UP NEXT:

Central banks continue to drive markets at the moment over the fundamentals. With ECB hinting at the purchase of corporate bonds whilst the FED also toying with the idea of delaying the end of their own QE, traders will continue to place bets on the likelihood of Central Bank action based on any market data available.

EUR: Out of the German and Eurozone Serves and Manufacturing PMI's, the more below 50 we get the greater the chances of stronger stimulus from ECB. Germany's Manufacturing peaked in Jan '14 and dipped into contraction last month, with further weakness expected ahead.

GBP: Retail sales are expected to have softened so any upside surprise here may help GBPUSD remain above 1.60

USD: With unemployment claims at a 14-year low and expected to be even lower then there is a clear bullish expectation from tonight's release. So any softness in this release will be a disappointment and may see further USD downside.

CAD: With BoC firmly stuck in neutral we do not expect any violent reactions from tonight's speech or rate 'decision', to remain fixed at 1%.

TECHNICAL ANALYSIS:

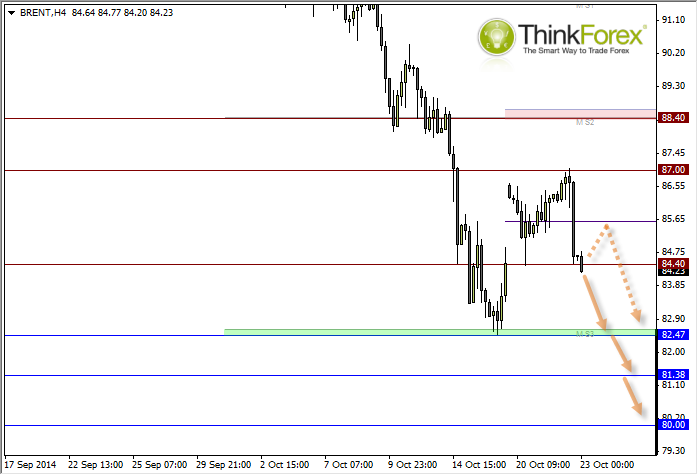

BRENT: Oil continues to slip

The decline on Oil has been impressive, to say the least. Looking at D1 (not pictured) you'll see that an 8 period MA has continued to cap as resistance to show how bearish the move has been. The 87 high was the recent test of this MA so I doubt we'll get a substantial pullback before losses resume.

Intraday trading already appears to be targeting the 82.47 lows so as long as we remain below 84.40 then we can consider selling into any rallies on much smaller timeframes (M5, M15 etc.).

If we do break back above 84.40 then we can consider bearish setups below 85.60 on H1 or H4 to target 82.47 and 80

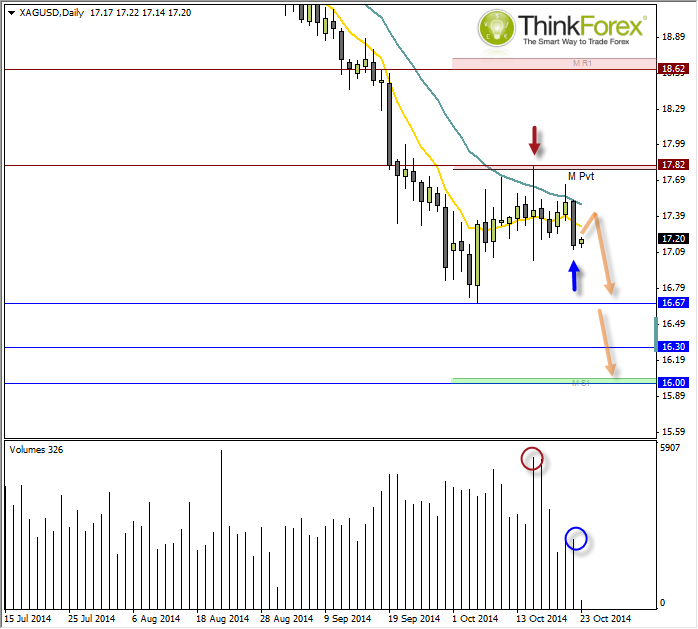

SILVER: Preparing for another drop

Remaining within a clear downtrend and the 21eMA continues to cap as resistance, current price action also suggests another leg down is pending.

The Rikshaw Man Doji on higher volume below 17.82 was the 1st clue which was followed by several smaller candles inside the range of the Doji, suggesting a hesitancy to buy at these lows.

However one slight concern is yesterday's Bearish Engulfing on lower volume. Whilst the candle itself is within line of the trend the lower volume suggests we may be treated to a retracement within yesterday’s range. If so this could provide a better reward/risk ratio to target 16.67, 16.30 and 16.00.

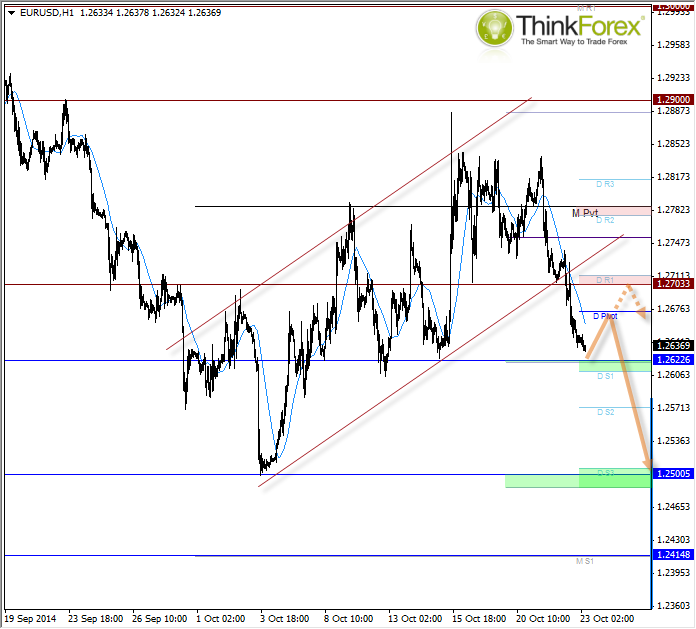

EURUSD: Break of Bearish Channel targets 1.25 lows

The downside break didn't mess around, which favours a shallow pullback if we see one. The chances are will see a rebound from current levels due to several technical support levels highlighted.

Areas to consider selling into (fading) could be the daily pivot, or Daily R1 to target the 1.250 lows.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD stays slightly above 1.0700 after mixed US data

EUR/USD lost its traction and turned negative on the day but managed to hold above 1.0700. Although the upbeat Employment Cost Index data boosted the USD earlier in the day, the weak consumer sentiment reading limits the currency's gains.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold extends daily slide toward $2,300 as US yields edge higher

Gold stays under bearish pressure and declines toward $2,300 on Tuesday. The benchmark 10-year US Treasury bond yield stays in positive territory above 4.6% after US Employment Cost Index data, weighing on XAU/USD.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.