Technical Bias: Neutral

Key Takeaways

- US dollar eyes Nonfarm Payrolls for the next move, as all major pairs consolidate recent losses.

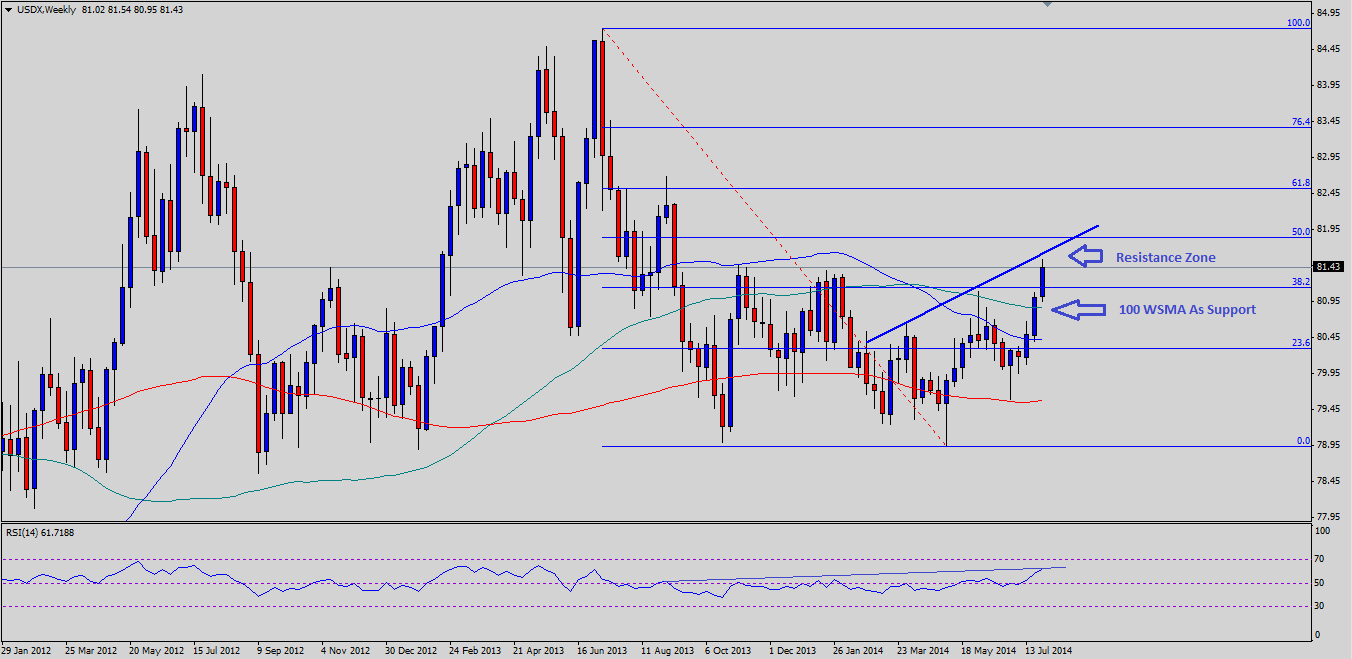

- US dollar index is around a critical level, which might result in a short-term pullback.

- US dollar index support seen at 80.85 and resistance ahead at 81.60.

The US dollar recently jumped higher against most of its counterparts, including the Euro and the British pound. However, it is approaching a major barrier where sellers might appear to protect further upside moving ahead.

RSI Divergence

There is a major RSI divergence forming on the weekly chart for the US dollar index, which if takes shape can result in a pullback in the US dollar. Moreover, there is a trend line on the weekly timeframe, which is almost coinciding with the 50% Fibonacci retracement level of the last major drop from the 84.74 high to 78.93 low. The US dollar index recently stalled right around the trend line mentioned, but one cannot deny a final push towards the 50% fib level before a substantial pullback takes shape. If somehow it breaks the trend line and the 50% fib level, then it would call for more gains towards the 61.8% fib level, which means the EURUSD pair could fall towards the 1.3300-1.3280 support area.

Alternatively, if fails to break higher, then a move lower might take the US dollar index towards the 100 weekly simple moving average, which is currently around the 80.85 level. The 81.50-60 resistance zone is very crucial, as it has acted as a pivot area numerous times.

US Nonfarm Payrolls And Unemployment Rate

The US Nonfarm Payrolls and the unemployment rate data will be published later during the New York session. The forecast is of yet another 200K+ reading and the unemployment rate to remain at 6.1%. If there is any major miss, then the mentioned scenario might happen, and we could witness swing moves later today.

Recommended Content

Editors’ Picks

AUD/USD tests lows near 0.6550 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is testing lows near 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data fails to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY rebounds to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.