Forex News and Events

The FX and commodities are volatile today as WTI crude approaches 3% loss on the session. The UK inflation dips to 1.0% on year to November, while the USD/RUB extends gains at all-time-highs despite the surprise CBR rate hike from 10.50% to 17%. Elsewhere, the carry reversal combined to political risks push USD/TRY to fresh record highs, the appetite in EUR-TRY rate spread is fully offset by the spike in implied vols.

Aggressive rate action from the CBR

In a wildly surprising move, the Russia Central Bank stated that it would increase its key interest rate to 17.0% from 10.50%, effective immediately. On the surface the decision was aimed at slowing the RUB collapse and lowering inflation risk. Yet, the massive unexpected adjustment reeks of panic and desperation. This hike come on the heels of the largest one-day drop in the ruble and largest single interest rate increase since 1998 prior to Russia default. However, despite the enticingly high yield, there is increasing probably that Russia will dip into recession due to the sliding oil prices making any long Russia trading extremely risky. In addition, with high-yield credit spreads making significant changes there is a material macro move to rotate from risky assets. And right now Russia is deemed one of the most risky assets on the market. It is uncertain that today’s hike, despite its size, will halt Ruble selling. Besides the geopolitical tensions, the oil exports stand for more than 50% of Russian income and with crude contracts trading below $55, we see the selling pressures on RUB hardly easing.

UK inflation drops to 1%

The UK inflation dropped by 0.3% on month to November (vs. 0.0% exp. & 0.1% last), pulling the yearly inflation down to 1.0%, significantly slower than 1.2% expected (& 1.3% last). The most of the CPI softness being already priced in, GBP/USD rebounded quickly after selling off to 1.5612.

At his speech on Financial Stability Report, the BoE Carney commented on housing markets, inflation and oil prices. Carney said that the housing market lost momentum, that the fundamental problem in UK housing is the “supply shortage”, while stamp duty change and low rates may revive the housing sector. He highlighted that the drop in oil is positive as it could support the economic growth, although it carries stability risk. “The CPI expectations could further be depressed” he added, as oil rallies to fresh lows. Combined to the strict stance on the fiscal leg (consolidation), the BoE has little room for surprisingly hawkish move, we keep our GBP-bias on the downside.

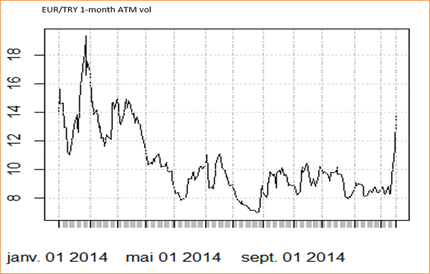

EUR/TRY implied vol spikes above 13%

After hitting our upper target at 2.75, EUR/TRY reversed direction sharply. The key unwind signal being the hike in volatilities, the spike from 8-9% to above 13% in one-month implied vols automatically cleared our bearish call on EUR/TRY on Monday. We expect the carry outflows to increase EUR/TRY-positive pressures after breaking the 200-dma (2.8790) on the upside. EUR/TRY tests resistance at 2.9488/3.00 (Fib 38.2% on January-November ease/psychological level). The 3-month cross currency basis rebounds alongside with the FX volatilities, confirming that the appetite in rate spread is now being fully offset by TRY-negative vols.

USD/TRY hits 2.3944, new record high. The pre-Fed USD appetite should help pushing the pair through 2.40-offers over the next trading sessions. Regardless of ECB, Fed news, the TRY is set to go through renewed wave of sell-off following global risk-off move, which in addition is amplified by rising political tensions recently. The average interbank repo rate hits the CBT overnight rate corridor upper end (11.25%). We stand ready for CBT intervention to cool-off the lira selling.

EUR/TRY volatility spikes above 13%

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.