- Dollar Outlook - Will the Fed Disappoint?

- Will BoE Minutes Halt the Rally in Sterling?

- AUD: RBA Minutes Contain Zero Guidance

- USD/CAD: Fourth Straight Day of Gains

- NZD: Oil Up, Gold Down

- Euro Hit By Weaker ZEW

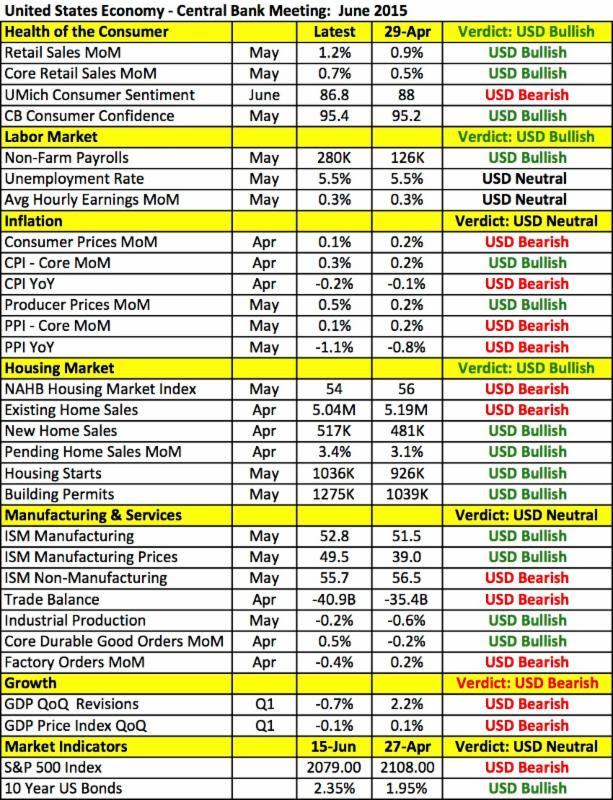

Expectations are running high for this week's FOMC meeting. While no one is looking for the Federal Reserve to raise interest rates on Wednesday, everyone is eager to know if rates will rise in September and again in December. Given that there is a very strong chance of lower economic forecasts and rate projections, in order for the dollar to resume its rise and hit new highs versus the Yen we need Janet Yellen to be unambiguously hawkish, drawing attention away from the downgrades. According to the table below, there have been widespread improvements in the U.S. economy since April. Job growth rose strongly in May, consumers came back, wages are up, core consumer price growth is on the rise, manufacturing activity accelerated and the housing market is recovering. Yet going into the April meeting, the Fed was extremely optimistic with some FOMC officials openly talking about the possibility of June tightening. They had not anticipated the first quarter slowdown and now need to adjust their forecasts accordingly. So while the market may not be able to escape lower growth and interest rate projections, this is primarily due to the Fed's overestimation of first half growth and not a reflection of their expectations for the second half of the year. Whether Janet Yellen is sufficiently hawkish remains to be seen - as a central banker who supports a 2015 rate hike, it would be smart to prepare the market for tightening now, giving them plenty of time to discount the move. However by the same token, the economy is only beginning to turn around and she may prefer not to commit to a specific timeline until there's more evidence of improvements. Yellen and her counterparts at the Fed have many speeches scheduled during the summer that they could use as venues to clarify a timing for tightening. We're optimistic and if the Fed disappoints, we'll view it as an opportunity to buy the dollar at a lower level in anticipation of additional monetary policy divergence. In the meantime, the focus should be on guidance, the economic projections and votes. There have been no dissenting votes among the members of the FOMC in the past 3 meetings, the longest stretch since 2011. With the economy improving, we could see a hawk like Jeffrey Lacker vote in favor of raising rates. Throughout 2012, he had no qualms about going against the majority. If even one member of the FOMC votes for tightening, it will help the dollar. Here's a summary of what we're looking for:

1. No Rate Hike in June

2. Lower 2015 GDP Forecast

3. No Changes to Unemployment Rate Forecast

4. Dot Plot Changes

5. One Dissenting Vote

6. Optimistic FOMC Statement that Acknowledges Data Improvements

7. Upbeat Yellen who Says Every Meeting this Year is an Option for Liftoff

Will BoE Minutes Halt the Rally in Sterling?

We have been impressed by the latest rally in the British pound. Seven trading days have now past without a down day for GBP/USD. While part of the strength can be attributed to FOMC uncertainty, sterling's outperformance versus other major currencies tell us that the move is primarily driven by demand for the U.K.'s currency. It is hard to explain where this demand is coming from because U.K. data has been mixed. According to the latest inflation report, consumer prices grew 0.2% in the month of May. This was in line with expectations but annualized core CPI growth rose to only 0.9% versus a forecast of 1%. This disappointment was driven by a surprise decline in input prices. This latest report follows a series of mixed numbers that should keep U.K. policy on hold for the rest of the year. The Bank of England minutes are scheduled for release tomorrow and we expect policymakers to share our view that there is very little urgency to raise rates. Aside from the minutes, labor market numbers are also scheduled for release and given the drop in the employment component of manufacturing and service sector PMI, the odds favor a downside surprise. In other words, we do not expect either report to help the pound. After 7 straight days of gains, a retracement is likely and tomorrow's event risks provide the perfect catalyst for a correction.

AUD: RBA Minutes Contain Zero Guidance

The Australian, New Zealand and Canadian dollars traded slightly lower versus the greenback today. To the market's surprise, the RBA minutes did not reiterate Governor Stevens strong stance on the currency and rates. After the monetary policy meeting, Stevens complained about the strong currency and said rates could be lowered if it was beneficial to the economy. However the minutes provided no specifics on the outlook for rates and only referred to the "ongoing assessment of the outlook" based on data flow. The only consistency was in the concerns about Sydney's housing market. The lack of guidance in the minutes tells us that the central bank is not serious about lowering rates. USD/CAD rallied for the fourth trading day in a row as oil prices hover below $60 a barrel. The New Zealand continued to consolidate ahead of first quarter GDP numbers due for release later this week.

Euro Hit By Weaker ZEW

After racing above 1.13, the euro ended the day lower against the greenback on the back of weaker investor confidence. Both the current and expectations component of the German ZEW survey declined with the investor outlook falling to its lowest level in 7 months. While economists had anticipated a pullback, both numbers printed at an even lower level than the forecast. Between the ongoing Greek debt saga and a 10% decline in the German DAX over the past month, it is no surprise to see sentiment deteriorate. Nonetheless EUR/USD remains confined within its 1.1050 to 1.1467 range itching for a break that is likely to occur after FOMC. Meanwhile no new progress has been made on the Greek debt negotiations.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD tests lows near 0.6550 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is testing lows near 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data fails to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY rebounds to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.