ASIA ROUNDUP:

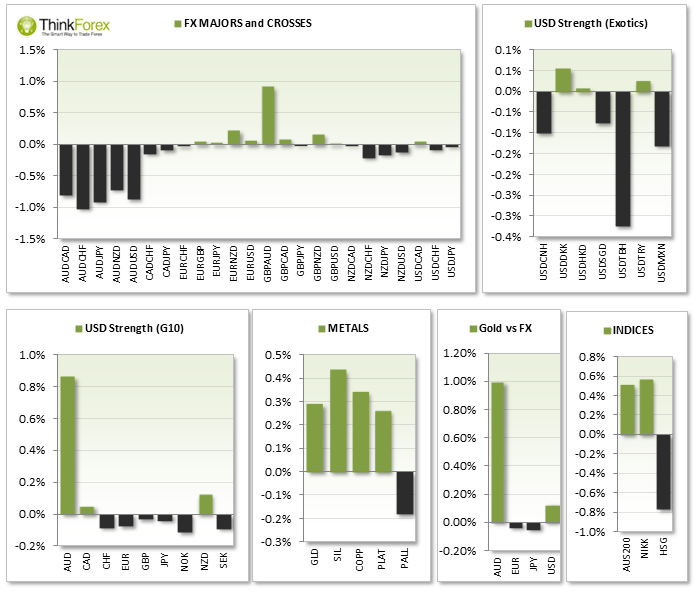

A$ sold off sharply across the board following today's disappointing CPI figures, after spending most of the session climbing higher in anticipation of good numbers.

Chinese Flash PMI followed shortly after to provide an extra blow for the Aussie crosses and Hang Seng as it confirmed a 4th consecutive number below 50 to suggest industry contraction. Whilst it came in above expectations at 48.3 vs 48.0 it wasn't enough to stop the declines.

NZD credit card spending y/y is up 8.1% to show consumer confidence is increasing

NZD Lamb exports fall but value has increased

UP NEXT:

GBP Bank rate and asset purchase votes will be announced. Whilst voting members have been consistently unanimous to keep policy fixed a change in these numbers could cause a stir in the markets tonight and increase speculation of rate increases this year

Last month's French Flash PMI was at it's highest level, and the first time above 50 in nearly 3 years. A reading above 51.9 would be strong for Euro.

German Manufacturing PMI follows shortly after and whilst is has seen 2 consecutive months below forecasts it has been in contraction (above 50) since July 2013. A reading above 53.90 would also be string for the Euro.

US Equities Futures have opened and held on to recent gains, seemingly not too shaken by today's Chinese Data.

Pairs to Monitor: EURGBP, GBPUSD, EURUSD, USDCHF

TECHNICAL ANALYSIS:

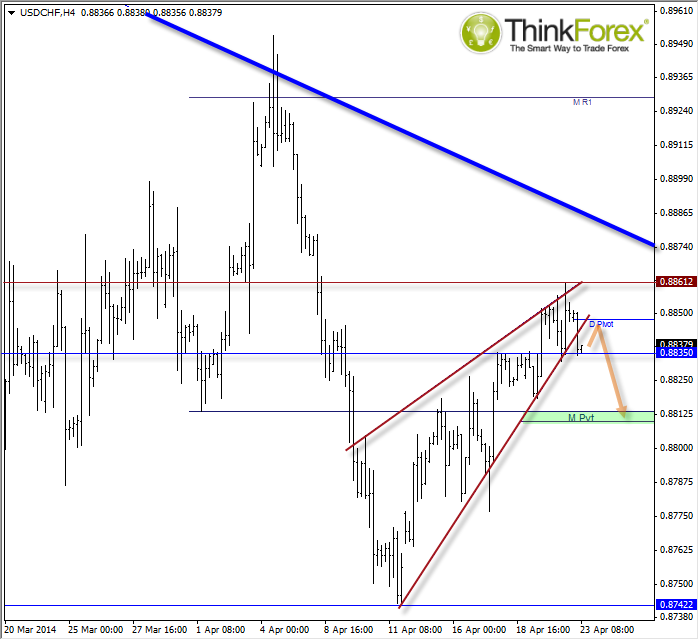

USDCHF: Confirmed bearish wedge; Initial target 0.8813

Yesterday's analysis worked out well as it hit both our lower timerame short target and higher timeframe bullish target, respecting the key levels of S/R along the way.

We appear to have broken out of the bearish wedge and now trading beneath the daily pivot. Scalpers could consider bullish setups towards the daily pivot.

A break above 0.8845 (Daily Pivot) opens up a run back to the 0.886 highs.

Bearish setups below the daily pivot could be considered for a bearish leg down to 0.8825 and 0.8813

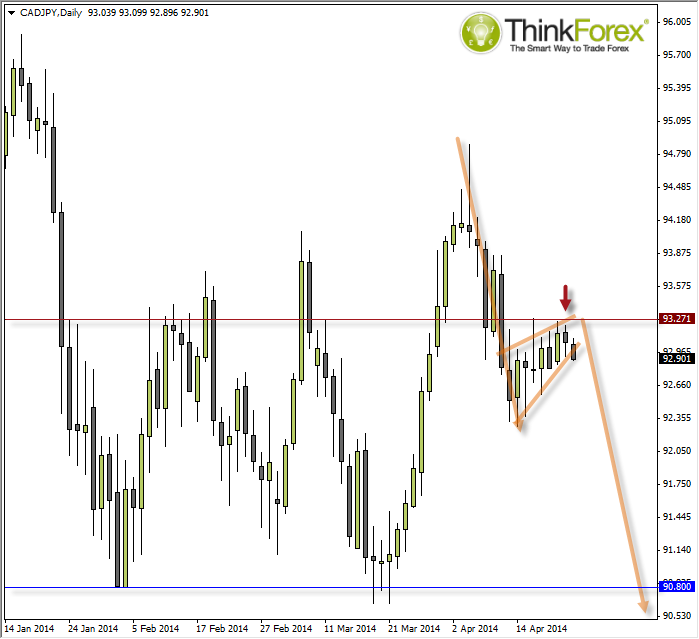

CADJPY: Bear flag below resistance

As this is on the daily chart this leaves more time to plan your entry.

The price action is oscillating wildly between a $5 range and currently mid-way between this range. Yesterday produced a Hanging Man Reversal below resistance level and now trading beneath yesterday's low.

The potential flag projects a target around the 90.0 lows; however the pattern would have to be reconsidered above 93.3 resistance.

Flags are particularly messy patterns to trade, so an option is to trade on lower timeframes in direction of the bearish target, seeking trend on H4, H1, or H15 etc.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.