Technical Analysis

EUR/USD targets 1.35

“The difference in monetary policy stance [between the ECB and other major central banks] is hurting the euro.”

- Societe Generale (based on CNBC)

Pair’s Outlook

As it turned out, EUR/USD did not find enough demand at 1.3568/63, meaning the sell-off should now extend at least down to 1.35—the major support level at the moment. From there the currency pair will be able to launch yet another attack on the two-month down-trend at 1.36. However, as long and the 200-day SMA at 1.37 and long-term falling line at 1.3850 are intact, the overall outlook will remain bearish.

Traders’ Sentiment

After wandering in the negative territory for the last 20 days, the sentiment has finally become positive. However, the difference between the shares of long (51%) and short (49%) positions remains insignificant.

GBP/USD wallows beneath 1.72

“You probably wouldn't see it [GBP/USD] above $1.75 but you won't see it weaken either.”

- New Edge (based on Reuters)

Pair’s Outlook

Although at the beginning of the week it seemed that GBP/USD has finally received a strong upward impetus after a test of the 2009 peak, the pair remains unable to surpass this month’s highs. Ideally, the Sterling should rise up to 1.74, perhaps even higher, before there is a notable bearish correction, since the currency has been trading within the bullish channel for the past 17 months. But the bullish momentum fails to gain any traction.

Traders’ Sentiment

There is strong conviction in the market that the Pound is heavily overvalued, being that as many as 73% of open positions are currently short. As for the orders, the amounts of buy (46%) and sell (54%) ones are nearly equal.

USD/JPY stumbled over monthly PP

“The rise in dollar-yen is a combination of improving risk appetite globally and also slightly higher rates in the U.S.”

- Pierpont Securities (based on Bloomberg)

Pair’s Outlook

Despite USD/JPY closing above 101.61/54 yesterday, the resistance represented by the 55-day SMA and monthly PP appears to be unwilling to let the price to advance further. And while the near-term technical indicators do suggest a sell-off from the current levels, the bulls will most likely define direction of the pair in the longer-term perspective, possibly with the help of the support at 101, which has been constantly proving its worth since February.

Traders’ Sentiment

While the SWFX market considers the Sterling to be overvalued against the Greenback, the Dollar itself is considered to be strongly undervalued against the Japanese Yen as well—this view is held by 74% of all traders.

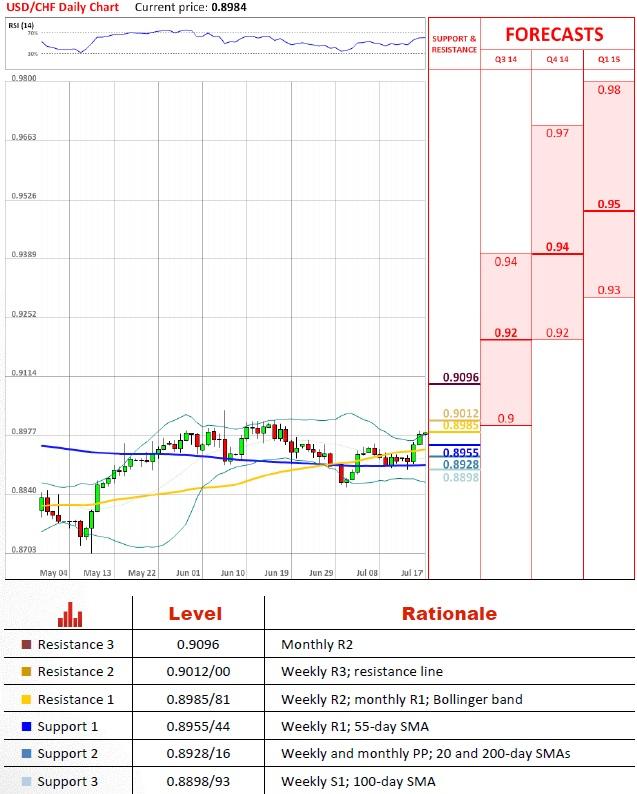

USD/CHF jumps higher

“If the labor market improves as it has been, there’s the potential for an earlier rate hike. The market’s playing off that.”

- BNP Paribas (based on Bloomberg)

Pair’s Outlook

As there was no opposition from the 55-day SMA and weekly R1, the U.S. Dollar continued to gain ground. But further advancement is expected to be more difficult, considering that there is the monthly R1 and resistance line respectively at 0.8982 and 0.9000 standing in the way of a rally. Moreover, a half of the technical indicators on the monthly time-frame are pointing downwards, suggesting Buck’s appreciation might not be sustainable.

Traders’ Sentiment

The sentiment with respect to USD/CHF stays distinctly bullish—70% of all open position are long, though five days ago they took up 74% of the market. Concerning the orders, the percentage of the buy ones 50 pips from spot dropped from 56% down to 43%.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.