Key Takeaways

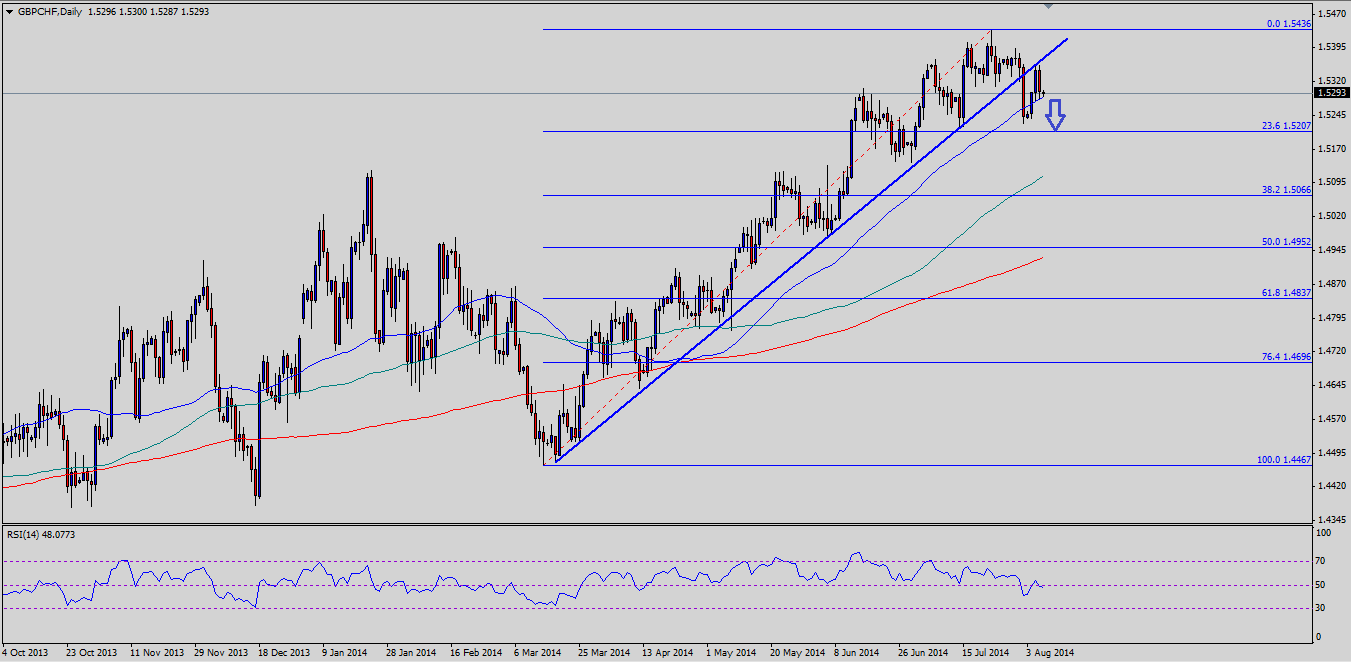

- British pound recently broke a long term bullish trend line against the Swiss franc.

- More losses in the near term cannot be denied considering the breakdown.

- GBPCHF support seen at 1.5210 and resistance ahead at 1.5360.

Technical Analysis

There was a monster bullish trend line on the daily timeframe for the GBPCHF pair, which was broken earlier during this week. This break can be seen as very critical because it increases the chances of a larger correction in the near term. The pair recently bounced back to test the broken trend line, but buyers failed to gain momentum above the same.

Ahead, it might continue to act as a resistance. On the downside, initial support can be seen around the 23.6% Fibonacci retracement level of the last move higher from the 1.4467 low to 1.5436 high. However, just above the mentioned fib level lies the 50-day simple moving average, which could act as a barrier for sellers in the short term. The chance of a move towards the 38.2% fib level is more considering the recent break of the bullish trend.

Alternatively, if the pair manages to trade higher from the current levels and closes back above the trend line, then a move towards the last high of 1.5436 might be possible. However, this scenario is less likely as the daily RSI has moved below the 50 level.

Moving Ahead

Overall, as long as the pair is trading below the 1.5360 level it could dive towards the 23.6% fib level, followed by the 38.2% fib level. The BOE interest rate decision is scheduled today, which might act as a catalyst for the GBPCHF pair.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.