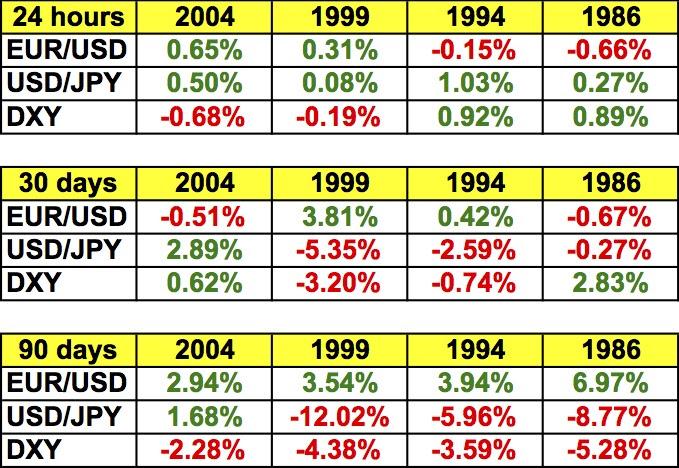

However if the Federal Reserve raises interest rates in October, our outlook for the greenback could be very different. Over the past 30 years, there have been 4 major tightening cycles in 2004, 1999, 1994 and 1986. On each occasion, USD/JPY rallied the day that the Fed raised interest rates for the very first time but 3 months later, the dollar (as measured by DXY) is generally worth less. 90 days after the first hike, the dollar index dropped an average of 3.8% with relatively strong losses seen against the euro and Japanese Yen. What is interesting about these moves is that the dollar weakened even though further hikes were made during these 90-day periods. So rather than encourage demand for U.S. dollars Fed tightening discouraged it. This counterintuitive price action could be driven by a number of factors from the central bank downplaying the tightening cycle to the negative impact of rate hikes on growth and the classic buy the rumor, sell the news price action. Of course, how the dollar behaves will depend on how aggressively the Fed decides to move again but based on Yellen's comments, the whole point of starting early is to avoid raising rates too fast.

The Japanese Yen is also at risk of severe losses in the fourth quarter if the Bank of Japan increases its asset purchase program next month. Japan's economy is performing much worse than anticipated. To everyone's surprise industrial production declined for the second month in a row when economists had been looking for an increase. Retail sales also stagnated while construction orders dropped a whopping 15.6% yoy. Tonight's quarterly Tankan report is expected to show Japanese businesses becoming less optimistic and paring their capital expenditure plans. Last week, we learned that core consumer prices dropped for the first time since April 2013 and all of these problems have the market talking about the possibility of another recession in Japan. Its too early to tell but the arguments for more stimulus from the BoJ is growing and the last time they surprised the market with more stimulus in 2014, the Yen fell more than 8% against the euro, sterling and U.S. dollar over the course of 6 weeks.

The euro was hit hard today by weaker than expected economic data. In Germany retail salesdropped 0.4% against expectations for a 0.2% rise. German unemployment rolls increased by 2k and consumer prices in the Eurozone dropped 0.1%. This was the first time that euro area inflation turned negative since March 2015 and despite Bundesbank President Weidmann's recent comment that deflation has become less of a concern, the drop in inflation at a time when commodity prices are very low raises the risk of the low inflation sticking which could revive the talk of additional ECB easing.

9 trading days have now past without a rally for the British pound versus the U.S. dollar, the longest stretch of weakness since August 2008. The latest U.K. economic reports were mixed. House prices increased at a faster pace according to Nationwide but annualized GDP growth was revised down to 2.4% from 2.6%. The main focus this week for sterling is tomorrow's UK PMI manufacturing report. Between the drop in industrial production and the sharp decline in the CBI Industrial Trends report, the risk is to the downside. However if the data is good and sterling rallies, the turn should last (as long as NFPs aren't horrid). GBP/USD is a high volatility pair and when it reverses the move can be strong ranging from 200 to 800 pips.

USD/CAD ended the North American trading session lower for the first time in 9 trading days on the back of stronger GDP growth. Canada's economy expanded by 0.3% in the month of July against expectations for a 0.2% rise. On an annualized basis, GDP growth in Canada accelerated to 0.8% from 0.5%. Considering that the past month's report was revised lower, oil prices were unchanged and the latest EIA data showed an unusually large increase in crude stockpiles, we believe that today's reversal is a reflection of trend exhaustion.

The Australian and New Zealand dollars also traded higher ahead of China's PMI Manufacturing report. This week's Chinese numbers are the second most important event risk on the calendar behind Non-Farm Payrolls. According to Caixin, manufacturing activity in the month of September slowed significantly but we are skeptical about how much weakness China will actually show. Australia will also release its PMI manufacturing report and given the weakness in China, softer activity is expected. Even though both New Zealand and Australia reported lower housing market data, NZD outperformed AUD because business confidence in New Zealand improved in September after the recent increase in dairy prices.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.