Key Takeaways

- Dollar steady after comments from Fed’s Yellen

- AUDUSD tested and failed around key resistance area

The dollar despite losing its gain against the Euro and British pound has managed to maintain interest against the Australian dollar. AUDUSD has struggled to find bids after the Federal Reserve Chairwoman Janet Yellen indicated in a speech that they have no plans to increase interest rates ahead of schedule, as policy makers have held the key interest-rate in a range of 0 to 0.25 percent since 2008 to back the economy.

AUDUSD is trading lower post the release of China’s GDP. According to the National Bureau of Statistics, China’s economy expanded 7.4 percent from a year earlier, more than the forecast of 7.3 percent. However, the recovering is still declining, which caught the attention of AUD bears.

Technical Analysis

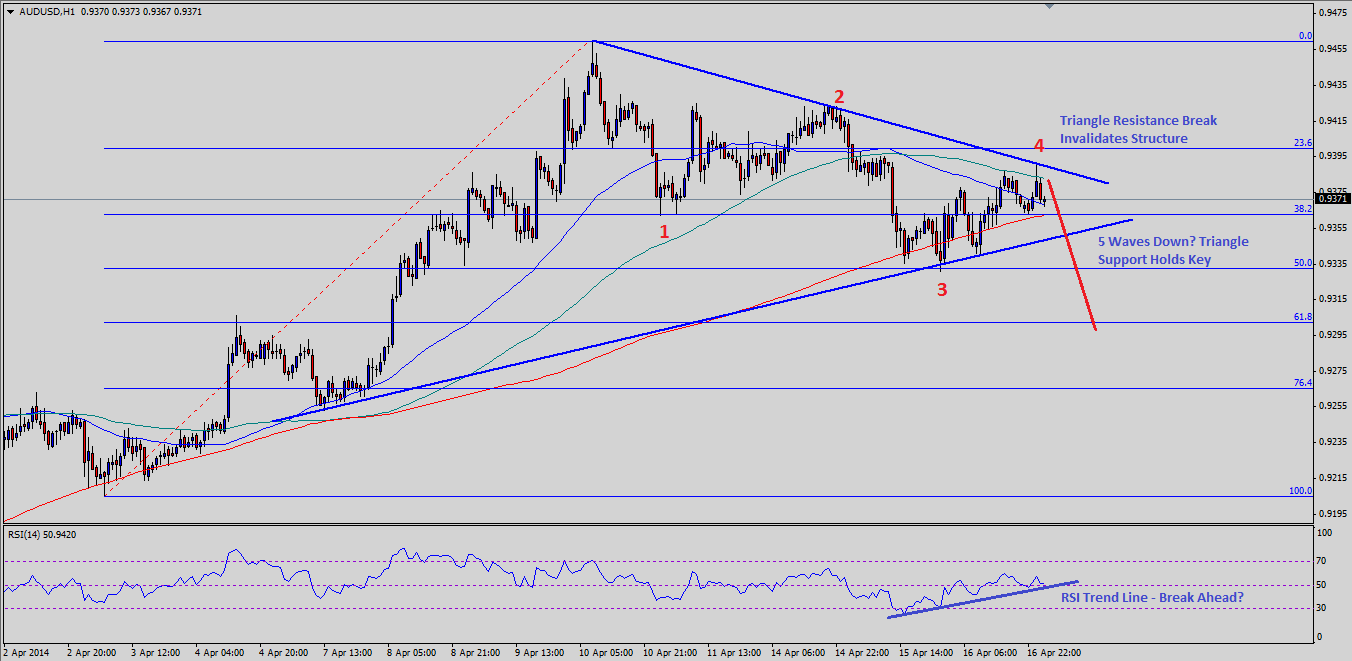

AUDUSD is forming a perfect bearish structure after setting a high at 0.9459. The pair recently dropped close to 0.9330, which represents 50% retracement level of the last move higher from the 0.9205 low to 0.9459 high. There is a contracting triangle forming on the 4 hour timeframe connecting lows and highs, which hold the key moving ahead.

The pair is currently in the fourth wave of the recent drop, and there are chances that the pair breaks the triangle support area to complete a 5-wave structure. A break below might take the pair towards the 61.8% fib retracement level, which also coincides with April 04, 2104 high.

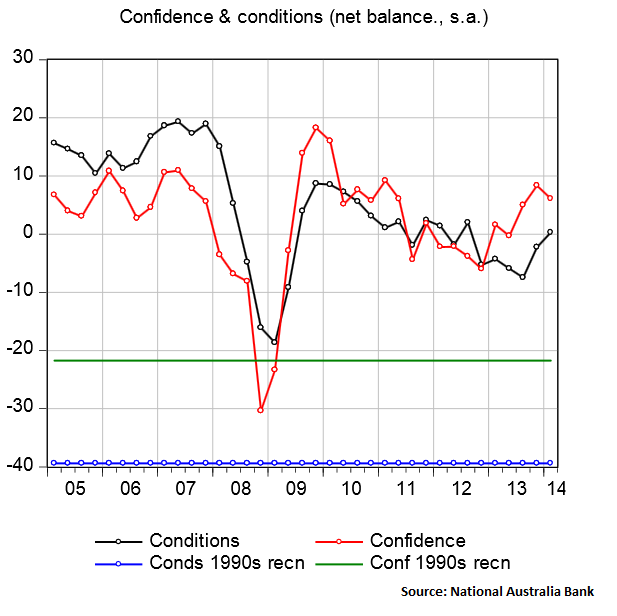

National Australia Bank's Business Confidence

The National Australia Bank Business Confidence was released in the Asian session. The outcome was disappointing, as business confidence eased from its recent high of 8 to 6, but remained elevated in the March quarter. The report highlighted that the “special question on the impact of currency still showing wholesale and manufacturing most affected by the level of the AUD”. This is not something which can distract the Australian dollar bears.

If the sellers take control, and manage to push AUDUSD below the triangle support level, then more losses are feasible in the coming days.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.