Forex News and Events

The FX markets trade heavily on central bank decisions today. The RBNZ kept its OCR unchanged at 3.5%, the Swiss National Bank maintained the status quo, disappointing those who bet for a pro-active rate action. Norges Bank unexpectedly cut its deposit rates, while the ECB announced the allotment of the second round of its TLTRO program. EUR-complex came back under selling pressures amid the weaker-than-expected 129.84 billion lending. EUR/CHF sold-off to 1.2015s.

Deflation: a solid reason to support the EUR/CHF floor

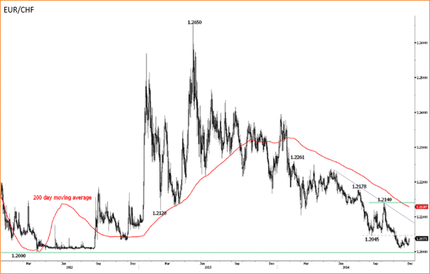

At its quarterly meeting, the SNB maintained the 3-month Libor target unchanged at 0.00-0.25% and reiterated its commitment to defend the EUR/CHF floor at 1.20. The SNB communication revealed concerns on the rising risk of deflation by next year. Governor Jordan stated that “the appreciably lower oil price will push inflation into negative territory during the next four quarters”. Additionally, the rising deflationary threat in the Euro-zone is another major concern for the Swiss price dynamics. The spill-over effect should further weigh on Swiss economy, which already struggles with deflation despite the zero interest rate policy. Therefore, the SNB rhetoric today has been a solid argument and a reinforcement of SNB’s commitment to defend the EUR/CHF’s 1.20 floor.

EUR/CHF sold-off below 1.2015 as knee-jerk reaction to no pro-active action on interest rates. Traders remain alert given that the aggressive ECB expansion will continue being an important challenge for the 1.20 floor. The SNB may have to introduce negative interest rates on sight deposits, should the floor comes seriously at risk. However we expect the SNB to proceed in a reactive fashion to ECB actions rather than a pro-active move. There is no need to pull out the big gun, given that the SNB’s maneuver margin is very tight and the ECB is about to proceed with a full-blown QE on next quarter.

At this point, the ECB is naturally the leading power and the main decision maker, the SNB is the follower. There is nothing surprising in this power balance given the respective size of the Euro-zone economy against Switzerland’s. The ECB lent 129.84 billion euros via the TLTRO2 (vs 170bn exp.) today. The total amount lent over the two rounds sum up to a moderate 212.44 billion euro verse 400 billion targeted by the ECB at launch of the program. The weak lending increase the probabilities for further ECB action.

Norges Bank unexpectedly cuts deposit rate

Norges Bank lowered its deposit rate by 25 basis points in a surprise decision today. This is the first time the bank proceeds with rate action in more than two years. This is a clear policy reaction to the sliding oil market threat for the Norwegian economy, alongside with the moderate Euro-zone recovery. USD/NOK rallied aggressively to 7.2892 post-decision, slightly below our key resistance of 7.32 (end 2008/beginning 2009 highs). The trend and momentum indicators are comfortably positive, a break above the 7.32 resistance should strengthen the bull market in USD/NOK, should the oil markets carry on sliding.

The WTI contracts now test $60 as Saudi Arabia seems unconvinced to cut the output to defend its market share and the US continues expanding its crude production to 9118K barrels per day, as of December 5th data.

EUR/CHF drops to 1.2015 post-SNB

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.