Technical Bias: Bullish

Key Takeaways

Australian dollar is trading in the positive territory against the Japanese yen and looks set for more upsides in the near term.

101.80 area can be considered as a buy zone where buyers are expected to appear.

BOJ monetary policy meeting minutes are scheduled for release during the Asian session, which is likely to cause swing moves in AUDJPY.

The Aussie dollar has shown a lot of resiliency against most major currencies recently, raising the case of more upside in pairs like AUDUSD and AUDJPY.

Technical Analysis

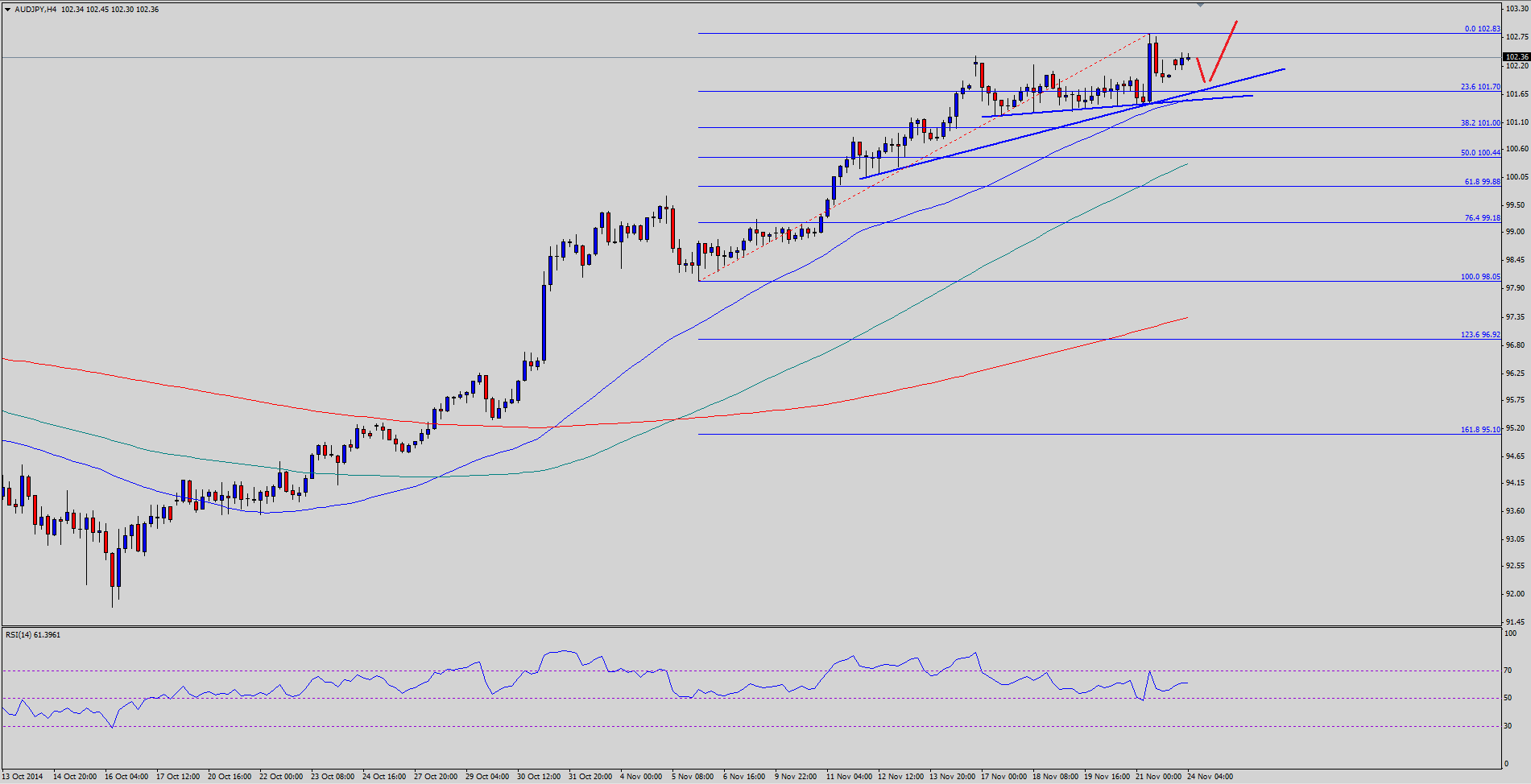

There are a couple of important trend line formed on the 4 hour chart of the AUDJPY pair, which are likely to act as a support for the pair moving ahead. The pair recently climbed towards 102.80 area where it found sellers, and is currently trading lower. There is a chance that the pair might spike lower towards the first bullish trend line, which is also sitting around the 23.6% Fibonacci retracement level of the last leg from the 98.05 low to 102.83 high. Moreover, there is one more bullish trend line, connecting lows sitting just below the first trend line. So, there is a lot of support around the 101.80-60 area where buyers are likely to take a stand. If the pair continues to trade higher from the current or lower levels, then initial hurdle is around the last swing high of 102.83, followed by the all-important 103.00 area.

On the other hand, if the AUDJPY pair breaks the highlighted support zone, then it is likely to head towards the 100 simple moving average (SMA) – 4H, which is around the 50% fib retracement level.

Moving Ahead

There is no major release in Australia in the coming sessions, but in Japan the BOJ monetary policy meeting minutes will be released during the next Asian session. We need to see how the Yen pairs react after the release. Overall, buying dips is a good idea in AUDJPY moving ahead.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.