Market Overview

Despite some incredible moves in the forex markets yesterday Wall Street ended with something of a disappointment. Having spent several days consolidating above 2000 on the S&P 500, last night it closed back below the psychological level again. There is a slight sense that the bull trend is beginning to lose momentum and the buyers are getting a little tired. Asian markets have also become fairly muted in recent days and closed once more with a mixed of broadly flat to slight losses. So, there is nothing like a Non-farm Payrolls Friday to shake things up again. After yesterday’s strong gains, the European markets have opened slightly lower today, but it is often the case in the run up to Payrolls that markets will consolidate.

Forex trading once again has a very slight dollar positive bias, but as with equities, the likelihood is that this will be the case through the morning until Payrolls are released at 13:30BST.

After the huge moves on the forex markets yesterday, don’t be lulled into a false sense of security as Non-farm Payrolls can be just as wild today, so expect further volatility this afternoon. The expectation is that last month’s 209,000 jobs will improve to 225,000 and post a seventh straight month above 200,000. If the ADP data is anything to go by (it was 204,000 yesterday and has been a decent harbinger in recent months) then perhaps thee forecast is a touch high. Traders will also be looking out for improvements in the average weekly earnings and also the participation rate (62.9% last month) as these are followed by the Fed and could have an impact on when the tightening cycle will begin.

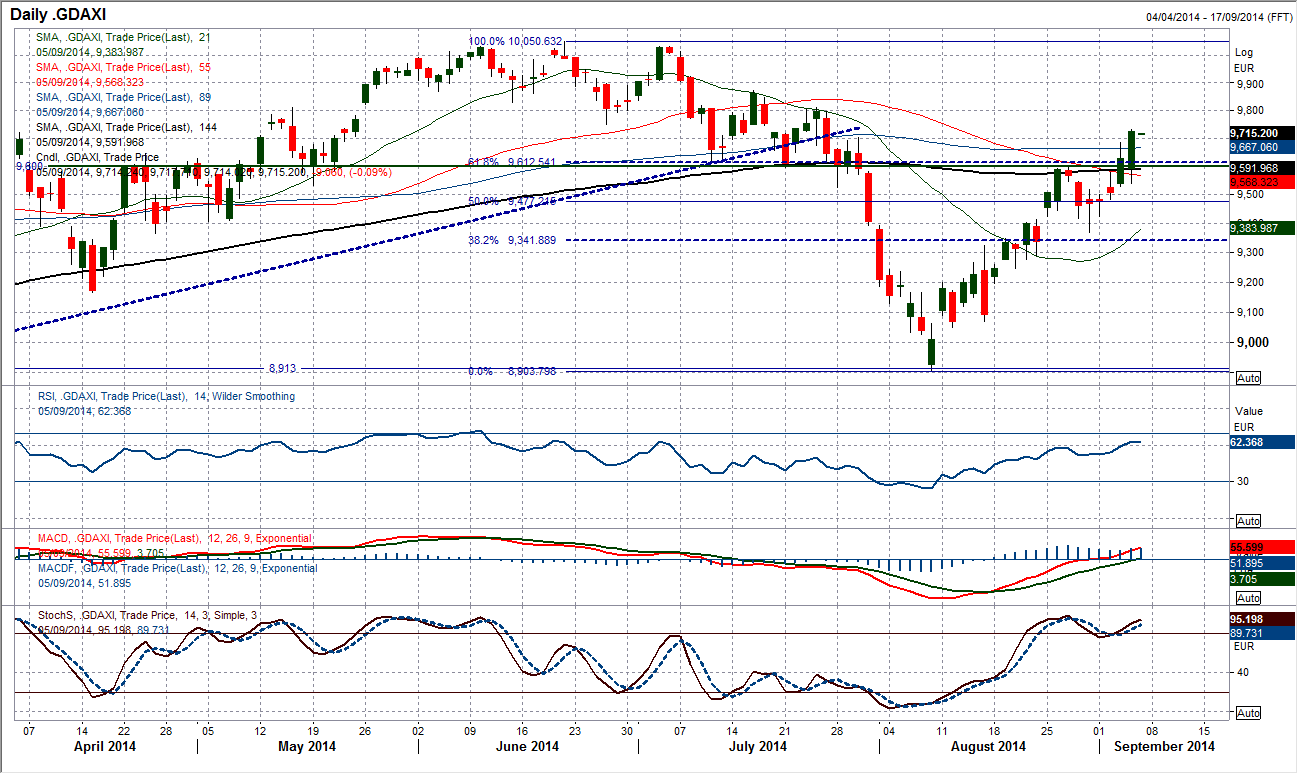

Chart of the Day – DAX Xetra

A hugely positive day for the DAX which reacted with glee at the prospect of a 200 pip down day on the euro. The outlook for the DAX has now turned far more positive. Having broken above the key pivot level at 9600 this has opened the way for an test of the next resistance around 9800. Furthermore, yesterday’s break was also a move above the 61.8% Fibonacci retracement level of the 10050/8904 decline at 9612 to suggest that a full retracement back to the highs at 10050 is now a real possibility. The initial move in early trading today has seen a slight retreat, however the 9600 pivot (which is also a price support from 27th August) now becomes a level that the bulls can work with. Momentum indicators are increasingly positive with this run and there is still further upside potential. Using the dips as a chance to buy is still working for the DAX. The key support is the 9369 reaction low.

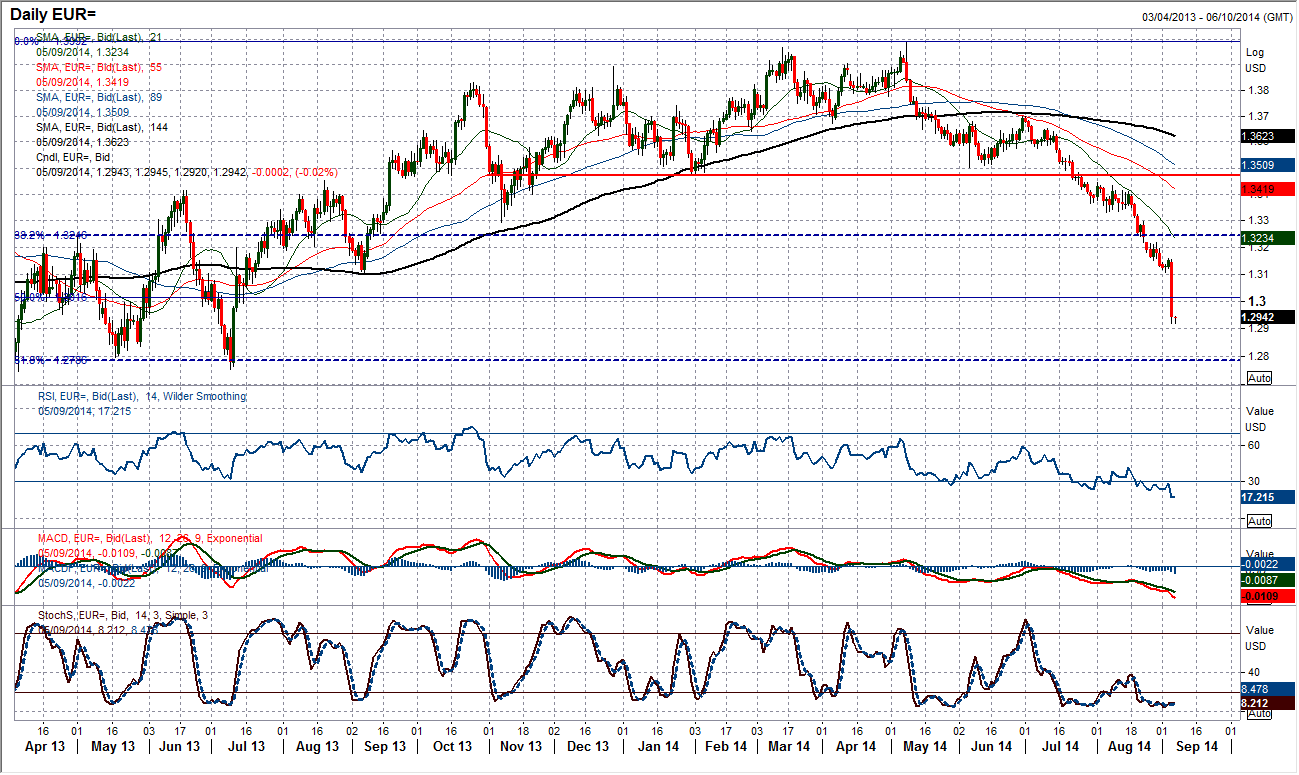

EUR/USD

What a day for Euro/Dollar yesterday! Well, I was certainly right about one thing, it was going to be a hugely volatile day. The surprise interest rate cut from the ECB of just 10 basis points in addition to a widely expected beginning to the asset backed securities purchase programme has created a massive sell-off on the euro. With a 231 high to low range, it was the largest bearish daily range on the euro since June 2009. Technical levels have been obliterated as a series of key supports have been swept aside. $1.3000 was supportive for about two hours before that was taken out. Furthermore, the 50% Fibonacci retracement of the big $1.2040/$1.3991 rally at $1.3016 also therefore failed. This now opens the next key support of the July 2013 lows around $1.2750 which is also around the 61.8% Fibonacci retracement level at $1.2786. The RSI closed at 17 yesterday which was a level it got to in September 2008 during the height of the credit crisis. This does therefore raise the prospect of a technical rally. The issue is that if there is a technical rally there is little real resistance until $1.3000 and arguably up towards $1.3100. It would be best to wait at least for support to come in first though, however with Non-farm Payrolls next up today the volatility is likely to remain high.

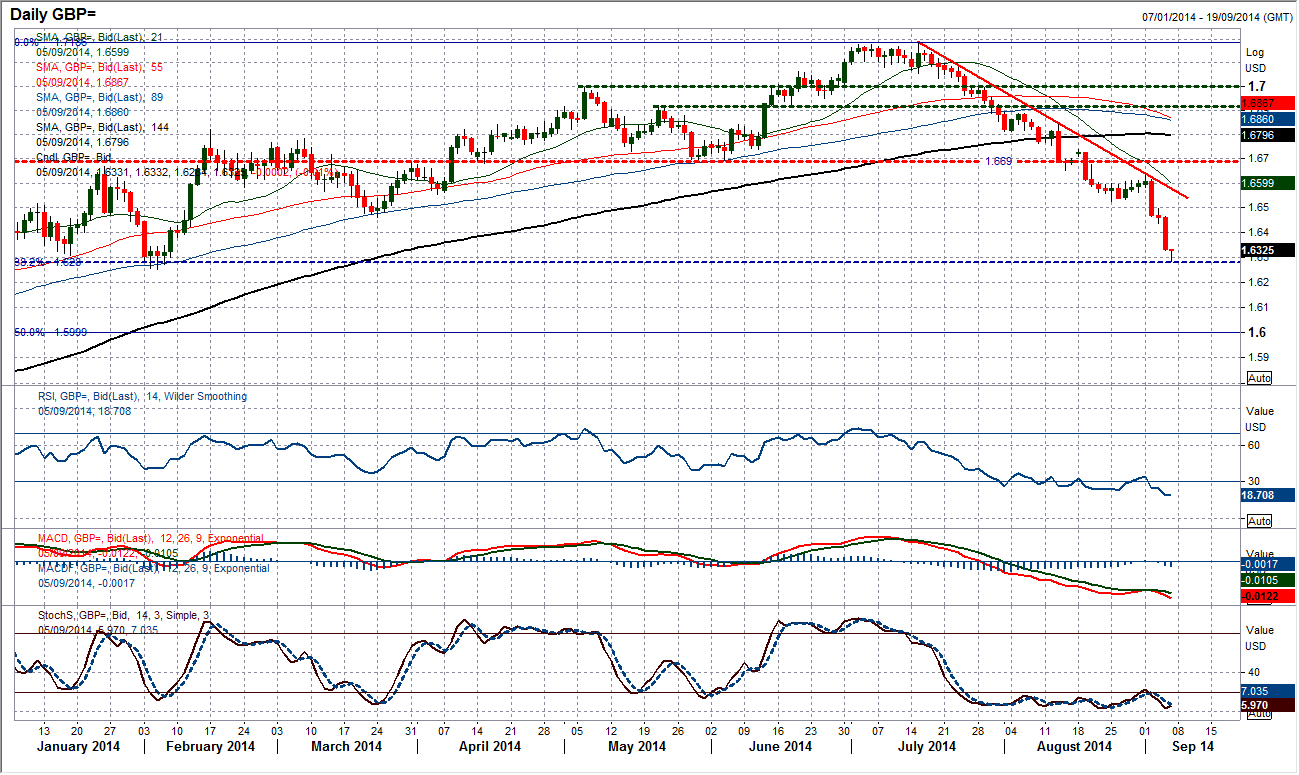

GBP/USD

The wave of selling pressure was not just limited to the euro yesterday. The dollar strength was felt in other places such as Cable as a second huge decline was seen in the past three days. Cable is now back to a test of the February low at $1.6250. This may though be a point at which there could be some support as this also coincides with the support of the 38.2% Fibonacci retracement of the big $1.4812/$1.7191 bull run. Momentum indicators remain incredibly weak, but the RSI is now back to below 20 and is the lowest since June 2012. With such a precipitous bear trend formation it would be a risky strategy indeed to play for a retracement, however the prospects of a technical rally are reasonably high having lost 300 points in just 3 days. However being Non-farm Payrolls Friday the risks either way are sizeable in front of such key data. A disappointing number could easily induce a snap back rally. Cable usually has a quiet morning in front of payrolls. There is no real resistance until $1.6440.

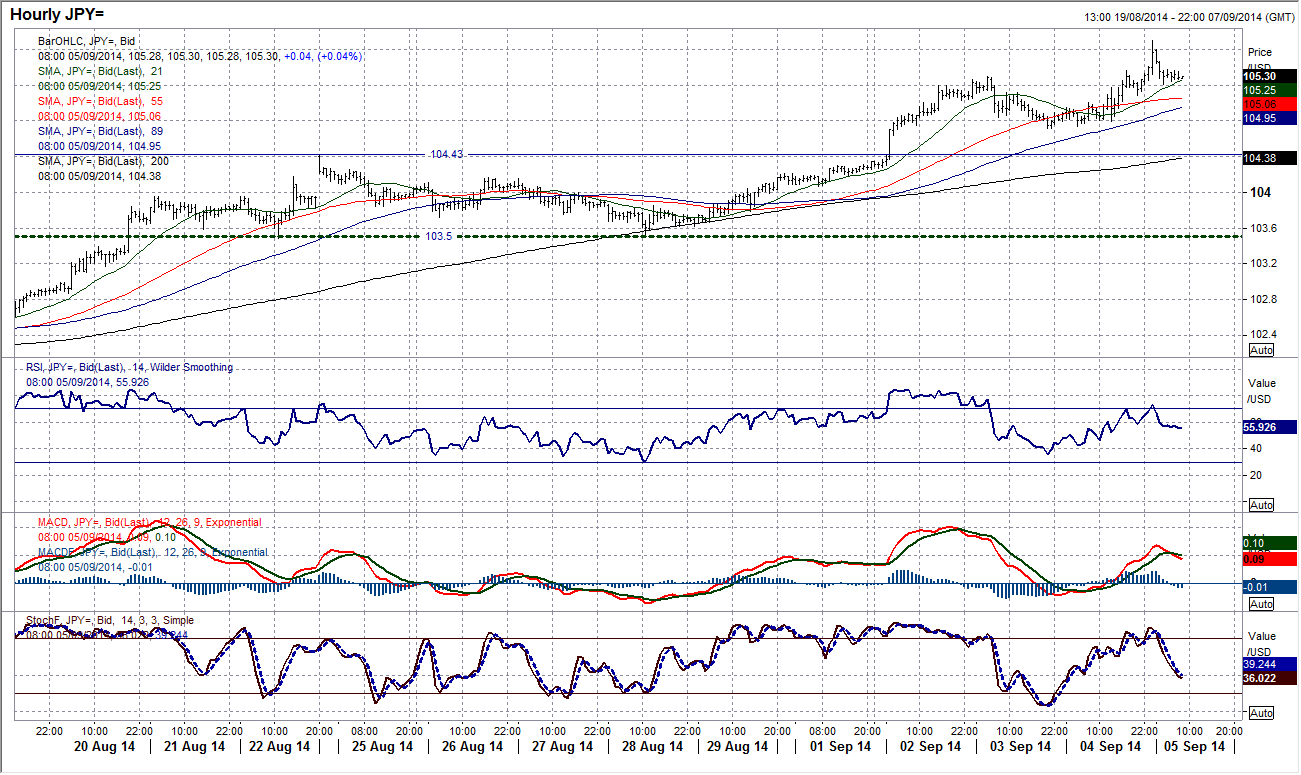

USD/JPY

With a spike higher overnight, the dollar has all but hit the implied target from the bull flag at 105.80. This has also seen the rate push through the January high at 105.44 which took it to a multi-year high. This has been an incredible run and momentum indicators remain extremely positive. The bulls remain in control despite a correction off 105.70. There is a band of support now 104.70/105.30 and this could prove to be key near term for whether the buyers can sustain such a significant move. If this band can hold then the bulls can reenergise for further upside into ground not seen since September 2008. However, the prospect of at least a near term consolidation is growing ever higher and now with the bull target hit the temptation to take profit will begin to grow. There is further support back at the flag breakout at 104.43. Will Non-farm Payrolls signal the end of the bull run?

Gold

The dollar strength continues to heap pressure on gold. In the Asian session, the price moved to within sniffing distance of the bottom of the trend channel (currently $1253.50), but has just rallied slightly off $1256.90. However, there is little to suggest that any rebound will not once more come under further downside pressure in due course with rallies continuing to be sold into and at ever lower levels. Yesterday’s bearish outside day has left another key near term resistance at $1276.50 and as the momentum indicators continue to deteriorate expect the bears to regain control and see the price fall further away. There is little real support now until the $1240.60 key June low. Resistance is now at $1276.50 and $1280.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.