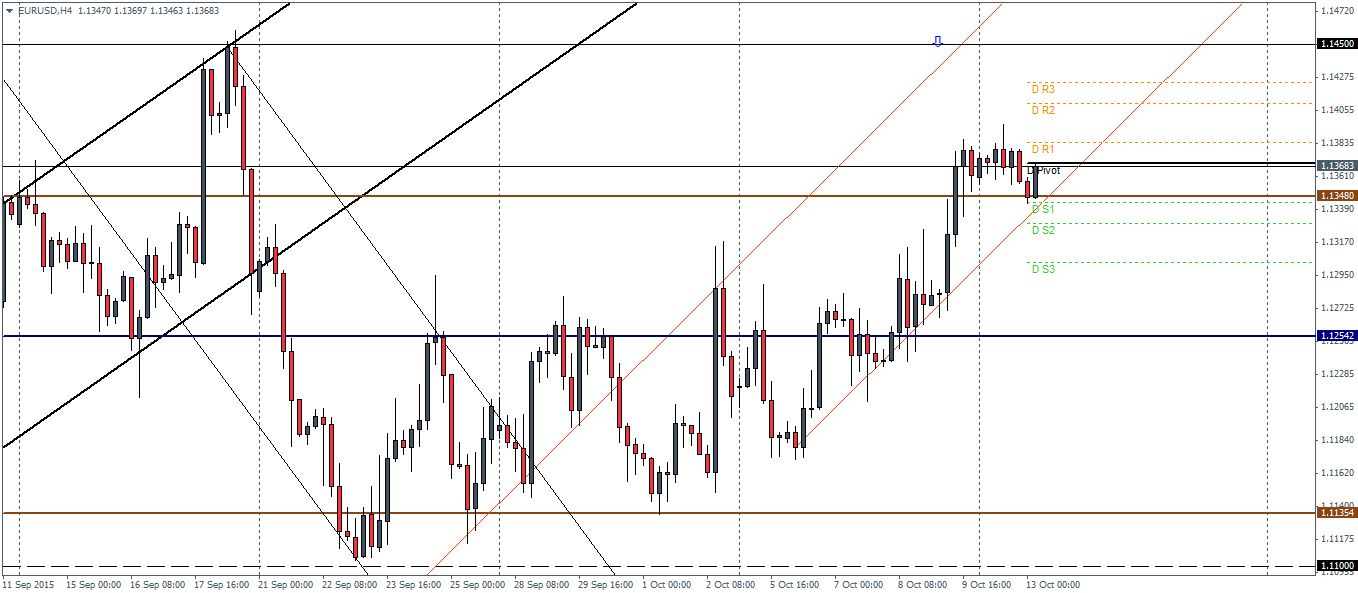

| R3 | 1.1424 |

| R2 | 1.1409 |

| R1 | 1.1383 |

| Pivot | 1.1369 |

| S1 | 1.1343 |

| S2 | 1.1329 |

| S3 | 1.1303 |

EURUSD (1.13): EURUSD closed with a doji pattern on the daily chart yesterday and price action is currently trading off the support at 1.1348. Failure to close above yesterday's higher close of 1.138 could see a potential fall out to the downside marking a breakout from the rising price channel. To the downside, support at 1.1254 remains to be tested and is likely to be the target in case of a breakout from the price channel. To the upside, a close above 1.138 could see a possible rally towards the previous highs of 1.145.

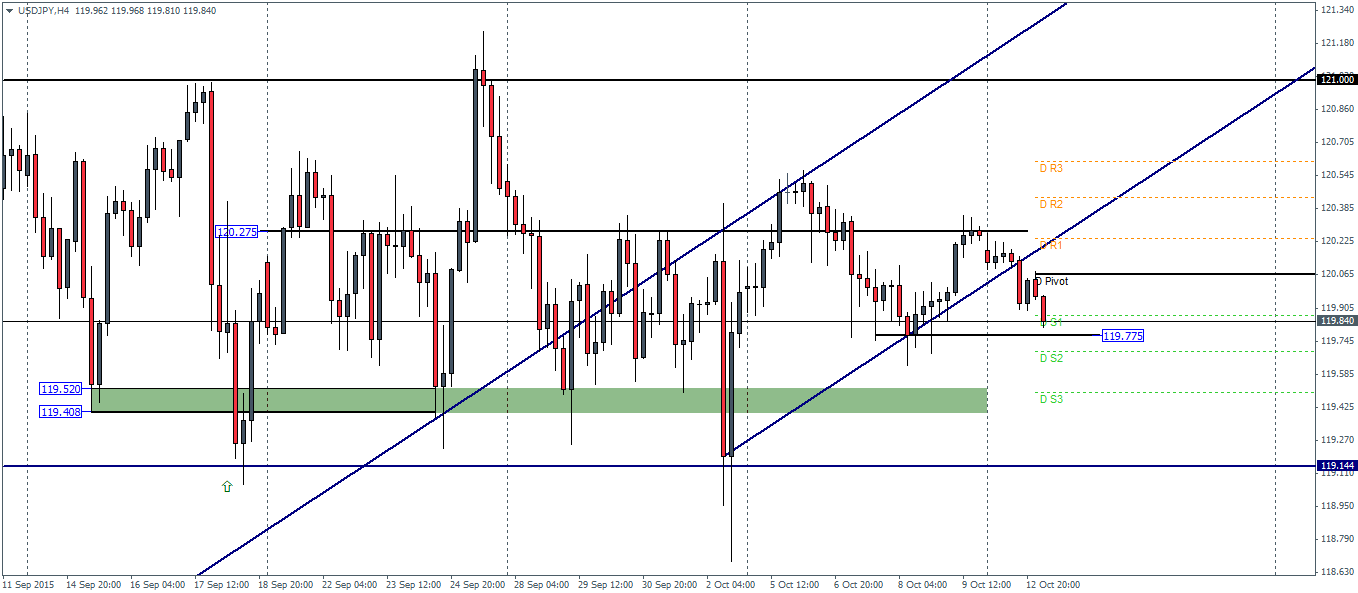

| R3 | 120.609 |

| R2 | 120.436 |

| R1 | 120.238 |

| Pivot | 120.065 |

| S1 | 119.867 |

| S2 | 119.94 |

| S3 | 119.497 |

USDJPY (119.8): USDJPY formed an inside bar yesterday with prices currently trading near the lower end of the range. The inside bar formation is likely to see another move back to the downside, keeping USDJPY trading sideways. On the 4-hour chart time frame, prices have broken out from the rising price channel indicating a move to the downside with the immediate support coming in at 119.775. If support holds, we could expect a retracement back to the breakout, but a failure could see a retest back to 119.52 through 119.4 level of support.

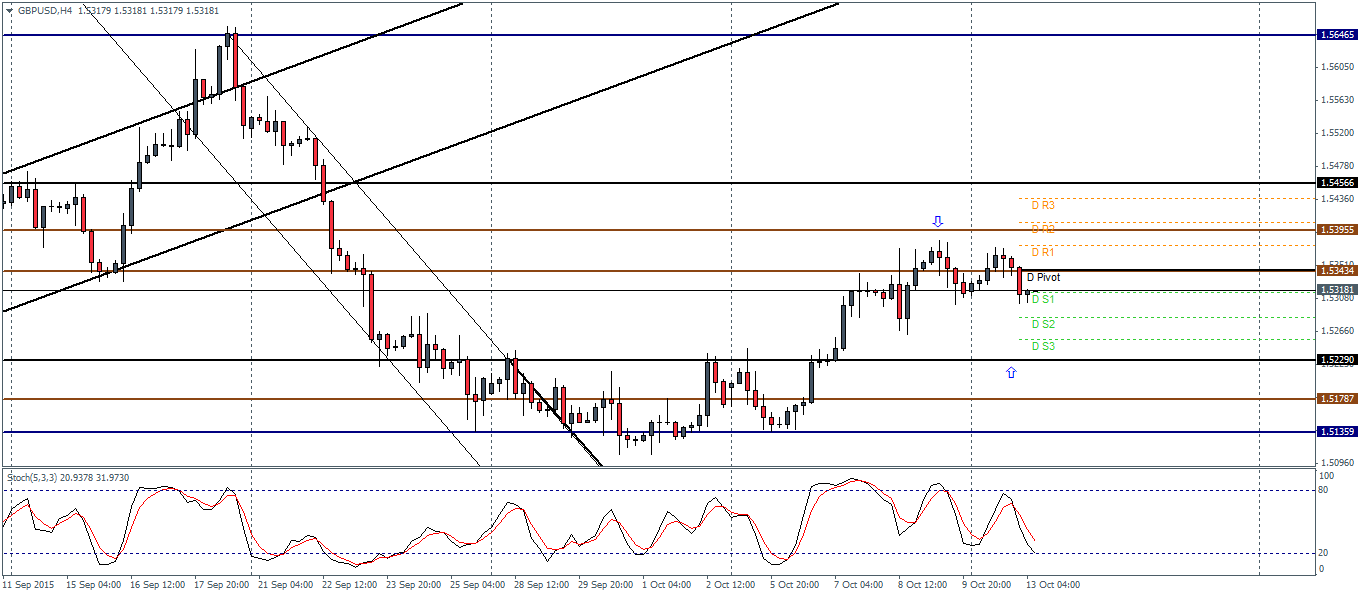

| R3 | 1.5436 |

| R2 | 1.5405 |

| R1 | 1.5375 |

| Pivot | 1.5343 |

| S1 | 1.5315 |

| S2 | 1.5283 |

| S3 | 1.5255 |

GBPUSD (1.53): GBPUSD has struggled near 1.5346 for the past 4 sessions but is trading above the support zone from 1.53 through 1.5216. For the short term a dip back to 1.523 looks possible while the bias remains to the upside if the support holds. We could expect GBPUSD to possibly rally towards 1.54 before declining lower to retest 1.5229 which marks a retest of the previously held resistance to now establish support. A break below 1.5229 could however put GBPUSD on par for further declines.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD trades on a stronger note 1.2530, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The United States Employment report will be released by the Bureau of Labor Statistics at 12:30 GMT. The US Dollar looks to employment data after the Fed signaled its intention to hold rates higher for longer on Wednesday.