Market Overview

The FOMC meeting minutes last night failed to give any further clues over the timing of the first rate hike by the Fed. There is an expectation for inflation to rise towards the 2% target in the medium-term. There were worries amongst the committee that long term inflation expectations may begin to fall, but also with concerns over raising rates too quickly and the volatility it may create. FX markets reacted to the minutes with a sharp move away from the dollar, only to be subsequently unwound, whilst Wall Street closed the day slightly lower as this bull run continues to struggle to gain real contraction. After all the volatility we saw during October, markets in November have been very quiet relatively. In fact there has not been a 1% move either higher or lower this month. It has a very similar feeling to how late September was prior to the sharp sell-off.

Asian markets have been mixed overnight contending with the Fed minutes and also a disappointing reading from the HSBC flash manufacturing PMI which fell to a 6 month low and now sits on the fence between contraction and expansion at 50.0. The Nikkei 225 is broadly flat which when you consider the continued weakness in the yen (down 0.8% already today) it just goes to show how disappointed the market has been. European markets have started off the day in similar fashion with uncertainty, ahead of the flash Eurozone PMI data which should set the tone for the morning.

After the volatile moves of yesterday following the various central bank announcements, forex trading shows the US dollar once more strengthening against the major currencies. Clearly the yen is the big mover, but once more we are seeing the weakness in the commodity currencies, with the Aussie and Kiwi dollars not being helped by the disappointing Chinese data.

Traders will be looking out for the Eurozone flash manufacturing PMIs which are released throughout the early part of the session. There is also the announcement of UK Retail Sales at 09:30GMT which is forecast to show a month-on-month improvement of +0.4%. Into the afternoon the main focus will be on US CPI which is at 13:30GMT which is forecast to drop by -0.1% on the month to 1.6% for the year. Weekly Jobless claims are expected to remain under 300,000 with a reading of 286,000 slightly better than last week’s 290,000. There are also existing home sales at 15:00GMT which are expected to show a slight dip to 5.16m (from 5.17m).

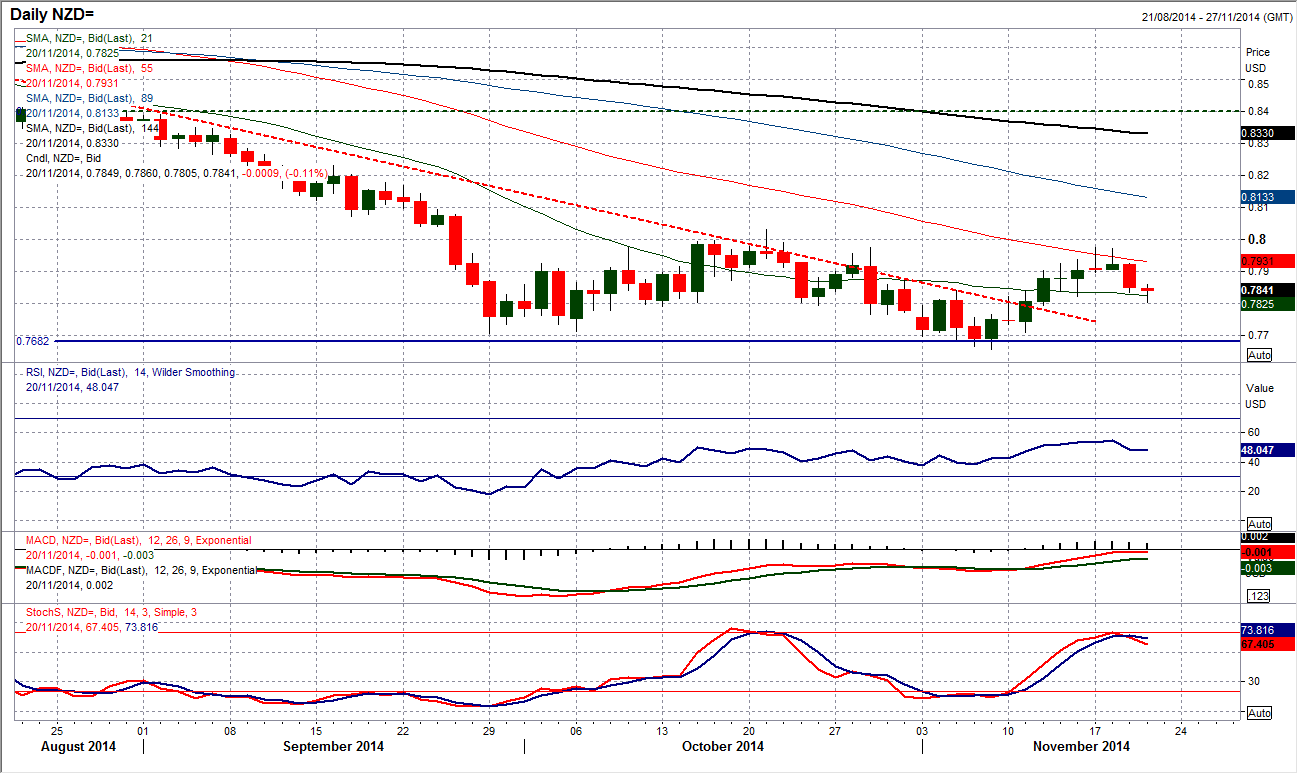

Chart of the Day – NZD/USD

The rally on the Kiwi seems to have lost its way and is beginning to shift lower again. Throughout this week the daily candlesticks have been rather negative, with arguably two shooting stars on Monday and Tuesday accompanied by a bearish confirmation yesterday. This has resulted in the recovery on the momentum indicators falling over. The Stochastics have crossed lower again (in a similar way to how they did in October prior to the previous down-leg), whilst the RSI seems to be peaking out around 55 and MACD lines failing around neutral again. These are all classic bear market rally signals and suggest that the technical rally may now have run its course. The intraday hourly chart shows negative configuration in momentum whilst trading below the hourly moving averages. The Kiwi is also at a key near term level as if the rate begins to trade consistently below support at 0.7820 would lose the latest key reaction low in the recovery and be further confirmation of weakness towards 0.7710 at least. Key near term resistance is at 0.7893.

EUR/USD

Despite the consolidation that has been present on the euro for the past two weeks, there has also been a gradual net gain for the euro. This move has seen the rate push from a low of $1.2357 to stand just around 100 pips higher. This is occurring as the Stochastics momentum indicator continues to pick up. However there is still a sense that this is just a bear market rally. The resistance at $1.2600 remains intact (last night the euro spiked to the resistance on the FOMC minutes), whilst there has been little real traction in the recovery. RSI continues to labour under 50, whilst there is no meaningful pick up in the MACD either. Last night’s spike rally also completed the unwinding of the rate back to the resistance of the 3 month downtrend. The time is close for using this rally as chance to sell, it is just a matter of a sell signal or the trigger. Subsequent resistance above $1.2632.

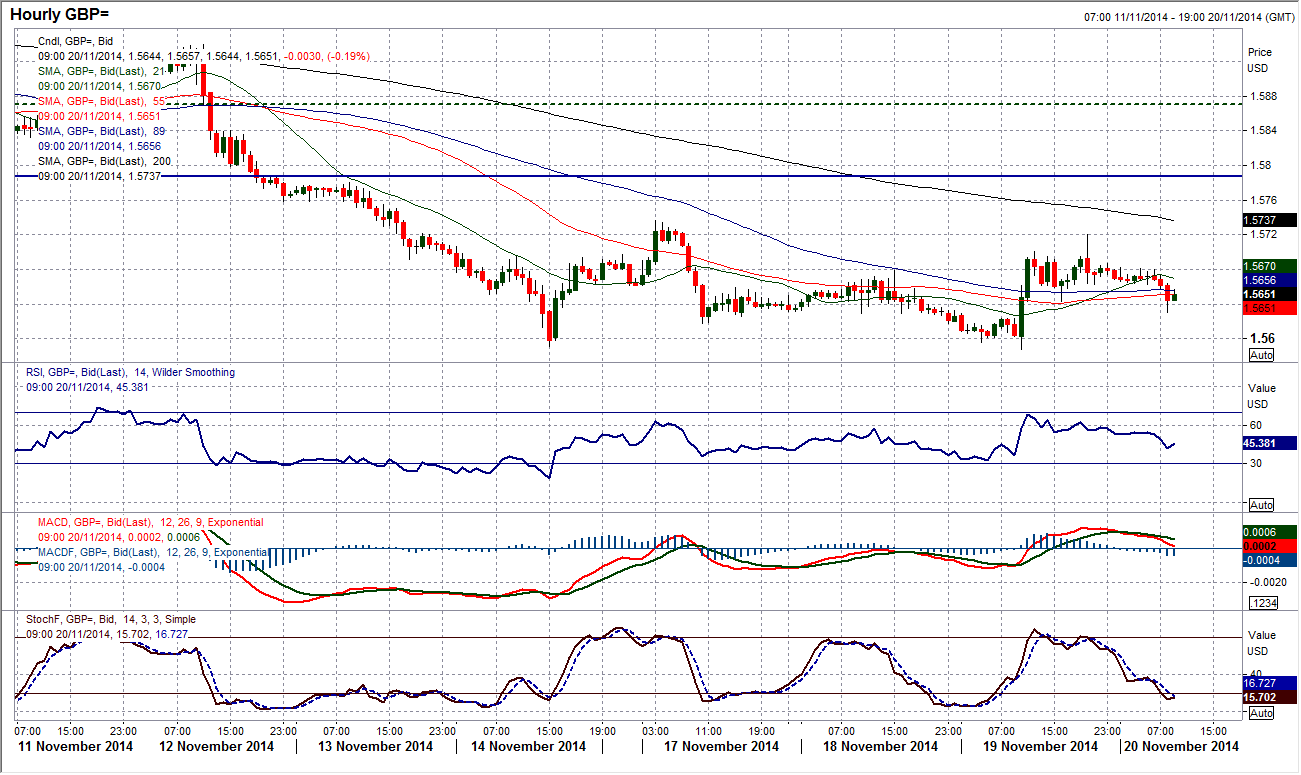

GBP/USD

In theory, Cable completed a bullish key one day reversal yesterday. A dip to a new low followed by an intraday rally to close above Tuesdays high. However, as key reversals go, this was not the most decisive. It followed a very small candle on the previous day, whilst also the close was well off the high of the day. There will need to be considerable further evidence of the bulls returning before the outlook changes. There is little real sign yet on the momentum indicators, which are mostly bumping along the bottom and retaining their bearish configuration. The intraday hourly chart is also fairly indecisive as the initial rebound (coming after the Bank of England meeting minutes) has consolidated and the upside impetus has been lost. The bulls will now be eying the resistance at $1.5736 which protects a small base pattern. Perhaps above there the near term outlook will begin to improve, however as things stand the bears look ready to regain control.

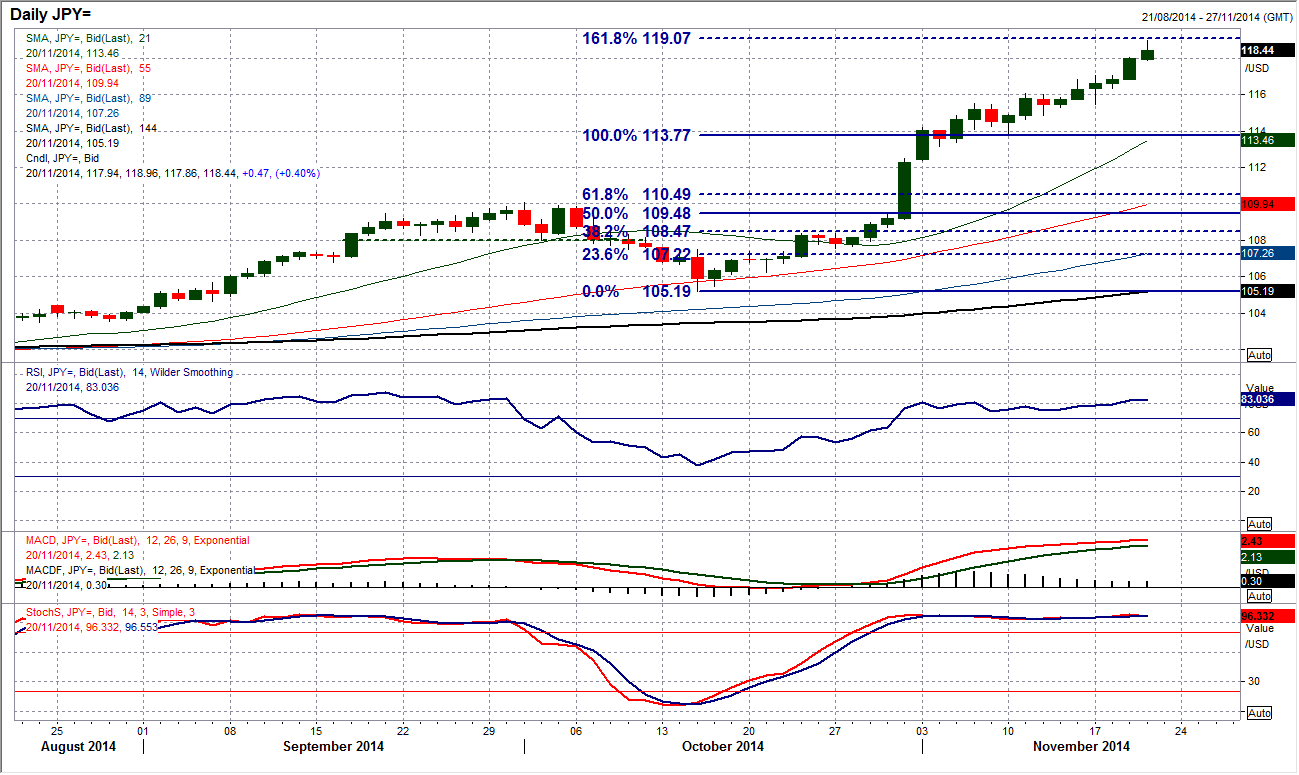

USD/JPY

The incredible bull run just shows no sign of stopping. In fact in the past 24 hours the bulls have had renewed vigour and the rate is accelerating higher. The 161.8% Fibonacci projection target at 119.07, which is derived by the rally of 101.49 to 110.08 measured from 105.18, is now seemingly just a matter of time. The momentum indicators remain incredibly strong, albeit stretched. There is little that can be levied against the bulls at the moment with momentum so strong. At some stage there will be a time for profit-taking but in times like these, with such little resistance to hold it is difficult to do much other than back the run. Initial support in the run comes in at 117.53 and 117.00.

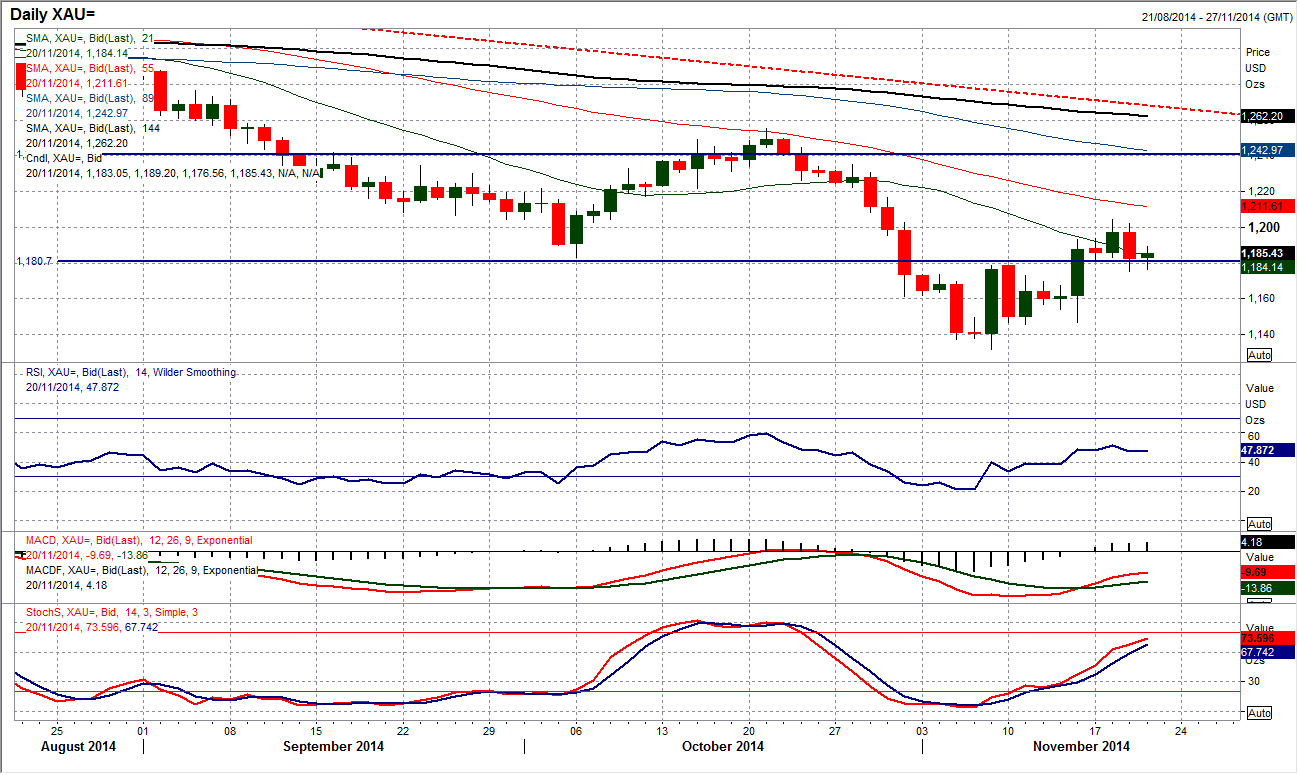

Gold

The bulls will now be asking themselves, how will the gold price react to the first really corrective day for the past week and a half? The initial observation is that the pivot level around $1180 is once more doing a job, however the momentum indicators have just lost a bit of impetus. The intraday chart shows that volatility has returned to the gold price in the past 24 hours. Two key events have driven this, with a reaction to the latest polls in the Swiss Gold Initiative referendum along with the minutes from the latest FOMC meeting. I still view this pivot level around $1180 as being critical for the near term outlook. If the bulls can hold on to it then there will be an improvement in the outlook. However if the support is lost then gold could quickly pick up momentum to the downside again. The outlook is subsequently mixed near to medium term. Resistance comes in at $1204.70, with support at $1270 protecting a further setback towards $1246.64.

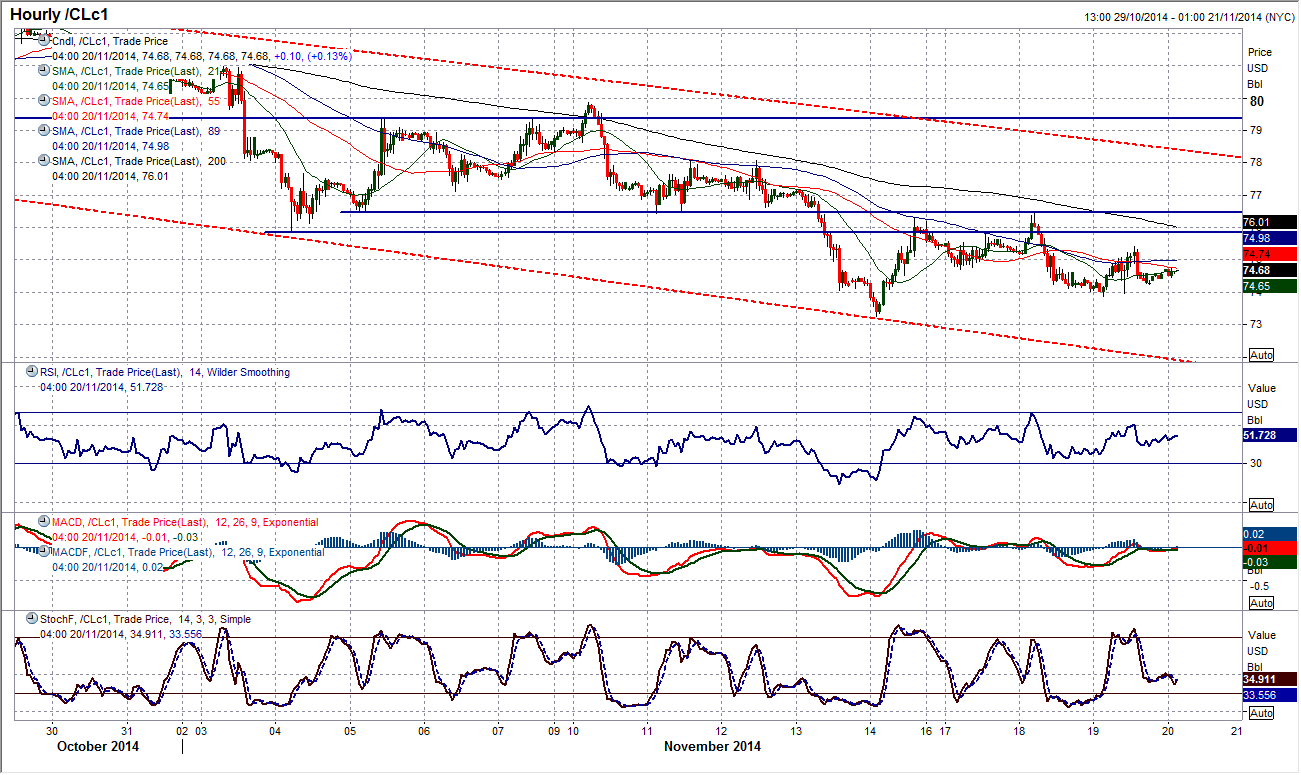

WTI Oil

Using rallies on WTI as a chance to sell remains the most viable strategy and the latest rebound is giving a chance for just that. The daily momentum indicators show little real sign of any recovery and throughout the 6 week downtrend channel have remained remarkably consistent in their bearish configuration. The bearish outside day on Tuesday has re-affirmed a 60 pip resistance band $75.84/$76.44 that is evident on the intraday hourly chart, whilst the hourly momentum indicators suggest that yesterday’s rebound has unwound to a level where the sellers will once more be interested. I continue to expect the key low at $73.25 to see further pressure, whilst the downtrend channel points towards additional downside in due course. Key resistance above $76.44 comes in at $78.10 and there will still be key overhead supply at $80.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Relief wave on altcoins likely as BTC shows a $5,000 range

Bitcoin price has recorded lower highs over the past seven days, with a similar outlook witnessed among altcoins. Meanwhile, while altcoins display a rather disturbing outlook amid a broader market bleed, there could be some relief soon as fundamentals show.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.