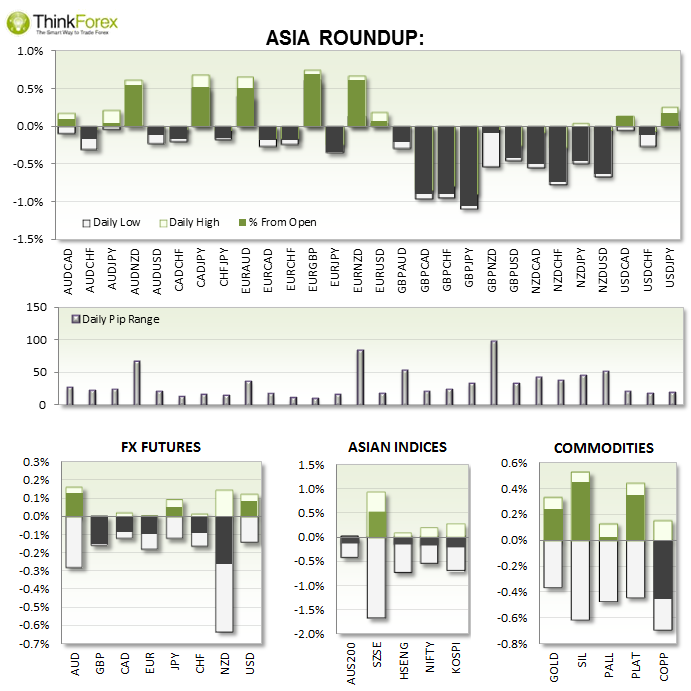

AUD business confidence at highs not seen since October 2013 and rises for a 4th consecutive month.

NZD House Price Index contracts a further -0.7% to see the 3rd consecutive decline. The Kiwi Dollar took a hit across the board and testing key S/R levels against USD, JPY and EUR. AUDNZD traded to a 3-day high.

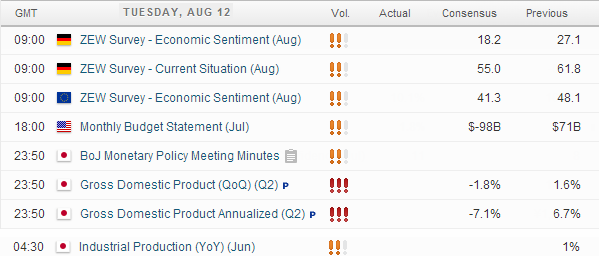

UP NEXT:

TECHNICAL ANALYSIS:

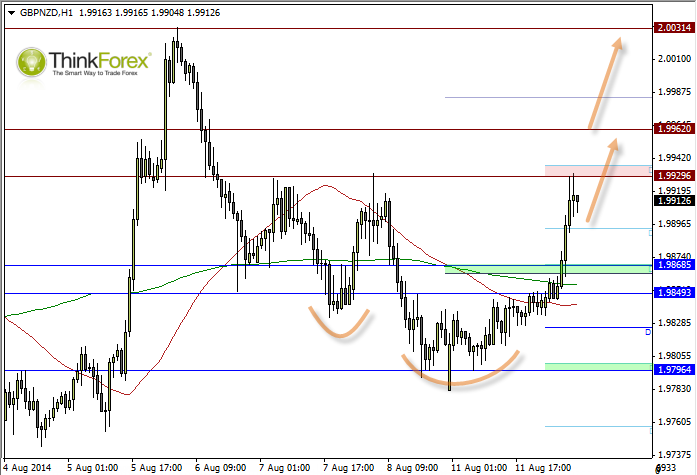

GBPNZD: Bottoms up!

Whilst it would appear at first we have missed a big part of the bullish move, there may be a longer-term opportunity to consider bullish setups above 1.9930-40. It appears to be a 'cup and handle pattern' although the handle (smaller rounded bottom) tends to be on the right and not the left. Still, it does highlight a clear breakout level - so if we do trade above the resistance zone we could seek bullish setups on lower timeframes in the direction of the breakout.

For those who wish to get in earlier we could consider buying any pullbacks at support levels to anticipate the breakout. A level to consider is around 1.9840.

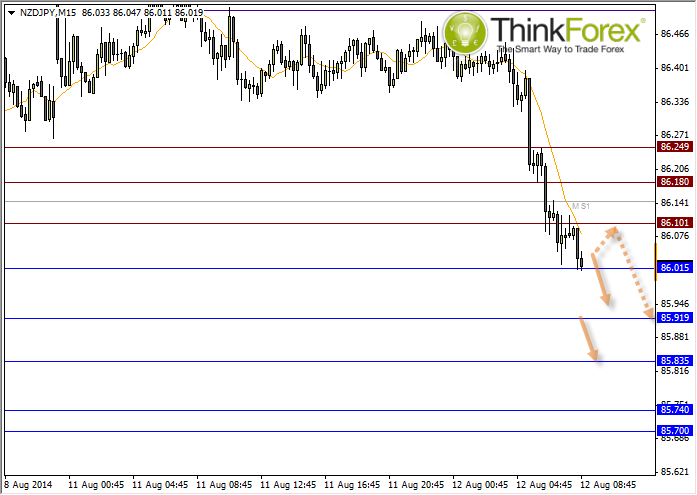

NZDJPY: Intraday momentum is clearly bearish

It's not often I refer to the 5 min chart but the trend is well established and there are clear levels of S/R to consider as profit objectives or buy/sell zones in line with the trend.

As the Kiwi has by far been the biggest mover throughout Asia we are requiring for this sentiment to continue when Europe and London markets open.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds steady above 1.0650, awaits US data and Fed verdict

EUR/USD is trading sideways above 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD flatlines below 1.2500 ahead of US data, Fed

GBP/USD is off the lows but stays flatlined below 1.2500 early Wednesday. The US Dollar strength caps the pair's upside amid a cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

ADP Employment Change Preview: US private sector expected to add 179K new jobs in April

The ADP report is expected to show the US private sector added 179K jobs in April. A tight labour market and sticky inflation support the Fed’s tight stance. The US Dollar seems to have entered a consolidative phase.