UP NEXT:

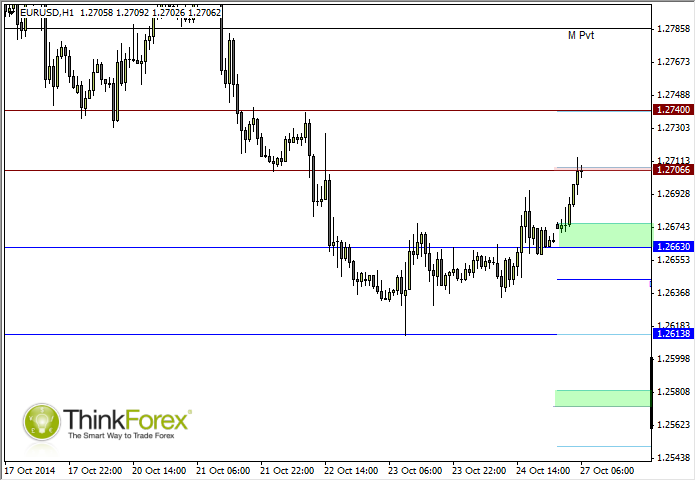

EUR: German business climate peaked in February, and expected to soften further today to its lowest since Jan '13. This leaves an upside surprise should it come in stronger, but several other indocators are pointing to a weaker Germany so this is an outside chance. With EURUSD rising throughout Asia it may provide an opportunity to get short before the release, in hope of a poor data set.

TECHNICAL ANALYSIS:

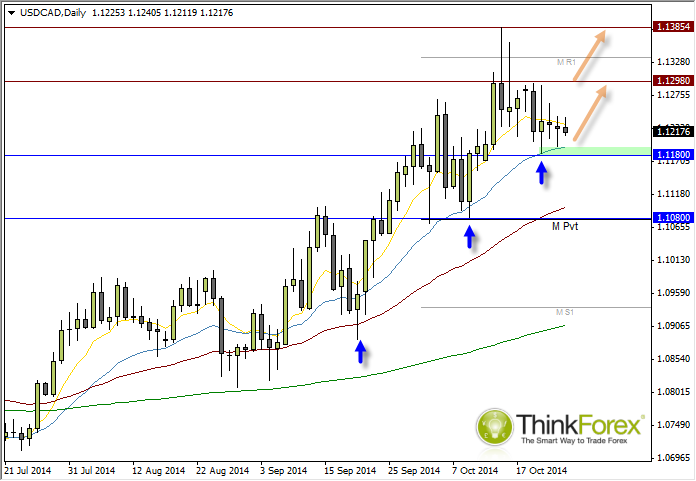

USDCAD: Grinding higher, but a trend is a trend

I admit the trend is quite messy - but it remains to be a trend as it produces higher highs and lows. 1.118 may be the swing low which produced a wide-ranged Rikshaw Man Doji and has produced 2 more indecision candles well within the range of the Doji to suggest a basing pattern is taking shape.

Any retracements towards this key level may produce a decent buying opportunity with a relatively high reward to risk ratio.

However in regards to targets I am erring on the side of caution as we have seen USDCAD has the tendency to be volatile whilst lacking direction for several days at a time. Therefor I am opting for a target around 1.129 (last week’s highs) and not attempting to get any home runs.

With FOMC and FED taking up the headlines this week, with any luck we can exit the trade before these events occur.

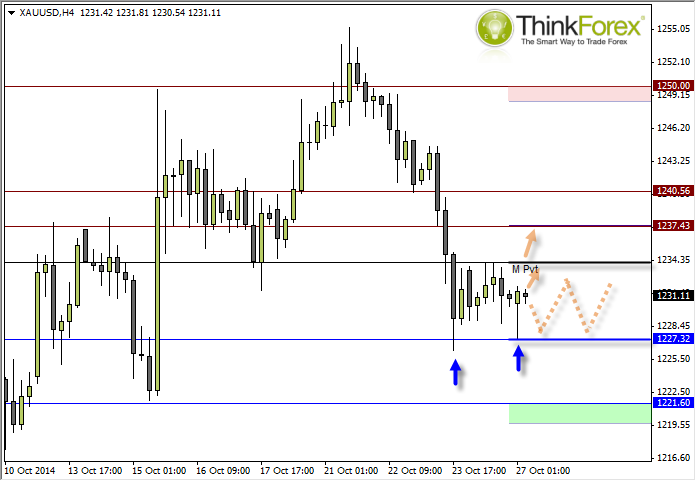

GOLD: Range trading strategies preferred

The recent H4 candle has produced a Bullish Hammer above the prior swing low to suggest the potential for a Double Bottom (confirmed with a break above $1234). However whilst we remain below this key level then traders are likely to opt for range-trading strategies by shorting below resistance or buying above support.

If we do see an upside break of $1234 then we could consider bullish setups above this level, and hope for a retracement to seek long positions. However take note of resistance at $1237 which may scupper the chances of the Double Bottom reaching the $1240 target.

EURUSD: Over to Germany

The markets are really waiting for comments from FED and FOMC so I don't expect any particularly big moves today. However is the data comes in weak enough for EURUSD it should help push it back down to 1.266 to undo the bulls work during Asia.

Any surprise strength from Germany should see EURUSD up to around 1.27 but to stay here we'd also need poor housing data from US.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD stays firm above 1.2500 amid US Dollar weakness

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair's uptick is supported by a broadly weakness US Dollar on dovish Fed signals. A mixed market mood could cap the GBP/USD upside ahead of mid-tier US data.

Gold price trades with modest losses amid positive risk tone, downside seems limited

Gold price edges lower amid an uptick in the US bond yields, though the downside seems cushioned. A positive risk tone is seen as another factor undermining demand for the safe-haven precious metal.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.