US dollar index registered 5-daydecline yesterday, which is most in the past few weeks. US dollar is tradinglower against almost all major currencies, including the euro, pound, AUD, CHFand Japanese yen. Most major currency pairs are trading around criticalbreakout levels, which is one of the main reasons why more losses are possiblein US dollar. The dollar index itself is nudging critical level and possess areal risk of a major breakdown.

Key Talking Points

- US dollar index testing key pivotal zone

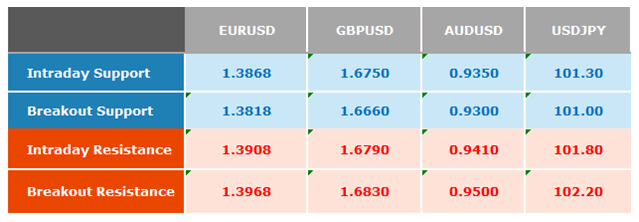

- Cable threatening to break multi-year highs above 1.6830

- Euro eyes all-important 1.40 figure again

- USDJPY at a critical juncture, 101 holds the key

- Contrarian sentiment-based strategy – Traders are buying aggressively into US dollar weakness, which can result into more losses

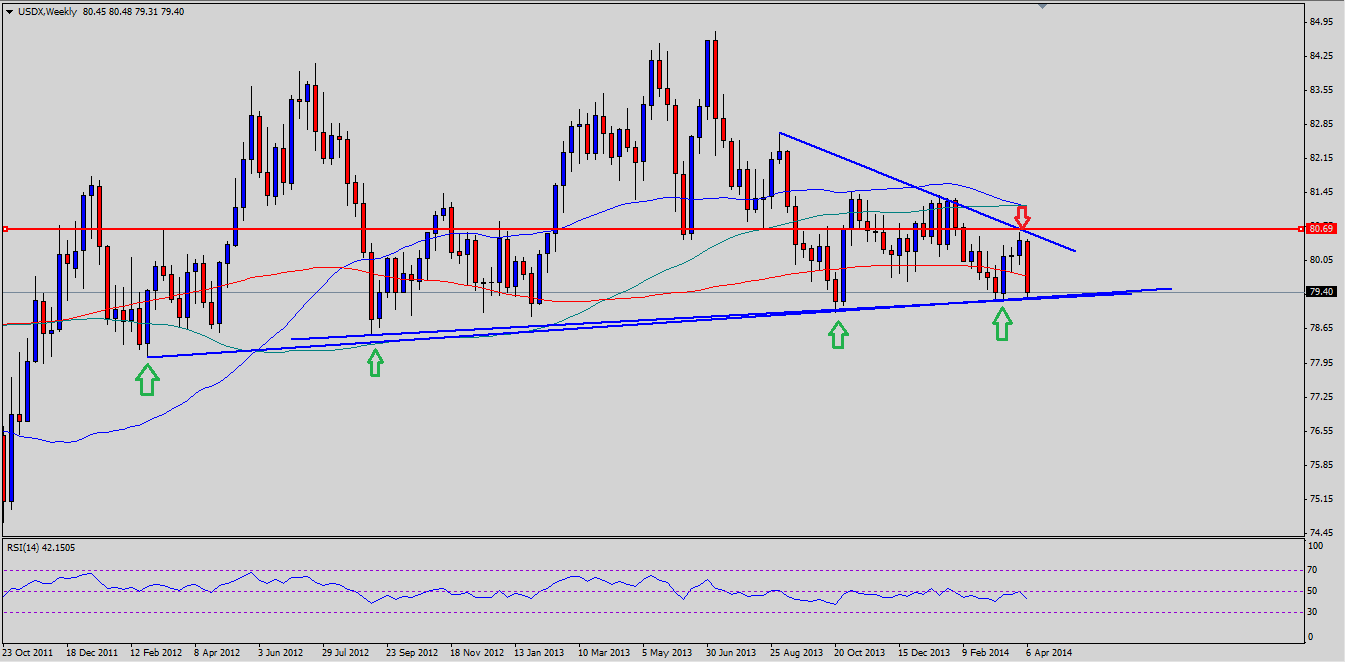

The aforementioned points suggesthow further losses could lead to a collapse in US dollar. Technically, USdollar index is nudging around an important confluence area of two crucialtrend lines. These two trend lines are connecting almost all the previous majorlows on weekly timeframe. These trend lines acted as a support numerous times. So,a break and close below 79.00 level might be considered very bearish for thedollar moving ahead. If bearish sentiment surrounding thegreenback gathers pace, then the dollar remains at risk of a major breakdown.

Fed won’t mind losses in USdollar

The fact of the matter is that incurrent market conditions almost every central bank wishes their currency totrade lower. Considering the recent dovish Federal OpenMarket Committee (FOMC) meeting minutes the Fed made it very clear thatthey are in no hurry to jump into rate hike expectations, which could furtherlead to more sustained losses in US dollar.

ECB’s reluctance to do more

The European central bankrefrained from acting again in the last meeting, which acted as a catalyst forthe euro, and in turn weakened US dollar. According to Reuters, ECB Executive Board member Peter Praetsaid during a meeting organized by The Economist that “despite lower thanexpected inflation in the euro zone forseveral months in a row, consumer price developments were still within the banks base-line scenario”. This means ECB seemsto be no urgency to use tools such as negative rates or QE, which could possiblyignite further bullish sentiment for EURUSD pair.

UK to grow further

There is no denial of the factthat recovery in UK is on the right track, which could lead pound to gainfurther against the dollar. International Monetary Fund recently predicted UKwill grow faster than other advanced economies this year, according to theguardian.

Overall, it’s the marketsentiment which can drive the dollar moving ahead, and investors need to becareful while buying aggressively into US dollar weakness.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.