Technical Analysis

EUR/USD headed towards 2013 low

“The upward revisions to the rate outlook have seen the USD strengthen this morning.”

- National Australia Bank (based on Reuters)

Pair’s Outlook

The currency pair lived up to the expectations by breaking out of the recently formed rising wedge to the downside. As the support at 1.29 is now out of the way, EUR/USD is free to descend lower, to the 2013 low at 1.2750, which is likely to be a difficult support to breach. If the bulls fail to stop the five-month sell-off here, the price will most likely fall down to the 2012 low at 1.2050 in the next few months.

Traders’ Sentiment

SWFX market participants used the latest dip to acquire the Euro at more attractive prices. As a result, the share of long positions went up from 56 to 61%. Similarly, the percentage of buy orders increased from 42 to 54%.

GBP/USD challenges 23.6% Fibo

“I am now forecasting the [pound] to head toward the $1.67 level, as long as ‘no’ is the outcome.”

- Jameel Ahmad, FXTM (based on MarketWatch)

Pair’s Outlook

Despite the U.S. Dollar appreciating across the market, the currency was unable to outperform the British Pound, which in turn is currently attacking the resistance area between 1.63 and 1.635. Considering the density of this supply zone (monthly S2, 23.6% Fibo, etc.), further advancement is highly unlikely. However, a close above this price interval will allow GBP/USD to target the 38.2% retracement of July-August decline at 1.65.

Traders’ Sentiment

As yesterday’s open and close prices were almost at the same level, the distribution between the bulls and bears stayed the same—59 and 41% respectively. As for the orders, as many as 68% are to purchase the Pound against the Greenback.

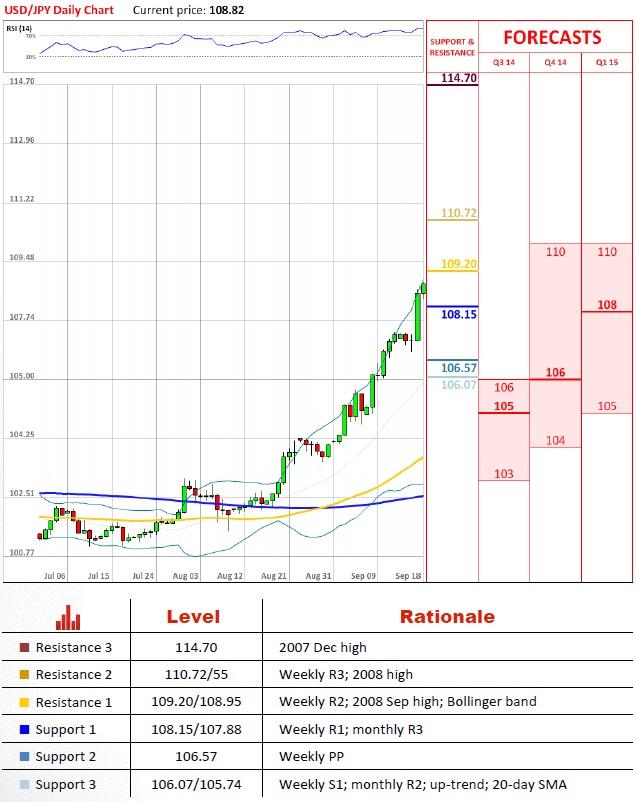

USD/JPY is at 109’s doorstep

“This hawkish twist to the Fed is pushing the greenback higher, and at the same time all its major peers are looking structurally weak at the moment. The U.S. dollar is probably going to continue in very good form.”

- IG (based on Bloomberg)

Pair’s Outlook

Following a brief correction USD/JPY jumped 140 pips in one day, effortlessly piercing through the monthly R3 in the process. The pair is now trying to climb over the resistance at 109, represented by the weekly R2 and 2008 Sep high—the last bastion of the bears before the main 2008 high at 110.70. Judging by the technical indicators on the weekly and monthly time-frames, this defence is not going to last long.

Traders’ Sentiment

The bearish sentiment with respect to USD/JPY is now as strong as five days ago, when 71% of open positions were short. Concerning the orders set 100 pips from the spot, 70 are to buy and 30% are to sell the Buck.

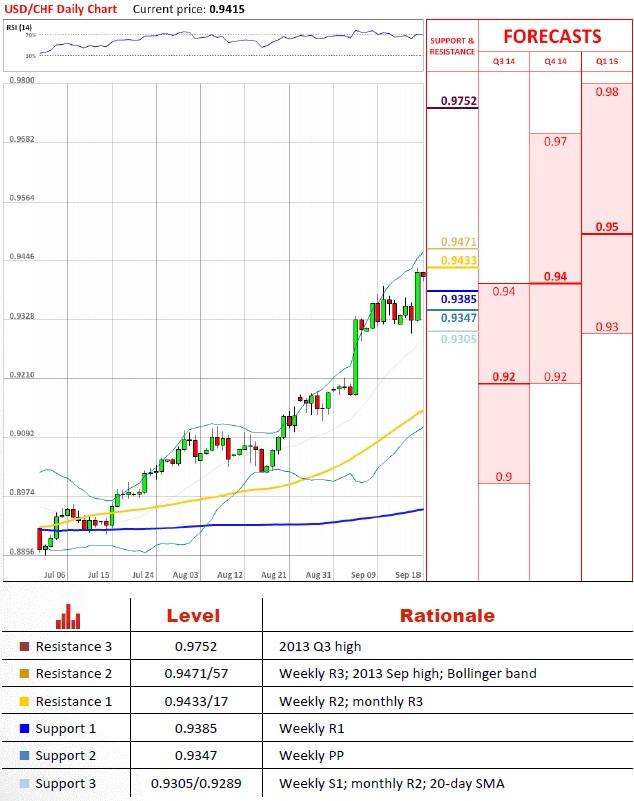

USD/CHF encounters resistance at 0.9450

“The dollar buying trend against everything has a momentum of its own globally for now.”

- Saxo Capital Markets (based on CNBC)

Pair’s Outlook

USD/CHF has finally escaped the boundaries of the flag pattern it has been forming the last two weeks. Now the pair is standing in front of the monthly R3 at 0.94, which is guarding the 2013 Sep high at 0.9450. Accordingly, we may seen some consolidation between these levels while the bulls prepare for a push that is supposed to pave the way for a recovery to the 2013 high that is located 400 pips to the North.

Traders’ Sentiment

Apparently, some of the SWFX market traders used USD/CHF’s thrust to take profits yesterday, being that the portion of longs contracted from 56 to 53%. There are also relatively less buy orders—60% (yesterday—62%).

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.