Technical Analysis

EUR/USD confirms support at 1.14

“I do believe there will be strength in the dollar. However, it’s going to be modest until there’s some greater clarity about the timing of liftoff.”

- U.S. Bank Wealth Management (based on Bloomberg)

Pair’s Outlook

As expected, the EUR/USD cross breached an important support line that was targeted by bears yesterday. Therefore, many crucial technical levels were violated, which increases the risk of a further sell off in the short term. Bears are likely to aim at yesterday's low of 1.1291. However, this level is reinforced by the 23.6% Fibonacci retracement of a 2014-2015 long term downtrend. On the contrary, bulls are still hoping for a recovery with daily indicators pointing upwards, but any rally should be capped by recent highs around 1.1560/80.

Traders’ Sentiment

The share of bulls slumped further from 49% to 42% in the past 24 hours. On the back of it the pending orders in 100-pip range from the spot surged 13 percentage points to reach 55%.

GBP/USD risks going further down the drain

“As markets are currently pricing the BoE to raise rates even later, we see little risk to our call for a stronger sterling and continue to recommend an overweight position, especially against the Australian dollar.”

- UBS (based on Reuters)

Pair’s Outlook

The Cable sustained unexpectedly heavy casualties on Wednesday, after the US Durable Goods Orders showed a lot better-than-expected results. The GBP/USD not only dropped under the support trend-line, but also breached the three closest supports, stabilising only at 1.5479. The Sterling risks suffering more weakness, as trade opened just under the 1.55 major level, also bolstered by the weekly S2; however, a break through this area would trigger a rally towards the resistance cluster around 1.5555. Technical studies are now giving mixed signals, unable to confirm either scenario.

Traders’ Sentiment

Bulls and bears broke out of equilibrium, with 51% of all positions being long. The number of buy orders increased from 61 to 64%.

USD/JPY struggles to hold above 120.00, awaits GDP data

“The yen, euro and Swiss franc are funding currencies...and so when things calm down, dollar/yen can rise and the euro can slip against the dollar.”

- Sumitomo Mitsui Banking Corp (based on CNBC)

Pair’s Outlook

The Greenback not only stabilised above 120.00 yesterday, but also tested the weekly S1 at 120.41. The Buck is nearly halfway through negating this week’s losses, which might occur today if the US Dollar receives a sufficient boost. However, technical studies retain their bearish signals, suggesting the USD/JPY is to weaken today, although a tough cluster supports the pair from below, represented by the Bollinger band and weekly and monthly S2s. The base case scenario, on the other hand, is a surge towards the 200-day SMA around the 121.00 major level.

Traders’ Sentiment

Bulls keep losing numbers, as only 55% of all positions are long today. The share of buy orders, however, inched up from 39 to 63%.

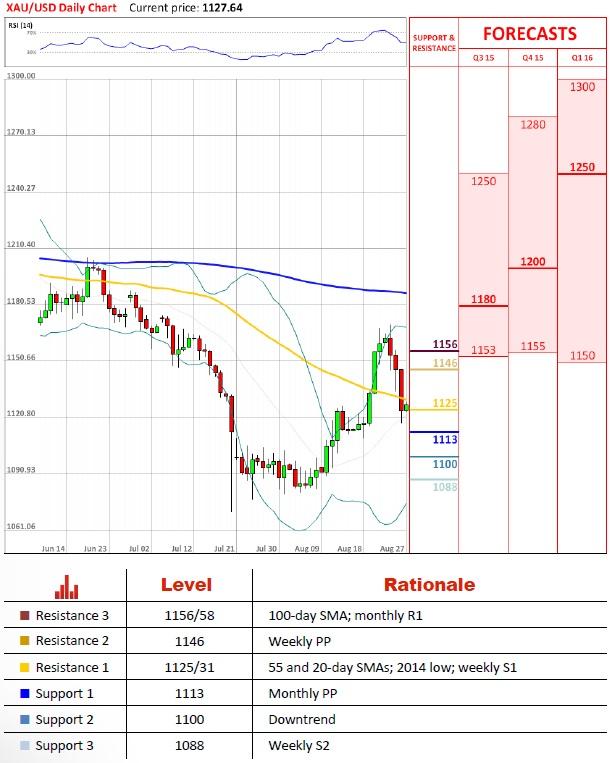

XAU/USD closes below demand zone at 1,125/31

“Gold has been correlated a lot with stock markets in the past couple of days due to the fear globally. It's not surprising to see gold come back off as stocks stabilize.”

- Phillip Futures (based on CNBC)

Pair’s Outlook

Bearish correction and a third straight day of losses pushed the price of the bullion below the most important support area at 1,131/25, where the XAU/USD rate closed Wednesday evening. In case bears keep the cross there on Thursday, the near-term outlook is going to worsen substantially and the bearish trend will be estimated to continue. Short traders may focus on recent lows and the monthly pivot point at 1,113, which is followed by the long term downtrend/psychological level at 1,100. Meanwhile, daily technical studies are now giving signals to sell the precious metal.

Traders’ Sentiment

SWFX sentiment with respect to gold has been unchanged since yesterday, as bulls and bears are still holding 56% and 44% of all open positions, respectively.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The data from the US showed that weekly Jobless Claims held steady at 208,000, helping the USD hold its ground and limiting the pair's upside.

GBP/USD fluctuates above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside after Unit Labor Costs and weekly Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.