Forex News and Events

New Zealand: Waiting on job report statistics (by Arnaud Masset)

New Zealand will release the job report for the third quarter later tonight (GMT 21:45). According to a Bloomberg survey, the unemployment rate should reached 6% in the June quarter from 5.9% in the previous. The participation rate is anticipated to remain stable at 69.3%, while the employment change should rise 0.4%q/q compared to 0.3%q/q previous reading. We expect the report to validate our view that the Kiwi economy went through a tough summer, which has seen a collapse in global dairy prices and lower commodity prices in general. Weaker Chinese demand has significantly hurt Kiwi farmers who have seen their revenue melt like snow in the sun, forcing many out of business.

Wage pressures continue to build but at a more moderate pace. Average hourly earnings are expected to have grown 1.1%q/q, versus 1.2% in the March quarter. This does not help the RBNZ in its fight against low inflation. Governor Wheeler is struggling to bring back the price index within the target range of between 1%-3%. We continue to expect a cut in the OCR in December and this is why we maintain our bearish view on the New Zealand dollar.

Goldilocks economy (by Peter Rosenstreich)

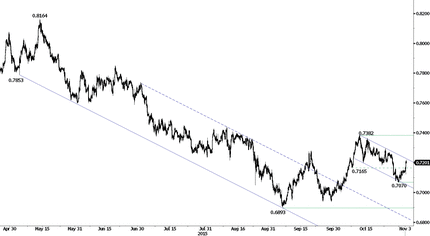

Events today further supported the “goldilocks” conditions and provided a lift to risk appetite. In Australia, the RBA left interest rates unchanged at 2.0% stating that the currency monetary policy was “quite accommodating”. The market had been pricing in a 50% probability of a rate cut supported by a recent soft CPI read (we expected rate to remain on hold see SQB Weekly Market Brief). The accompanying statement provided classic “goldilocks” balance, indicating that the central bank stood ready to cut interest rates further, yet the sense of immediacy was not there. The statement verbiage suggested that the growth outlook was not as dire as some had predicted. The inflation outlook language delivered the overall dovish tone stating "the outlook for inflation may afford scope for further easing of policy, should that be appropriate to lend support to demand”. The market reacted quickly as the front-end of the AUD rate curve rose indicting of less than a 30% changed of a 25bp rate hike in 2015. AUDUSD rose 0.5% to 0.7219, reinforced by a short squeeze, clearing 65d MA at 0.7179 and minor horizontal resistance at 0.7205. Also supporting the risk taking environment was data release that showed New Zealand commodity price index rose 6.9% in October. Asia regional equity indices rallied with the Hang Seng rising 0.94% and Shanghai composite index up 1.42% (Nikkei was closed for the Japanese holiday). Moving forward we anticipate the RBA to revise lower its forecast for inflation yet growth outlook should remain unchanged. Expectation for a rate cut should keep AUD contained however, our view that a stimulus fueled China will see growth stabilize and additional easing from the BoJ in January will support regional economies including Australia.

AUDUSD - Challenging its key resistance

| Today's Key Issues | Country/GMT |

| Oct Unemployment MoM Net ('000s), exp 71, last 26,1 | EUR/08:00 |

| Oct Markit/CIPS UK Construction PMI, exp 58,8, last 59,9 | GBP/09:30 |

| oct..31 FGV CPI IPC-S, exp 0,68%, last 0,67% | BRL/10:00 |

| Central Bank Weekly Economists Survey | BRL/10:25 |

| Oct Markit Brazil PMI Manufacturing, last 47 | BRL/12:00 |

| Oct ISM New York, exp 45,7, last 44,5 | USD/14:45 |

| Oct Foreign Reserves, exp 496,3, last 513,6 | DKK/15:00 |

| Oct Change in Currency Reserves, exp -15.5b, last -22.5b | DKK/15:00 |

| Sep Factory Orders, exp -0,90%, last -1,70% | USD/15:00 |

| Sep Factory Orders Ex Trans, last -0,80% | USD/15:00 |

| Nov IBD/TIPP Economic Optimism, exp 47,4, last 47,3 | USD/15:00 |

| Sep CNI Capacity Utilization (SA), last 77,90% | BRL/16:00 |

| SNB's Jordan Holds Speech in Geneva | CHF/17:00 |

| Oct Trade Balance Monthly, exp $1233m, last $2944m | BRL/17:00 |

| Oct Exports Total, exp $16283m, last $16148m | BRL/17:00 |

| Oct Imports Total, exp $15173m, last $13204m | BRL/17:00 |

| ECB's Draghi Speaks in Frankfurt | EUR/18:00 |

| Oct Foreign Reserves, last $368.11b | KRW/21:00 |

| 3Q Unemployment Rate, exp 6,00%, last 5,90% | NZD/21:45 |

| 3Q Employment Change QoQ, exp 0,40%, last 0,30% | NZD/21:45 |

| 3Q Employment Change YoY, exp 2,50%, last 3,00% | NZD/21:45 |

| 3Q Participation Rate, exp 69,30%, last 69,30% | NZD/21:45 |

| 3Q Pvt Wages Ex Overtime QoQ, exp 0,50%, last 0,50% | NZD/21:45 |

| 3Q Pvt Wages Inc Overtime QoQ, exp 0,50%, last 0,50% | NZD/21:45 |

| 3Q Average Hourly Earnings QoQ, exp 1,10%, last 1,20% | NZD/21:45 |

| Oct AiG Perf of Services Index, last 52,3 | AUD/22:30 |

| Oct SACCI Business Confidence, last 81,6 | ZAR/23:00 |

The Risk Today

Peter Rosenstreich

EUR/USD is digesting its recent short-term overextended rise and shifted into consolidation pattern. Breaking above the minor resistance at 1.0989, alleviated short-term concerns stemming from last weeks bearish intra-day correction. Hourly resistance is given at 1.1095 (28/10/2015 reaction high). Stronger resistance can be found at 1.1387 (20/10/2015 low). Since March 2015, the pair is improving. Key supports can be found at 1.0458 (16/03/2015 low) and 1.0000 (psychological support). The technical structure favours an eventual break higher. Strong resistance is given at 1.1871(12/01/2015).

GBP/USD bullish rally has paused but watch initial resistance can be found at 1.5529 (18/09/2015 high). The short-term technical structure suggests continued bullish momentum. An initial support lies at 1.5404 (02/11/2015) then 1.5202 (06/06/2014 high). In the longer term, the technical structure looks like a recovery as long as support given at 1.5089 stands. A full retracement of the 2013-2014 rise is expected.

USD/JPY continues to move within its range after failing to challenging its recent lows at 120.80 (28/10/2015 low). Lack of technical drivers indicate that range trading should continue. Strong resistance is given at 121.75 (28/08/2015 high). Expected to show continued increase before targeting again resistance at 121.75. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF continues to struggle to decisively break the declining channel resistance at 0.9880. However, as long as the support at 0.9808 (27/10/2015 low) holds, a break to the upside is favored. Additional hourly support is given at 0.9476 (15/10/2015 low). In the long-term, the pair has broken resistance at 0.9448 suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).

Resistance and Support:

| EURUSD | GBPUSD | USDCHF | USDJPY |

| 1.1714 | 1.593 | 1.0676 | 135.15 |

| 1.1561 | 1.5819 | 1.024 | 125.86 |

| 1.1387 | 1.5659 | 1.0129 | 121.75 |

| 1.098 | 1.541 | 0.9894 | 120.77 |

| 1.0809 | 1.5202 | 0.9476 | 118.07 |

| 1.0521 | 1.5089 | 0.9384 | 116.18 |

| 1.0458 | 1.496 | 0.9259 | 115.57 |

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.