Technical Bias: Neutral

Key Takeaways

- Euro continued its decline against the US dollar and likely heading towards the previously mentioned weekly target of 1.3020.

- A short-term correction might find sellers for another low in the coming days.

- EURUSD support seen at 1.3100 and resistance ahead at 1.3180.

The Euro continued to drop against the US dollar and failed to close the last week gap, which suggests that more downside is possible in the near term.

Technical Analysis

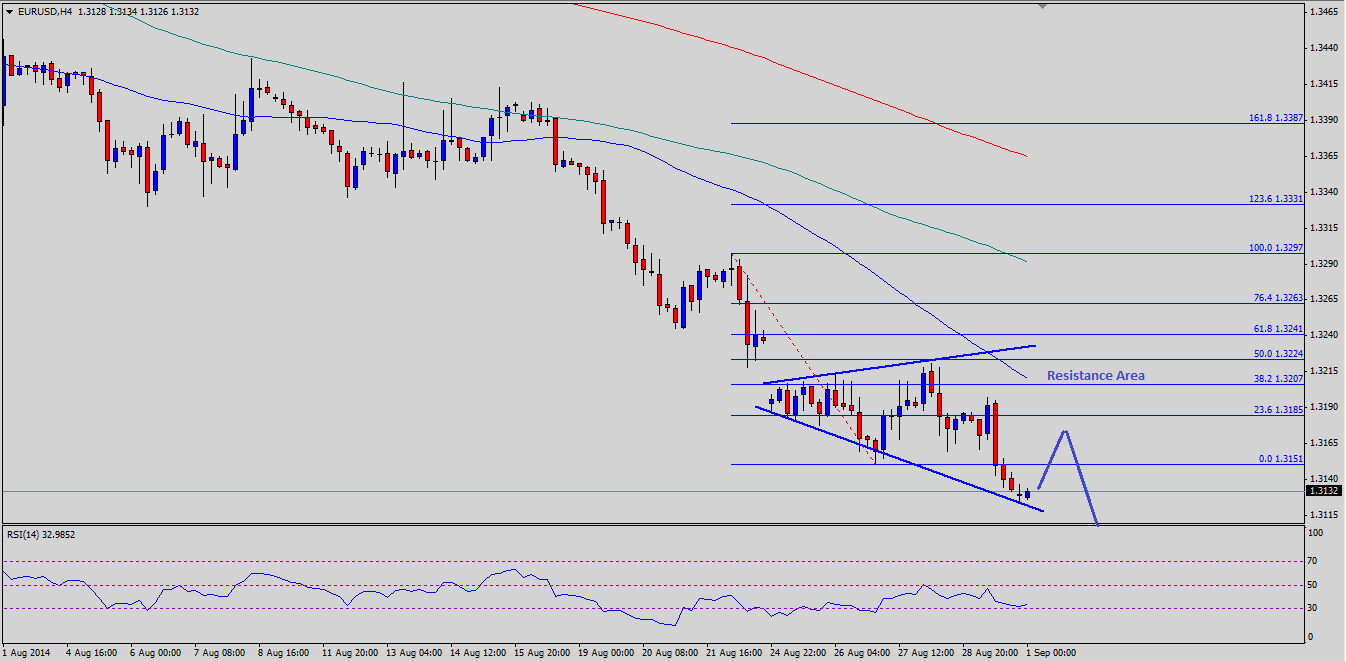

There is a monster triangle forming on the 4 hour chart for the EURUSD pair, which is likely to break soon. The pair is currently testing the triangle support trend line, and might bounce a bit from the current levels which can be seen as a selling opportunity. This past week the EURUSD pair climbed from the 1.3150 low, but failed to break the 50% Fibonacci retracement level of the last drop from the 1.3297 high to 1.3150 low. The most important thing was that the mentioned level also coincided with the triangle resistance area. The pair is now trading below the 1.3150 low and likely heading towards the last week’s weekly possible target of 1.3020. The pair might bounce from the current levels, but might find sellers around the 1.3180 level. The most critical resistance can be seen around the 1.3230 level, which is the gap close level.

On the downside, initial support is around the 1.3100 level, followed by the 1.3080 swing area. It would be interesting to see how the pair reacts around the mentioned support area if reached.

German GDP

Today during the London session, the German Gross Domestic Product (GDP) will be published, which is expected to register a decrease of 0.2%. If the outcome exceeds the expectation, then the Euro might find bids in the short term.

Overall, selling rallies still remains an attractive option until the pair is trading below the 1.3230 level.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.