Technical Bias: Bearish

Key Takeaways

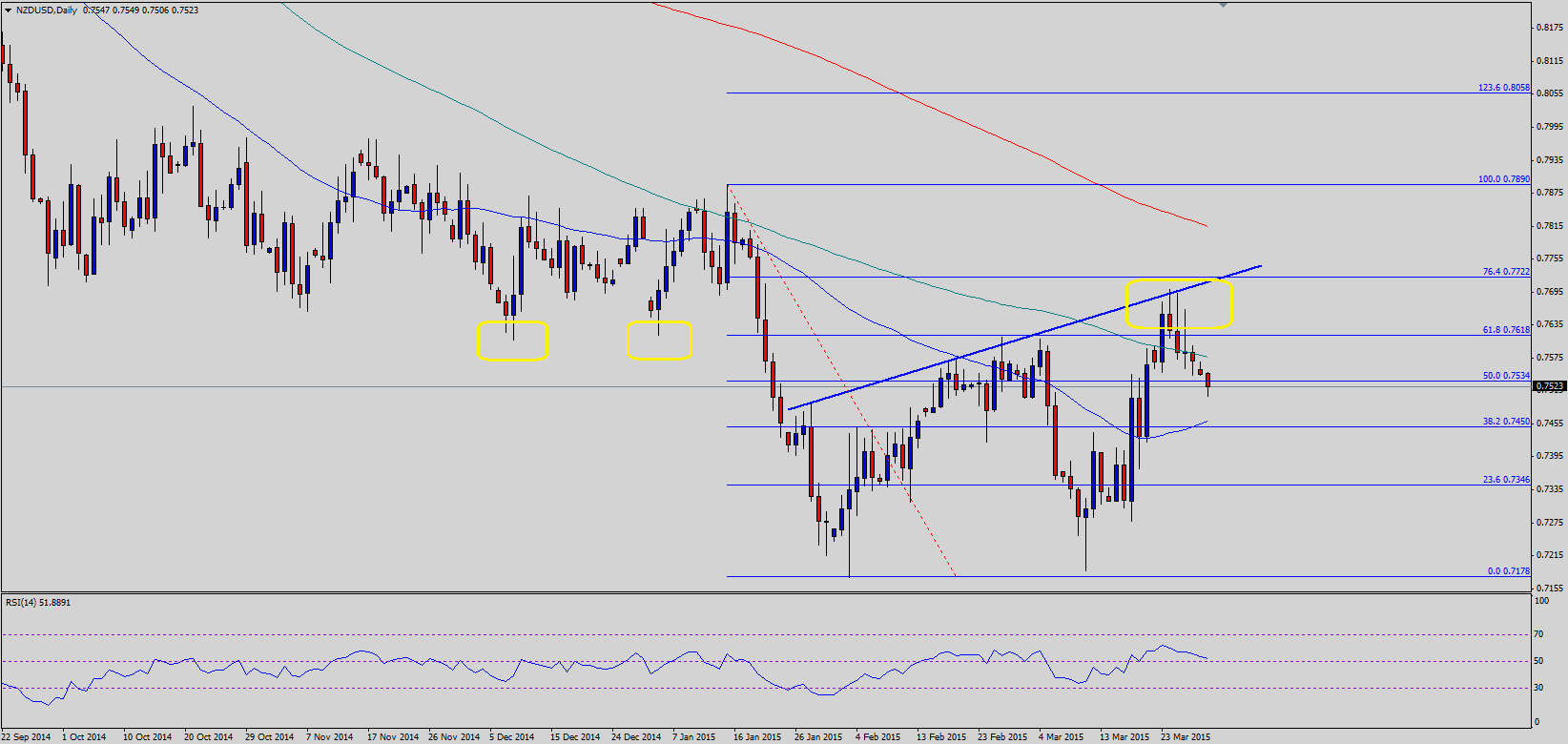

- New Zealand dollar climbed higher this past week against the US dollar, but failed to break a critical resistance area.

- NZDUSD formed a major resistance around 0.7680-0.7700, which holds the key moving ahead.

- In the US, the Consumer Confidence will be released by the Conference Board today, which is expected to decline from 96.4 to 96.0.

NZDUSD failing around the 0.7700 levels was crucial, as it gave sellers a reason to take it lower against the US dollar.

Technical Analysis

The New Zealand dollar upside was stalled around the 0.7700 area against the US dollar, which represents a major pivot area. The NZDUSD pair found support around the mentioned levels a couple of times earlier, and now the same support acted as a resistance for the pair. This was not all, as there is a resistance trend line formed on the daily chart, which also stopped the pair from moving higher. Moreover, the pair also failed to settle above an important confluence area of the 100-day simple moving average, and the 61.8% fib retracement level of the last drop from the 0.7890 high to 0.7178 low. In short, the recent failure was crucial, and might ignite more losses in NZDUSD moving ahead.

On the downside, there is a major support around the 50-day SMA at 0.7450. There is a chance that the NZDUSD pair might find buyers around the mentioned levels.

The daily RSI is above the 50 level, which is a positive sign in the short term.

US Consumer Confidence

Later during the NY session, the US Consumer Confidence will be released by the Conference Board. The forecast is lined up for a decrease from 96.4 to 96.0 in March 2015.

Trade Idea

One might consider selling rallies in the NZUSD pair as long as it is trading below the 100-day SMA.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.