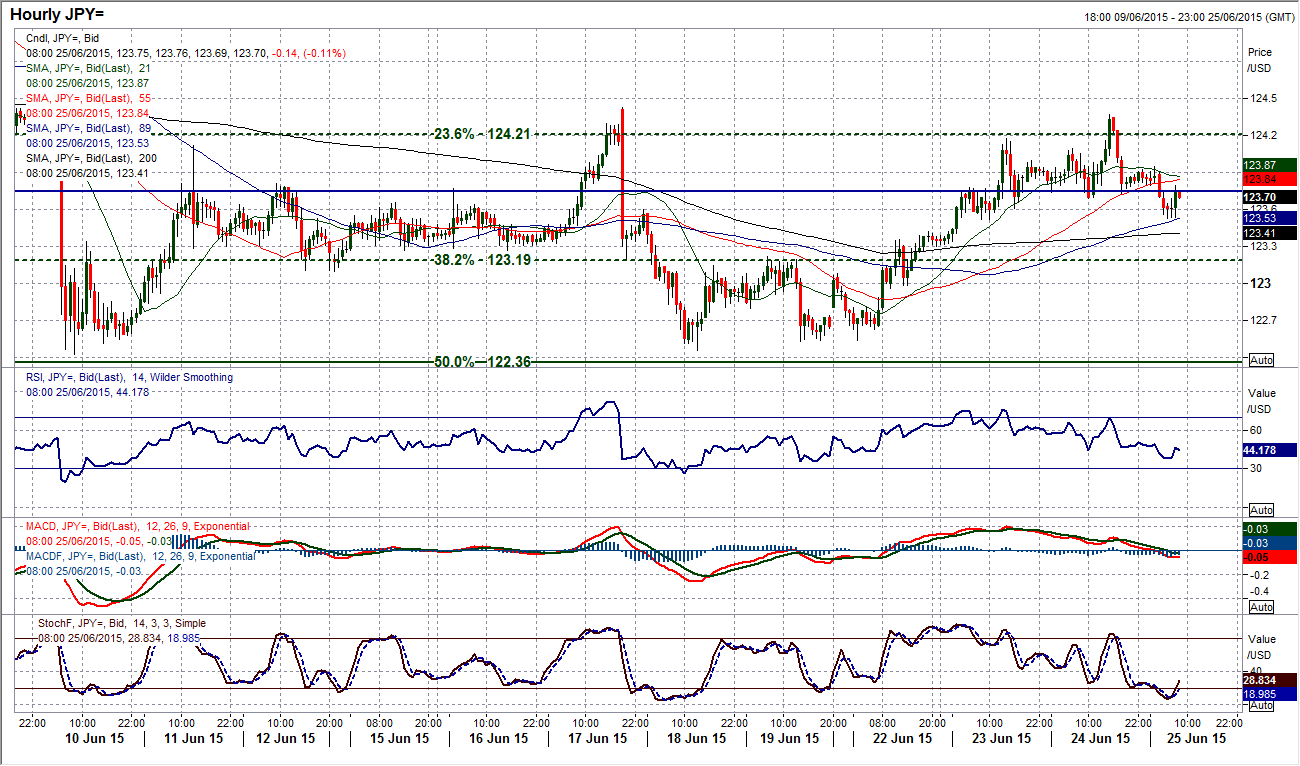

USD/JPY

The sharp correction of early June (a one day move on the suggestion from BoJ Governor Kuroda that the Yen was too weak) seems to have been the big correction. However whilst the support has come in around the 50% Fibonacci retracement of the 118.86/125.85 bull run at 122.35, the bulls have yet to be able to grasp the initiative again. A 200 pip trading range has formed in the past couple of weeks between 123.43/124.43 and this is now taking the momentum indicators into a more neutral configuration (RSI just peaking under 60 is a key sign of this). The hourly chart is also rather neutral and perhaps for now trading with short term time horizons is the best way to play Dollar/Yen. In the past day or so there has been a mini top pattern formed under 123.70 as the rebound has rolled over. The implied downside move is for a retreat back towards 123.00, whilst the hourly RSI/MACD lines are also corrective. If this is to be a range continuation then rallies should be seen as a chance to for near term shorting positions. Ultimately though I would see Dollar/Yen as making an eventual break to the upside, however for now this looks like a range play to me.

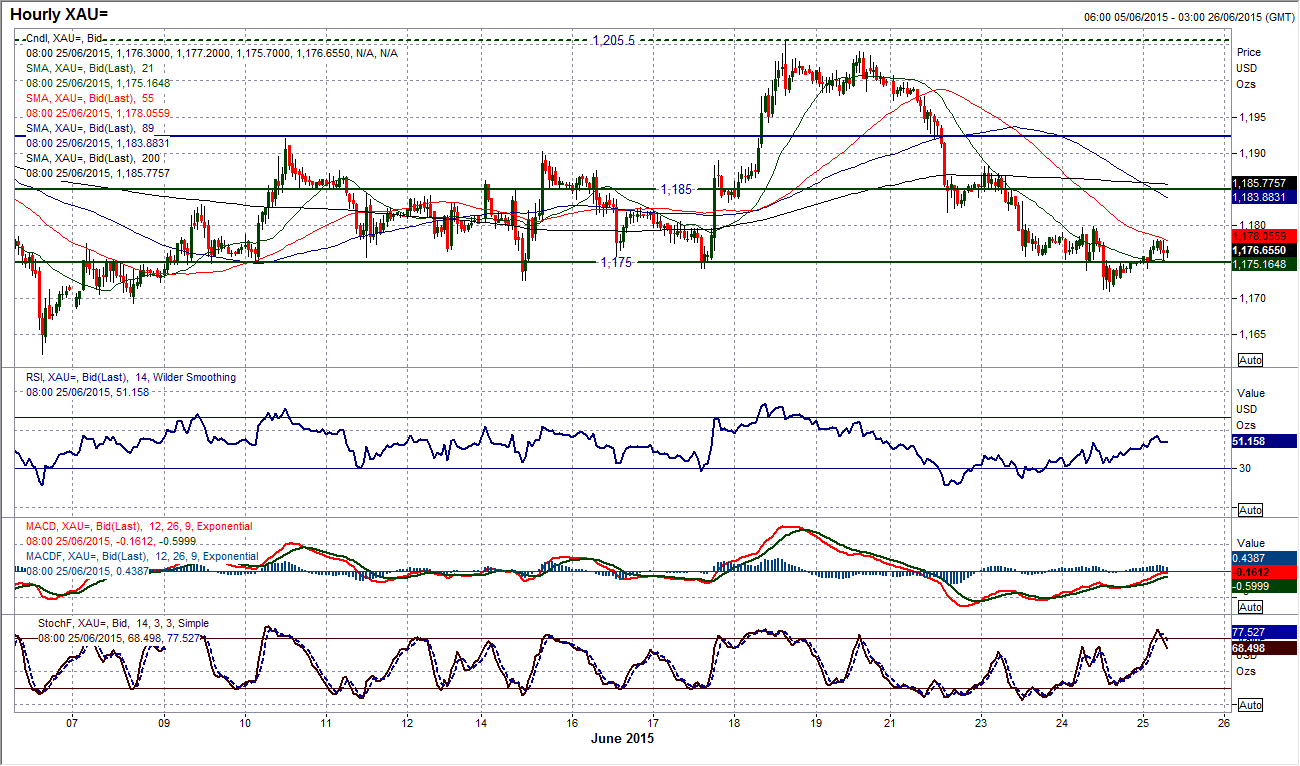

Gold

Gold has been in retreat now for the past four days as the sharp upside move of last week has more than unwound. This has once more brought it back to the lower reaches of a trading band. Over the past couple of weeks the support around $1175 has been extremely interesting as every time it has been tested on an intraday basis, the bulls have managed to claw back some gains to close around or just above $1175. This has happened again yesterday (close at $1174.80 on my Reuters chart) only for the price to continue to build on support today. That makes today’s trading rather important for the near term outlook because breaking a sequence of 4 consecutive bearish candles would be a sign that the range is once more going to continue. It is very interesting also that in the past few months since gold has struggled for trend direction, the RSI has very rarely broken below the low 40s and one more it is back there again. SO conditions are set up for support to lick in once more. The intraday hourly chart shows that there is minor resistance around $1180 and a move above there would suggest another rebound is on. Continued pressure below $1180 would ramp up the pressure on $1175 and a closing price clear of $1175 would begin to suggest the bears are gaining control for a retest of $1162.

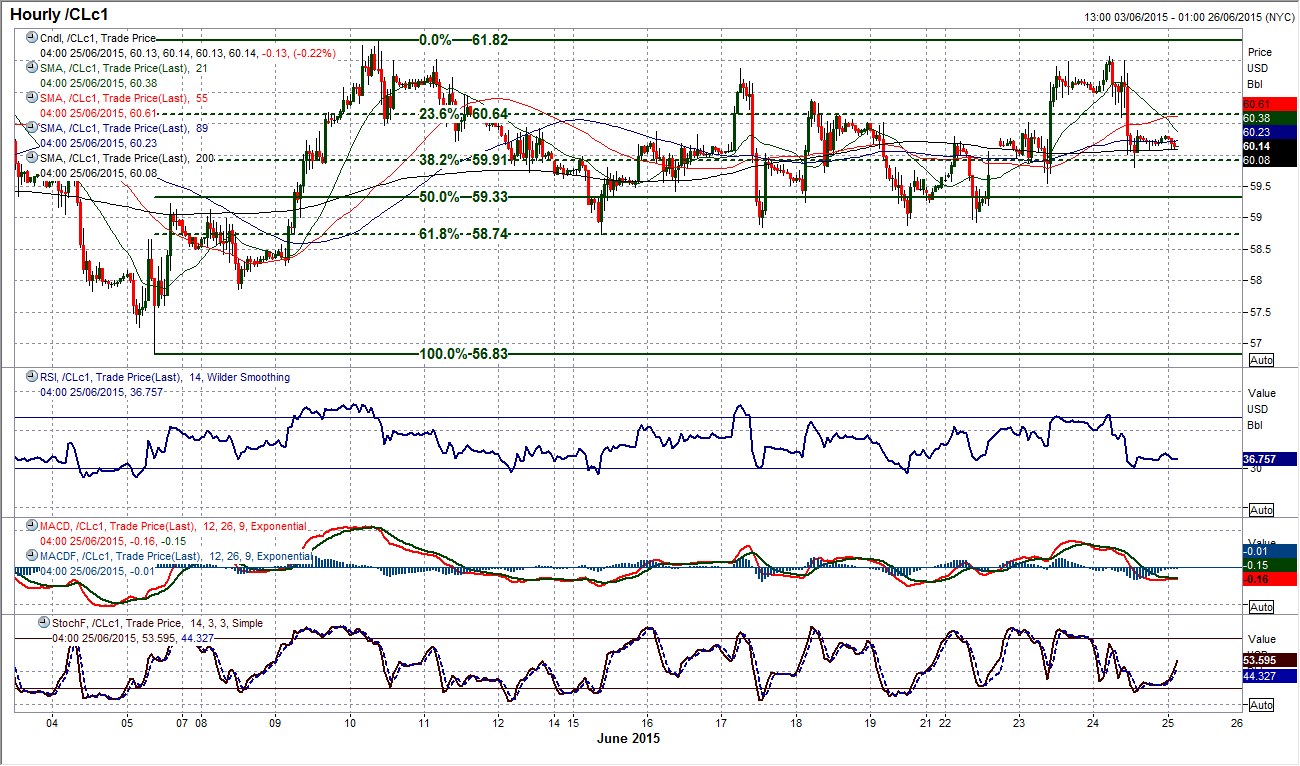

WTI Oil

Once more within this phase of eight weeks of range trading the WTI price has retraced previous gains and reverted back towards the middle of the trading range. The lack of trend continues although the daily momentum indicators retain a very slight positive bias (RSI oscillating just above 50, Stochastics also above neutral) there is very little by way of directional signals to suggest an imminent breakout. The intraday chart continues to show volatility in the intraday moves even if the daily chart is far more settled. The hourly RSI could be used for classic momentum buy/sell signals for very short term trading opportunities. The Fibonacci retracements of $56.83/$61.82 can still be used as key consolidation/turning points. The 38.2% Fibaoncci level at $59.91 and 61.8% Fibonacci at $58.73 are particularly popular.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD tests lows near 0.6550 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is testing lows near 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data fails to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY rebounds to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.